- The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant, and equipment cost.

ty, plant and equipment's cost.

ty, plant and equipment's cost.

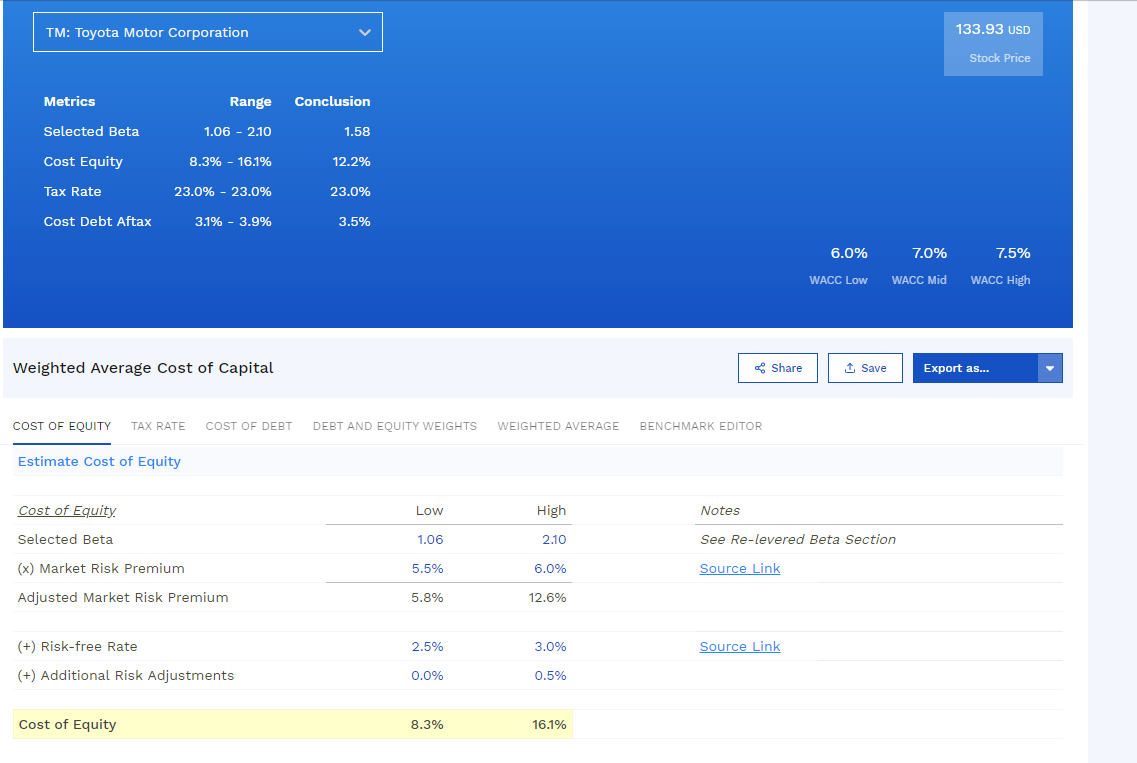

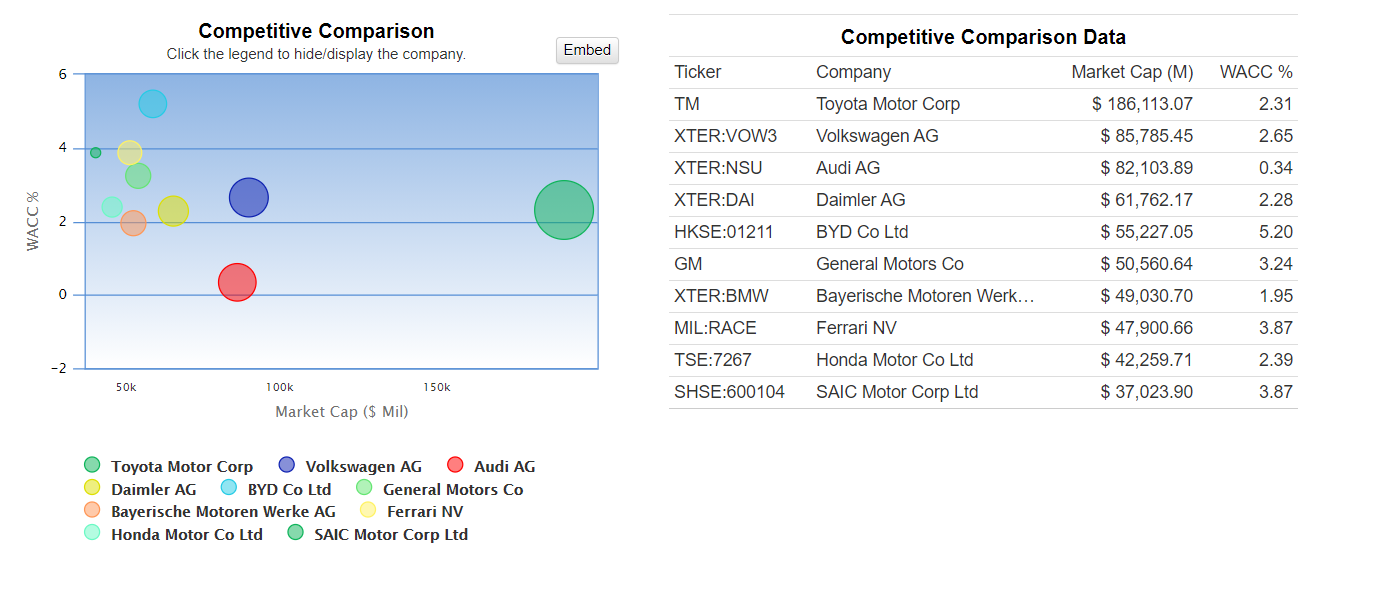

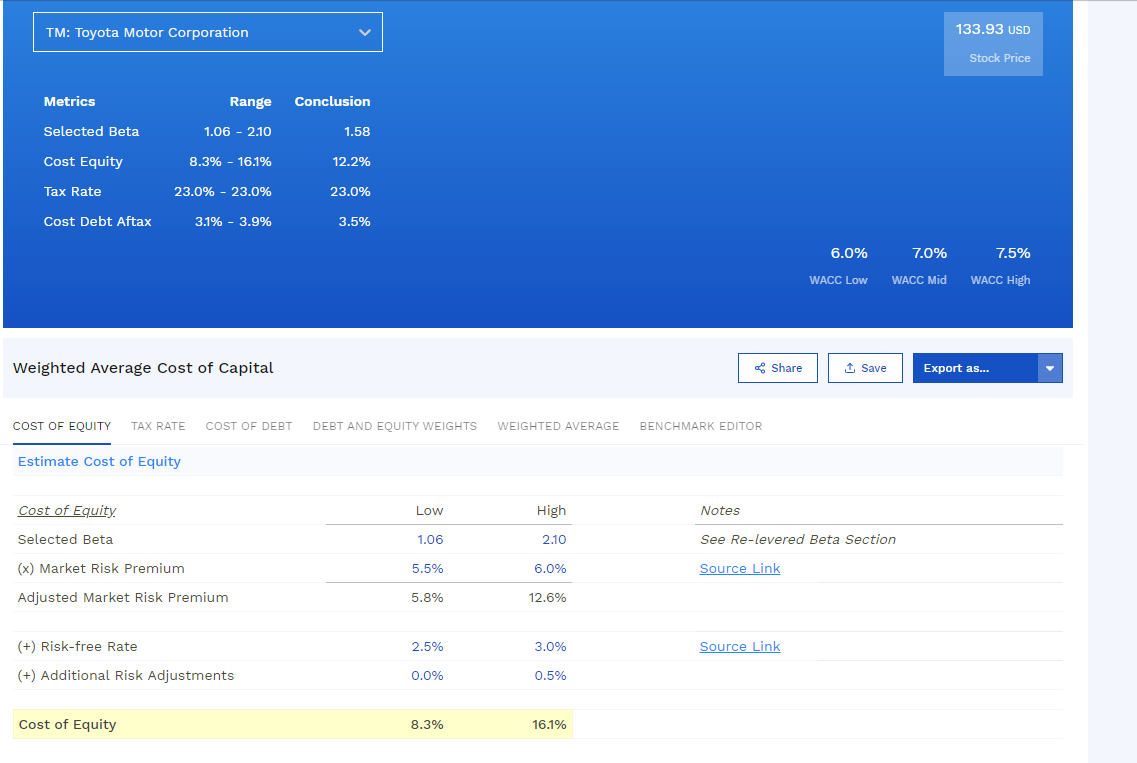

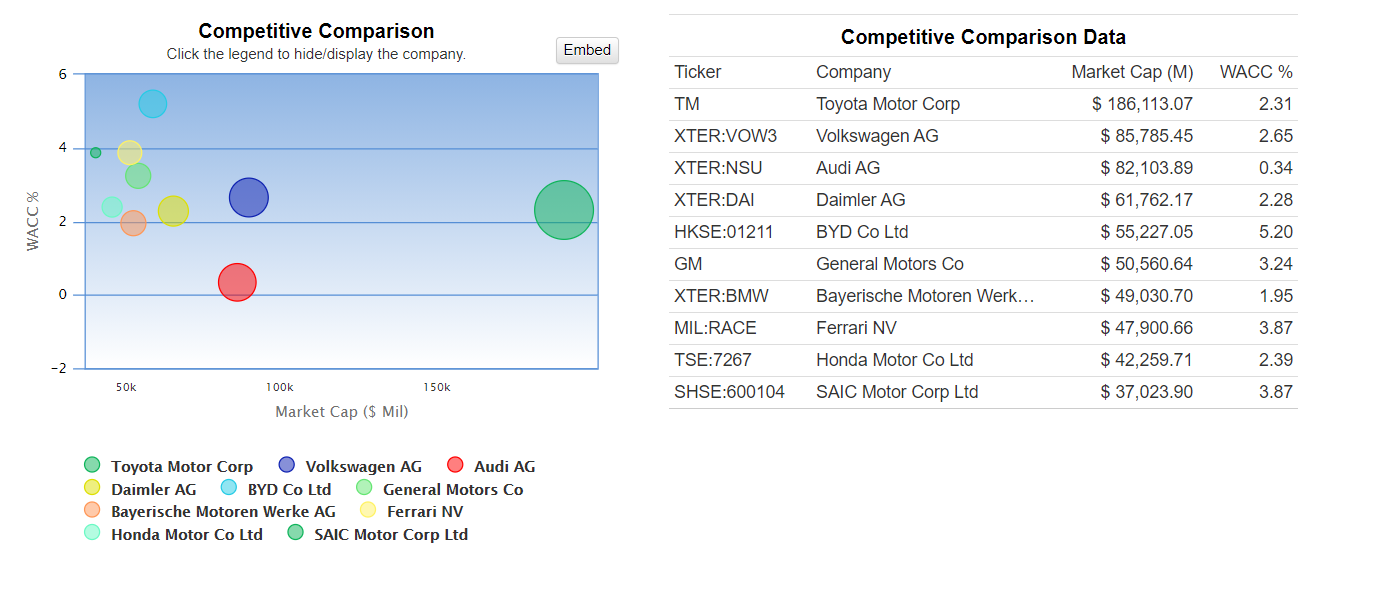

TM: Toyota Motor Corporation 133.93 USD Stock Price Metrics Range Conclusion Selected Beta 1.06 - 2.10 1.58 Cost Equity 8.3% - 16.1% 12.2% Tax Rate 23.0% - 23.0% 23.0% Cost Debt Aftax 3.1% - 3.9% 3.5% 6.0% 7.0% 7.5% WACC Low WACC Mid WACC High Weighted Average cost of Capital Share 1 Save Export as... COST OF EQUITY TAX RATE COST OF DEBT DEBT AND EQUITY WEIGHTS WEIGHTED AVERAGE BENCHMARK EDITOR Estimate Cost of Equity Cost of Equity Low High Notes Selected Beta 1.06 2.10 See Re-levered Beta Section (x) Market Risk Premium 5.5% 6.0% Source Link Adjusted Market Risk Premium 5.8% 12.6% (+) Risk-free Rate 2.5% 3.0% Source Link (+) Additional Risk Adjustments 0.0% 0.5% Cost of Equity 8.3% 16.1% Competitive Comparison Click the legend to hide/display the company. Embed 6 Ticker WACC % TM 2.31 XTER:VOW3 2.65 XTER:NSU 0.34 2.28 WACC % XTER:DAI HKSE:01211 Competitive Comparison Data Company Market Cap (M) Toyota Motor Corp $ 186,113.07 Volkswagen AG $ 85,785.45 Audi AG $ 82,103.89 Daimler AG $ 61,762.17 BYD Co Ltd $ 55,227.05 General Motors Co $ 50,560.64 Bayerische Motoren Werk... $ 49,030.70 Ferrari NV $ 47,900.66 Honda Motor Co Ltd $ 42,259.71 SAIC Motor Corp Ltd $ 37,023.90 5.20 GM 3.24 0 XTER:BMW 1.95 MIL:RACE 3.87 TSE:7267 2.39 -2 50k 100K 150k SHSE:600104 3.87 Market Cap ($ Mil) Toyota Motor Corp Volkswagen AG Audi AG O Daimler AG O BYD Co Ltd O General Motors Co Bayerische Motoren Werke AG Ferrari NV Honda Motor Co Ltd SAIC Motor Corp Ltd TM: Toyota Motor Corporation 133.93 USD Stock Price Metrics Range Conclusion Selected Beta 1.06 - 2.10 1.58 Cost Equity 8.3% - 16.1% 12.2% Tax Rate 23.0% - 23.0% 23.0% Cost Debt Aftax 3.1% - 3.9% 3.5% 6.0% 7.0% 7.5% WACC Low WACC Mid WACC High Weighted Average cost of Capital Share 1 Save Export as... COST OF EQUITY TAX RATE COST OF DEBT DEBT AND EQUITY WEIGHTS WEIGHTED AVERAGE BENCHMARK EDITOR Estimate Cost of Equity Cost of Equity Low High Notes Selected Beta 1.06 2.10 See Re-levered Beta Section (x) Market Risk Premium 5.5% 6.0% Source Link Adjusted Market Risk Premium 5.8% 12.6% (+) Risk-free Rate 2.5% 3.0% Source Link (+) Additional Risk Adjustments 0.0% 0.5% Cost of Equity 8.3% 16.1% Competitive Comparison Click the legend to hide/display the company. Embed 6 Ticker WACC % TM 2.31 XTER:VOW3 2.65 XTER:NSU 0.34 2.28 WACC % XTER:DAI HKSE:01211 Competitive Comparison Data Company Market Cap (M) Toyota Motor Corp $ 186,113.07 Volkswagen AG $ 85,785.45 Audi AG $ 82,103.89 Daimler AG $ 61,762.17 BYD Co Ltd $ 55,227.05 General Motors Co $ 50,560.64 Bayerische Motoren Werk... $ 49,030.70 Ferrari NV $ 47,900.66 Honda Motor Co Ltd $ 42,259.71 SAIC Motor Corp Ltd $ 37,023.90 5.20 GM 3.24 0 XTER:BMW 1.95 MIL:RACE 3.87 TSE:7267 2.39 -2 50k 100K 150k SHSE:600104 3.87 Market Cap ($ Mil) Toyota Motor Corp Volkswagen AG Audi AG O Daimler AG O BYD Co Ltd O General Motors Co Bayerische Motoren Werke AG Ferrari NV Honda Motor Co Ltd SAIC Motor Corp Ltd

ty, plant and equipment's cost.

ty, plant and equipment's cost.