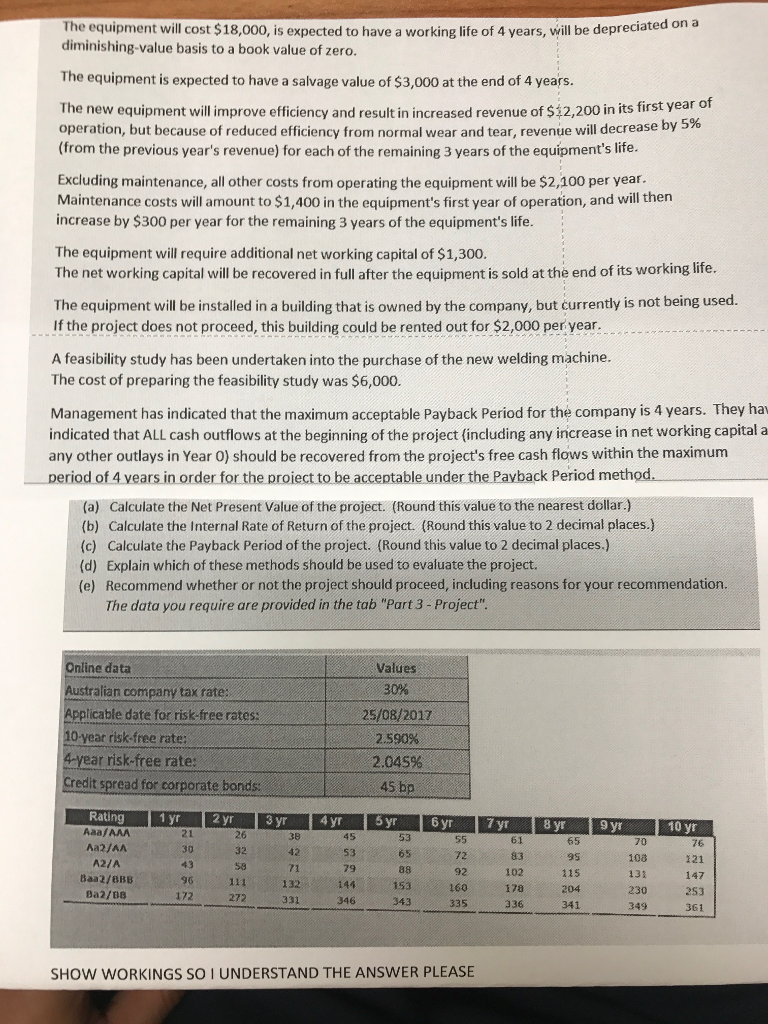

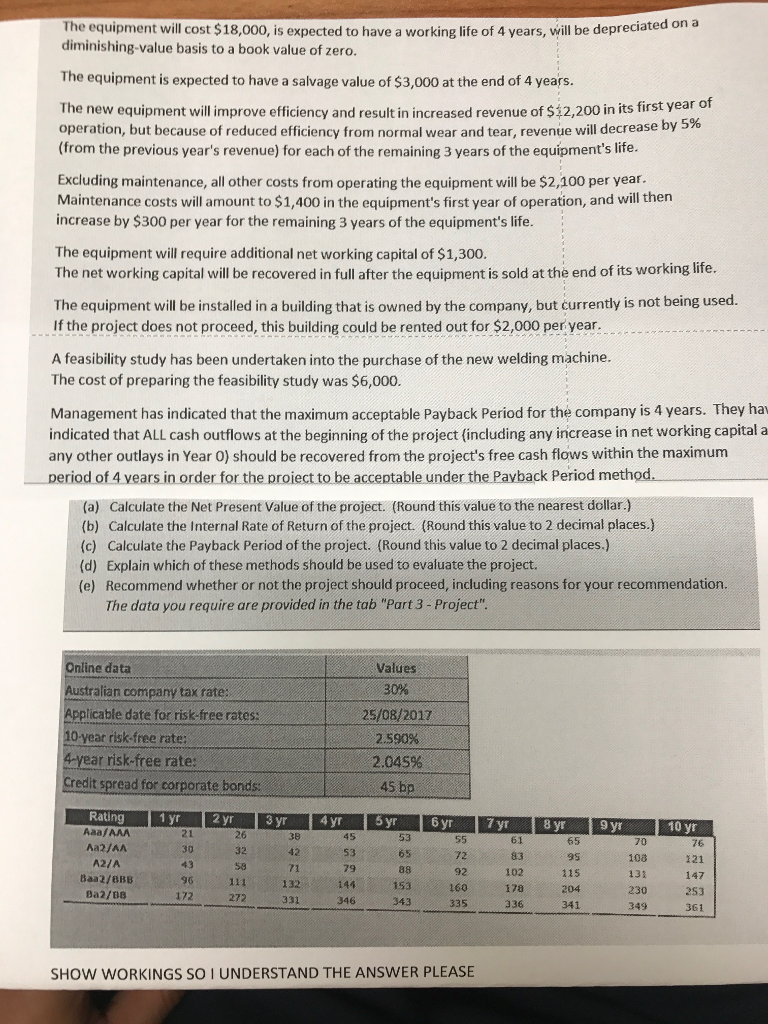

The equipment will cost $18,000, is expected to have a working life of 4 years, will be depreciated on a diminishing-value basis to a book value of zero 4 years. ar of The new equipment will improve efficiency and result in increased revenue of $12,200 in its first ye operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 56 (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $2,100 per year Maintenance costs willamount to $1,400 in the equipment's first year of operation, and will then increase by $300 per year for the remaining 3 years of the equipment's life The equipment will require additional net working capital of $1,300. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $2,000 per year A feasibility study has been undertaken into the purchase of the new welding machine The cost of preparing the feasibility study was $6,000. Management has indicated that the maximum acceptable Payback Period for the company is 4 years. They ha indicated that ALL cash outflows at the beginning of the project (including any increase in net working capital a any other outlays in Year 0) should be recovered from the project's free cash flows within the maximum pe riod of 4 years in order for the proiect to be acceptable under the Payback Period metho (a) Calculate the Net Present Value of the project. (Round this value to the nearest dollar (b) Calculate the Internal Rate of Return of the project. (Round this value to 2 decimal places.) (c) Calculate the Payback Period of the project. (Round this value to 2 decimal places.) (d) Explain which of these methods should be used to evaluate the project. (e) Recommend whether or not the project should proceed, including reasons for your recommendation The data you require are provided in the tab "Part 3 Project" Online data Values 30% 25/08/2017 2.590% 2.045% s bp ustralian company tax rate plicable date for risk-free rates: 10-year risk-free rate: ear risk-free rate: redit spread for corporate bonds Rating Aaa/AAA Aa2/AA A2/A Baa2/BBB Ba2/DB yr 2 yr 3 yr 4 yr 5 yr 6 8 yr 9 yr 10 yr 21 30 26 32 58 38 42 71 132 53 65 65 70 108 131 230 349 76 53 79 72 92 160 335 102 96 172 153 343 115 204 341 147 253 361 272 346 336 SHOW WORKINGS SO I UNDERSTAND THE ANSWER PLEASE