Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The equity shares of the company are quoted at 102 and the company is expected to declare a dividend of 9 per share for the

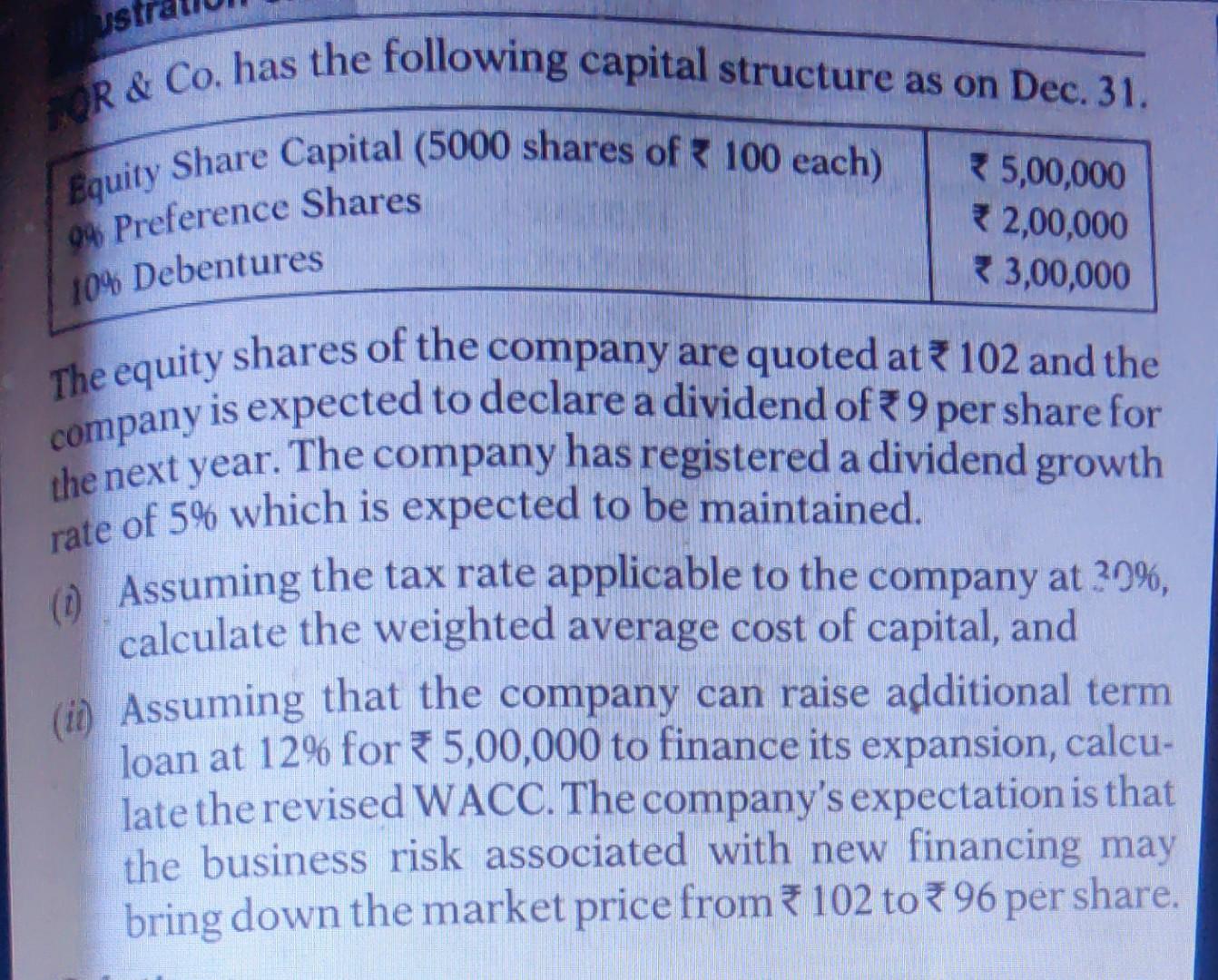

The equity shares of the company are quoted at 102 and the company is expected to declare a dividend of 9 per share for the next year. The company has registered a dividend growth rate of 5% which is expected to be maintained. (i) Assuming the tax rate applicable to the company at 2.5%, calculate the weighted average cost of capital, and (ii) Assuming that the company can raise additional term loan at 12% for 5,00,000 to finance its expansion, calculate the revised WACC. The company's expectation is that the business risk associated with new financing may bring down the market price from 102 to 96 per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started