Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The equipment has a book value of TZS 40,000,000/=( TZS 50,000,000/= less 20% depreciation of TZS 10,000,000/=). An appraisal concluded that the equipment's replacement cost

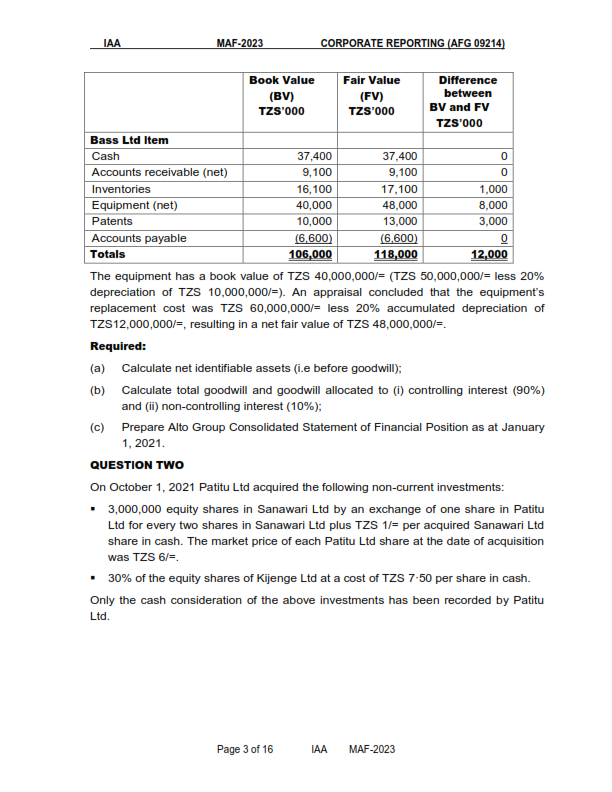

The equipment has a book value of TZS 40,000,000/=( TZS 50,000,000/= less 20% depreciation of TZS 10,000,000/=). An appraisal concluded that the equipment's replacement cost was TZS 60,000,000/= less 20% accumulated depreciation of TZS12,000,000/=, resulting in a net fair value of TZS 48,000,000/=. Required: (a) Calculate net identifiable assets (i.e before goodwill); (b) Calculate total goodwill and goodwill allocated to (i) controlling interest (90\%) and (ii) non-controlling interest (10%); (c) Prepare Alto Group Consolidated Statement of Financial Position as at January 1,2021. QUESTION TWO On October 1, 2021 Patitu Ltd acquired the following non-current investments: - 3,000,000 equity shares in Sanawari Ltd by an exchange of one share in Patitu Ltd for every two shares in Sanawari Ltd plus TZS 1/= per acquired Sanawari Ltd share in cash. The market price of each Patitu Ltd share at the date of acquisition was TZS6/=. - 30% of the equity shares of Kijenge Ltd at a cost of TZS 7-50 per share in cash. Only the cash consideration of the above investments has been recorded by Patitu Ltd

The equipment has a book value of TZS 40,000,000/=( TZS 50,000,000/= less 20% depreciation of TZS 10,000,000/=). An appraisal concluded that the equipment's replacement cost was TZS 60,000,000/= less 20% accumulated depreciation of TZS12,000,000/=, resulting in a net fair value of TZS 48,000,000/=. Required: (a) Calculate net identifiable assets (i.e before goodwill); (b) Calculate total goodwill and goodwill allocated to (i) controlling interest (90\%) and (ii) non-controlling interest (10%); (c) Prepare Alto Group Consolidated Statement of Financial Position as at January 1,2021. QUESTION TWO On October 1, 2021 Patitu Ltd acquired the following non-current investments: - 3,000,000 equity shares in Sanawari Ltd by an exchange of one share in Patitu Ltd for every two shares in Sanawari Ltd plus TZS 1/= per acquired Sanawari Ltd share in cash. The market price of each Patitu Ltd share at the date of acquisition was TZS6/=. - 30% of the equity shares of Kijenge Ltd at a cost of TZS 7-50 per share in cash. Only the cash consideration of the above investments has been recorded by Patitu Ltd Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started