Answered step by step

Verified Expert Solution

Question

1 Approved Answer

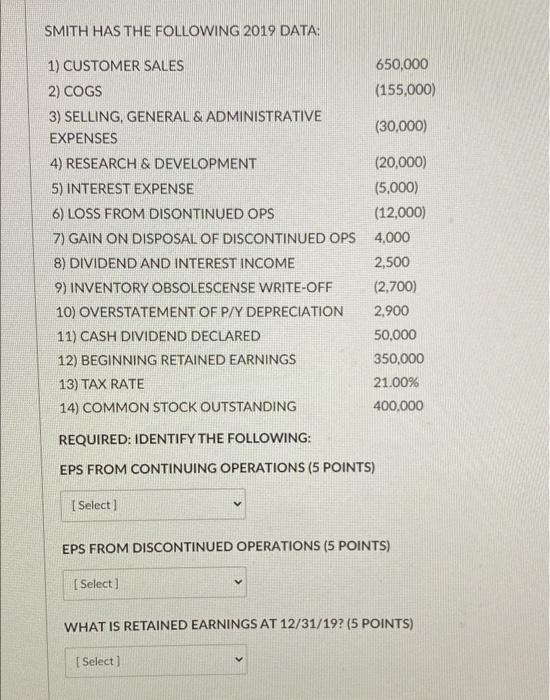

SMITH HAS THE FOLLOWING 2019 DATA: 1) CUSTOMER SALES 2) COGS 3) SELLING, GENERAL & ADMINISTRATIVE EXPENSES 650,000 (155,000) (30,000) (20,000) (5,000) 6) LOSS

SMITH HAS THE FOLLOWING 2019 DATA: 1) CUSTOMER SALES 2) COGS 3) SELLING, GENERAL & ADMINISTRATIVE EXPENSES 650,000 (155,000) (30,000) (20,000) (5,000) 6) LOSS FROM DISONTINUED OPS (12,000) 7) GAIN ON DISPOSAL OF DISCONTINUED OPS 4,000 8) DIVIDEND AND INTEREST INCOME 2,500 9) INVENTORY OBSOLESCENSE WRITE-OFF (2,700) 10) OVERSTATEMENT OF P/Y DEPRECIATION 2,900 11) CASH DIVIDEND DECLARED 50,000 12) BEGINNING RETAINED EARNINGS 350,000 13) TAX RATE 21.00% 14) COMMON STOCK OUTSTANDING 400,000 4) RESEARCH & DEVELOPMENT 5) INTEREST EXPENSE REQUIRED: IDENTIFY THE FOLLOWING: EPS FROM CONTINUING OPERATIONS (5 POINTS) [Select] EPS FROM DISCONTINUED OPERATIONS (5 POINTS) [Select] WHAT IS RETAINED EARNINGS AT 12/31/19? (5 POINTS) [Select]

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution We perform separation of variables yx t XzTt again The boundary conditions dictate that the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started