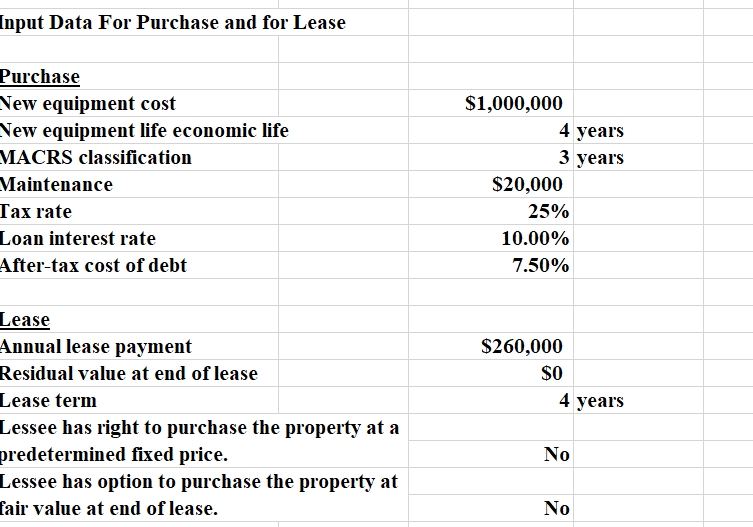

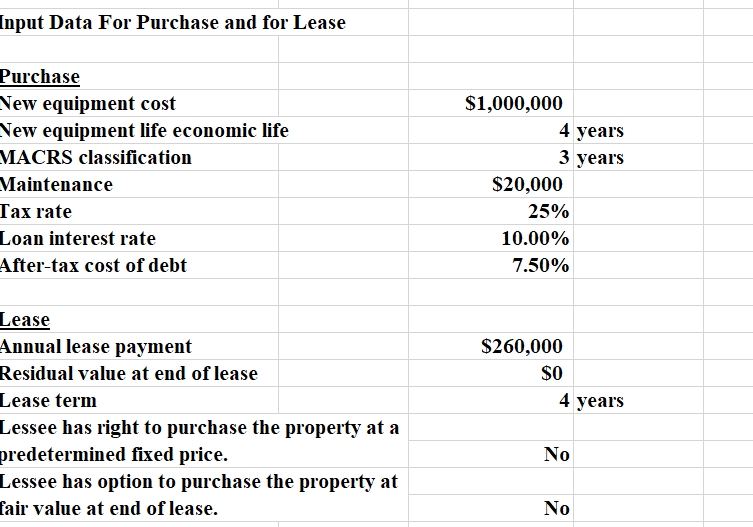

The equipment costs $ and,if it were purchased, Lewis could obtain a term loan for the full purchase price at a 10% interest rate. Although the equipment has a 6-year useful life, it is classified as a special-purpose computer and therefore falls into the MACRS 3-year class. If the system were purchased, a 4-year maintenance contract could be obtained at a cost of $20,000 per year, payable at the beginning of each year. The equipment would be sold after 4 years, and the best estimate of its residual value is $200,000. However, because real-time display system technology is changing rapidly, the actual residual value is uncertain.

As an alternative to the borrow-and-buy plan, the equipment manufacturer informed Lewis that Consolidated Leasing would be willing to write a 4-year guideline lease on the equipment, including maintenance, for payments of $260,000 at the beginning of each year. Lewis's marginal federal-plus-state tax rate is 25%. You have been asked to analyze the lease-versus-purchase decision and, in the process, to answer the following questions.

CAN ANYONE SEE IF I HAVE DONE THAT CORRECTLY? IF THERE ARE MISTAKES, COULD YOU PLEASE, EXPLAIN?

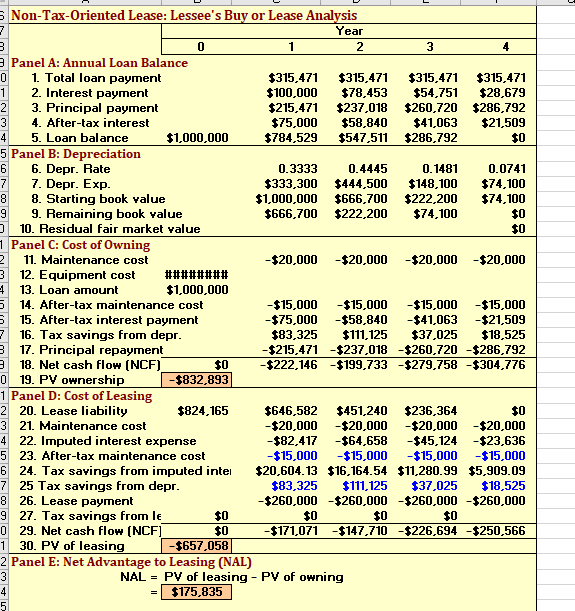

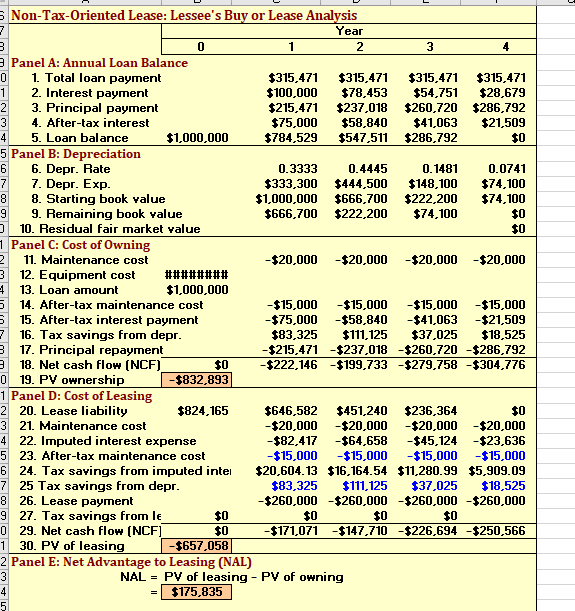

- What is the present value of owning the equipment? (Hint: Set up a time line that shows the net cash flows over the period t = 0 to t = 4, and then find the PV of these net cash flows, or the PV of owning.)

- What is Lewis's present value of leasing the equipment? (Hint: Again, construct a time line.)

- What is the net advantage to leasing (NAL)? Does your analysis indicate that Lewis should buy or lease the equipment? Explain.

CAN ANYONE SEE IF I HAVE DONE THAT CORRECTLY? IF THERE ARE MISTAKES, COULD YOU PLEASE, EXPLAIN?

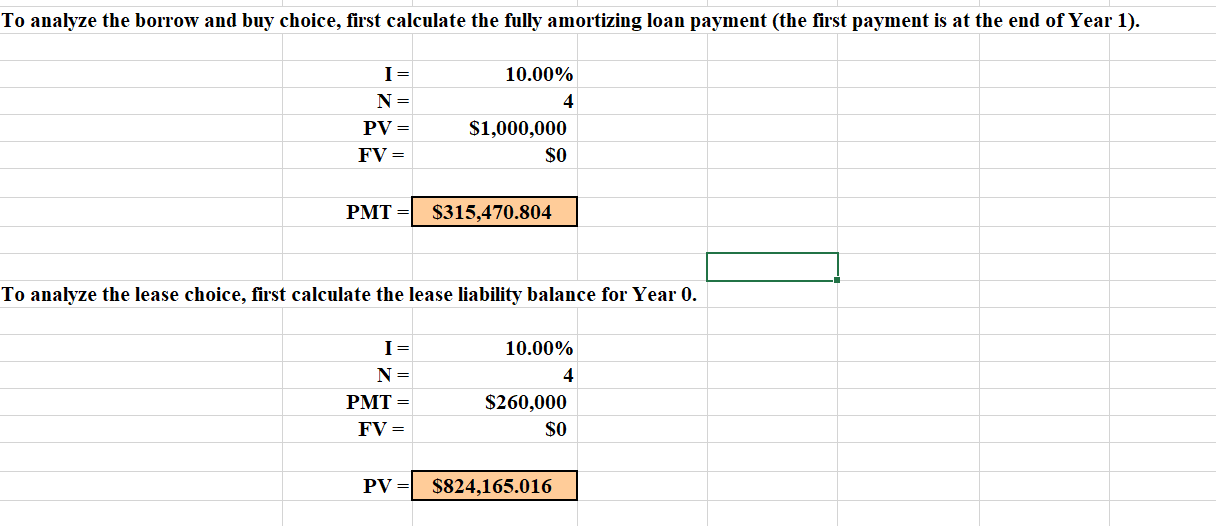

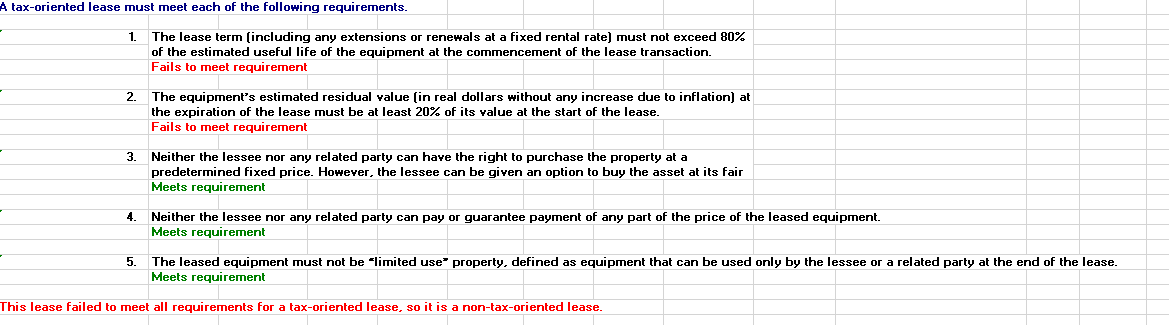

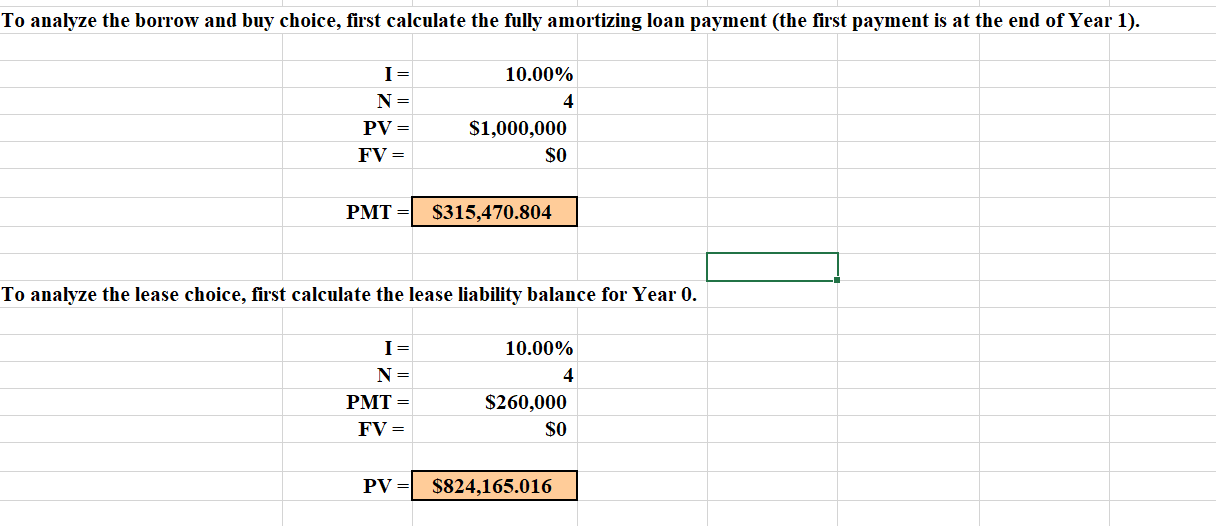

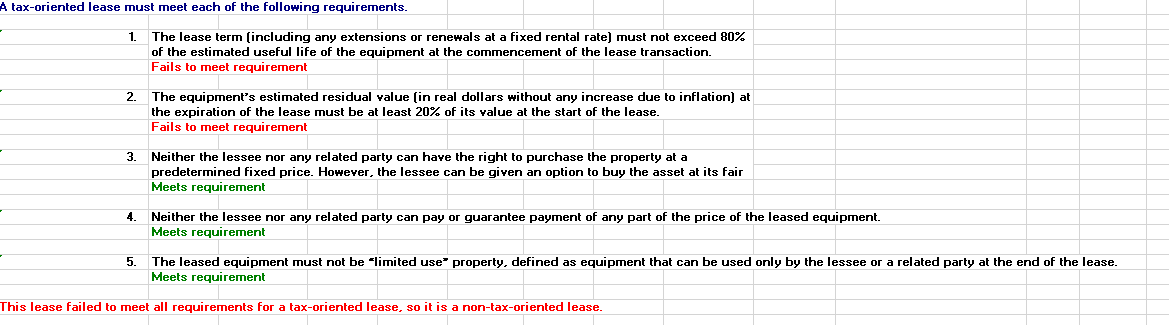

Input Data For Purchase and for Lease Purchase New equipment cost New equipment life economic life MACRS classification Maintenance Tax rate Loan interest rate After-tax cost of debt $1,000,000 4 years 3 years $20,000 25% 10.00% 7.50% $260,000 $0 4 years Lease Annual lease payment Residual value at end of lease Lease term Lessee has right to purchase the property at a predetermined fixed price. Lessee has option to purchase the property at fair value at end of lease. No No To analyze the borrow and buy choice, first calculate the fully amortizing loan payment (the first payment is at the end of Year 1). I= N= PV= FV= 10.00% 4 $1,000,000 $0 PMT $315,470.804 To analyze the lease choice, first calculate the lease liability balance for Year 0. I= N= PMT= FV= 10.00% 4 $260,000 $0 PV= $824,165.016 A tax-oriented lease must meet each of the following requirements. 1. The lease term (including any extensions or renewals at a fixed rental rate) must not exceed 80% of the estimated useful life of the equipment at the commencement of the lease transaction. Fails to meet requirement 2. The equipment's estimated residual value (in real dollars without any increase due to inflation) at the expiration of the lease must be at least 20% of its value at the start of the lease. Fails to meet requirement 3. Neither the lessee nor any related party can have the right to purchase the property at a predetermined fixed price. However, the lessee can be given an option to buy the asset at its fair Meets requirement 4. Neither the lessee nor any related party can pay or guarantee payment of any part of the price of the leased equipment. Meets requirement The leased equipment must not be limited use property, defined as equipment that can be used only by the lessee or a related party at the end of the lease. Meets requirement 5. This lease failed to meet all requirements for a tax-oriented lease, so it is a non-tax-oriented lease. Non-Tax-Oriented Lease: Lessee's Buy or Lease Analysis 7 Year 3 0 1 2 3 4 Panel A: Annual Loan Balance 0 1. Total loan payment $315,471 $315,471 $315,471 $315,471 1 2. Interest payment $100,000 $78,453 $54,751 $28,679 2 3. Principal payment $215,471 $237,018 $260,720 $286,792 3 4. After-tax interest $75,000 $58,840 $41,063 $21,509 4 5. Loan balance $1,000,000 $784,529 $547,511 $286,792 $0 5 Panel B: Depreciation 6 6. Depr. Rate 0.3333 0.4445 0.1481 0.0741 7 7. Depr. Exp. $333,300 $444,500 $148, 100 $74,100 8 8. Starting book value $1,000,000 $666,700 $222,200 $74,100 9 9. Remaining book value $666,700 $222,200 $74,100 $0 . 10. Residual fair market value $0 1 Panel C: Cost of Owning 2 11. Maintenance cost -$20,000 -$20,000 -$20,000 -$20,000 3 12. Equipment cost ######## 4 13. Loan amount $1,000,000 5 14. After-tax maintenance cost $15,000 $15,000 $15,000 $15,000 15. After-tax interest payment $75,000 -$58,840 $41,063 -$21,509 16. Tax savings from depr. $83,325 $111,125 $37,025 $18,525 3 17. Principal repayment -$215,471 $237,018 - $260,720 - $286,792 3 18. Net cash flow (NCF) $0 -$222,146 $199,733 $279,758 $304,776 0 19. PV ownership -$832,893 1 Panel D: Cost of Leasing 2 20. Lease liability $824,165 $646,582 $451,240 $236,364 $0 3 21. Maintenance cost -$20,000 -$20,000 -$20,000 $20,000 4 22. Imputed interest expense $82,417 $64,658 $45,124 -$23,636 5 23. After-tax maintenance cost $15,000 $15,000 -$15,000 $15,000 6 24. Tax savings from imputed inter $20,604.13 $16, 164.54 $11,280.99 $5,909.09 7 25 Tax savings from depr. $83,325 $111,125 $37,025 $18,525 8 26. Lease payment $260,000 $260,000 - $260,000 - $260,000 9 27. Tax savings from le $0 $0 $0 $0 0 29. Net cash flow (NCF] $0 $171,071 $147,710 $226,694 $250,566 1 30. PV of leasing $657,058 2 Panel E: Net Advantage to Leasing (NAL) NAL = PV of leasing - PV of owning 4 $175,835 5