Question

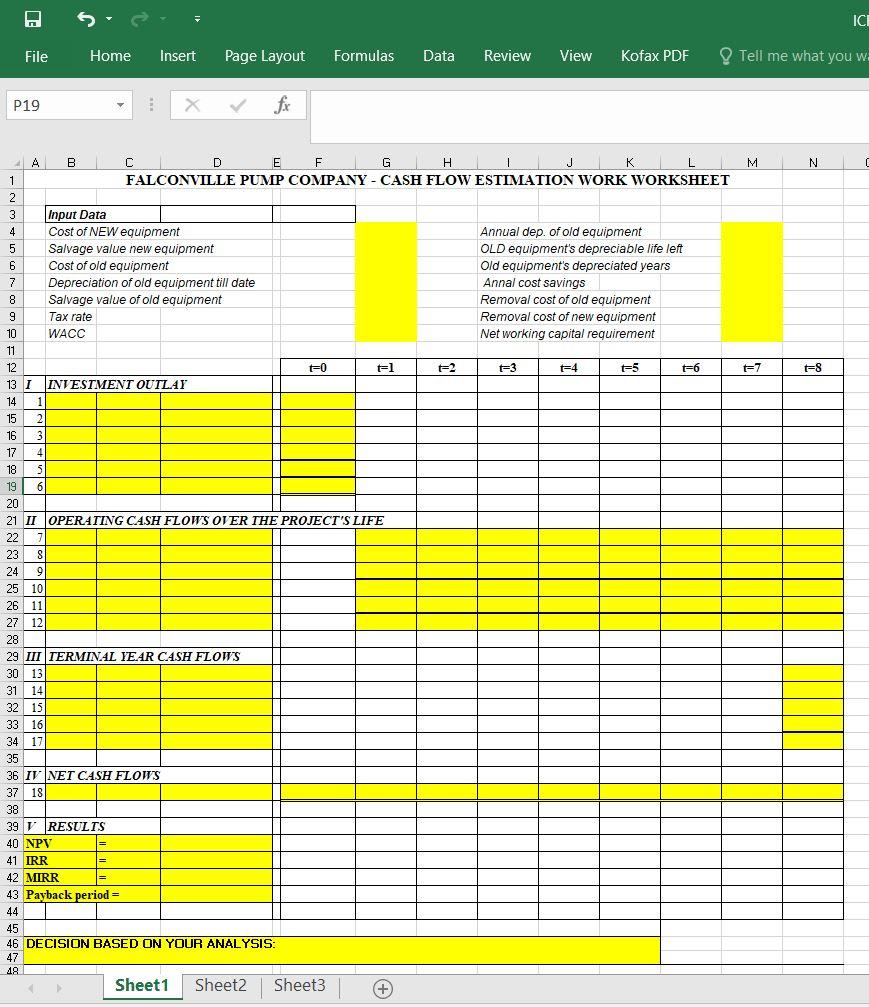

The equipment has a delivered cost of $112,000. An additional $4,000 is required to install and test the new system. The new pumping system is

The equipment has a delivered cost of $112,000. An additional $4,000 is required to install and test the new system.

The new pumping system is classified by the IRS as 5-year property, although it has an 8-year estimated service life. For assets classified by the IRS as 5-year property, the Modified Accelerated Cost Recovery System (MACRS) permits the company to depreciate the asset over 6 years at the following rates: Year 1 = 20 percent, Year 2 = 32 percent, Year 3 = 19 percent, Year 4 = 12 percent, Year 5 = 11 percent, Year 6 = 6 percent. At the end of 8 years, the salvage value is expected to be around 5 percent of the original purchase price, so the best estimate of salvage value at the end of the equipment's service life is $5,600, with removal costs of $1,300.

The existing pumping system was purchased at $45,000 eight years ago and has been depreciated on a straight-line basis over its economic life of 10 years. If the existing system is removed from the well and crated for pickup, it can be sold for $3,500 before tax. It will cost $1,000 to remove the system and crate it.

At the time of replacement, the firm will need to increase its net working capital requirements by $4,200 to support inventories

The new pumping system offers lower maintenance costs and frees personnel who would otherwise have to monitor the system. In addition, it reduces product wastage because of a higher cooling efficiency. In total, it is estimated that the yearly savings will amount to $28,000 if the new pumping system is used.

FPCs assets are financed by debt and common equity and has a target debt ratio of 25 percent. Its debt carries an interest rate of 6 percent. The firm has paid $2.00 of dividend per share this year (D0) and expects a constant dividend growth rate of 4 percent per year in the coming years. The firms current stock price, P0, is $26.00. The firm uses its overall weighted average cost of capital in evaluating average risk projects, and the replacement project is perceived to be of average risk.

The firms federal-plus-state tax rate is 30 percent, and this rate is projected to remain fairly constant into the future

QUESTIONS (Please provide answers to the following four questions on the attached Cash Flow Estimation Worksheet. You should show all your work with Excel formulas/equations for all computed numbers for Questions 1, 2 & 3, and concise and direct answers for Question #4 on the attached Cash Flow Estimation Worksheet and answers to te tables at the bottom of your spreadsheet, whenever applicable. NO WORK SHOWN, NO POINTS.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started