Answered step by step

Verified Expert Solution

Question

1 Approved Answer

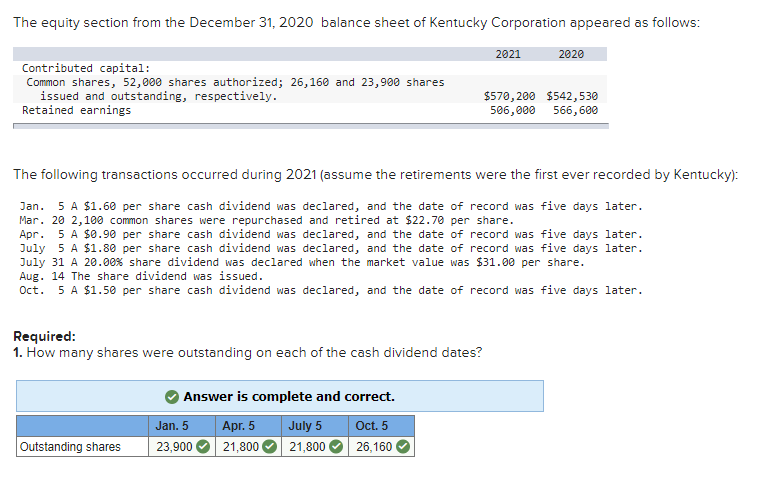

The equity section from the December 31, 2020 balance sheet of Kentucky Corporation appeared as follows: 2021 2020 Contributed capital: Common shares, 52,000 shares

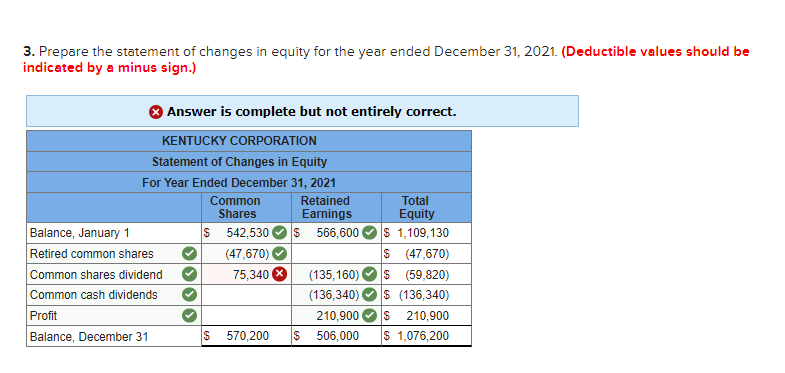

The equity section from the December 31, 2020 balance sheet of Kentucky Corporation appeared as follows: 2021 2020 Contributed capital: Common shares, 52,000 shares authorized; 26,160 and 23,900 shares issued and outstanding, respectively. Retained earnings $570, 200 $542,530 506,000 566, 600 The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Kentucky): Jan. 5 A $1.60 per share cash dividend was declared, and the date of record was five days later. Mar. 20 2,100 common shares were repurchased and retired at $22.70 per share. Apr. July 5 A $1.80 per share cash dividend was declared, and the date of record was five days later. July 31 A 20.00% share dividend was declared when the market value was $31.00 per share. Aug. 14 The share dividend was issued. Oct. 5 A $1.50 per share cash dividend was declared, and the date of record was five days later. 5 A $0.90 per share cash dividend was declared, and the date of record was five days later. Required: 1. How many shares were outstanding on each of the cash dividend dates? Answer is complete and correct. Jan. 5 Ap. 5 July 5 Oct. 5 Outstanding shares 23,900 21,800 21,800 26,160 3. Prepare the statement of changes in equity for the year ended December 31, 2021. (Deductible values should be indicated by a minus sign.) Answer is complete but not entirely correct. KENTUCKY CORPORATION Statement of Changes in Equity For Year Ended December 31, 2021 Common Shares Retained Total Earnings Equity Balance, January 1 $ 566,600 Os 1,109,130 S (47,670) (135,160) Os (59,820) (136,340) Os (136,340) $ 210,900 $ 1,076,200 542,530 Retired common shares (47,670) Common shares dividend 75,340 Common cash dividends Profit 210,900 Balance, December 31 570,200 $ 506,000

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Common Share Reatined Earning Total Equity Beginning ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started