Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Evan 2021 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to

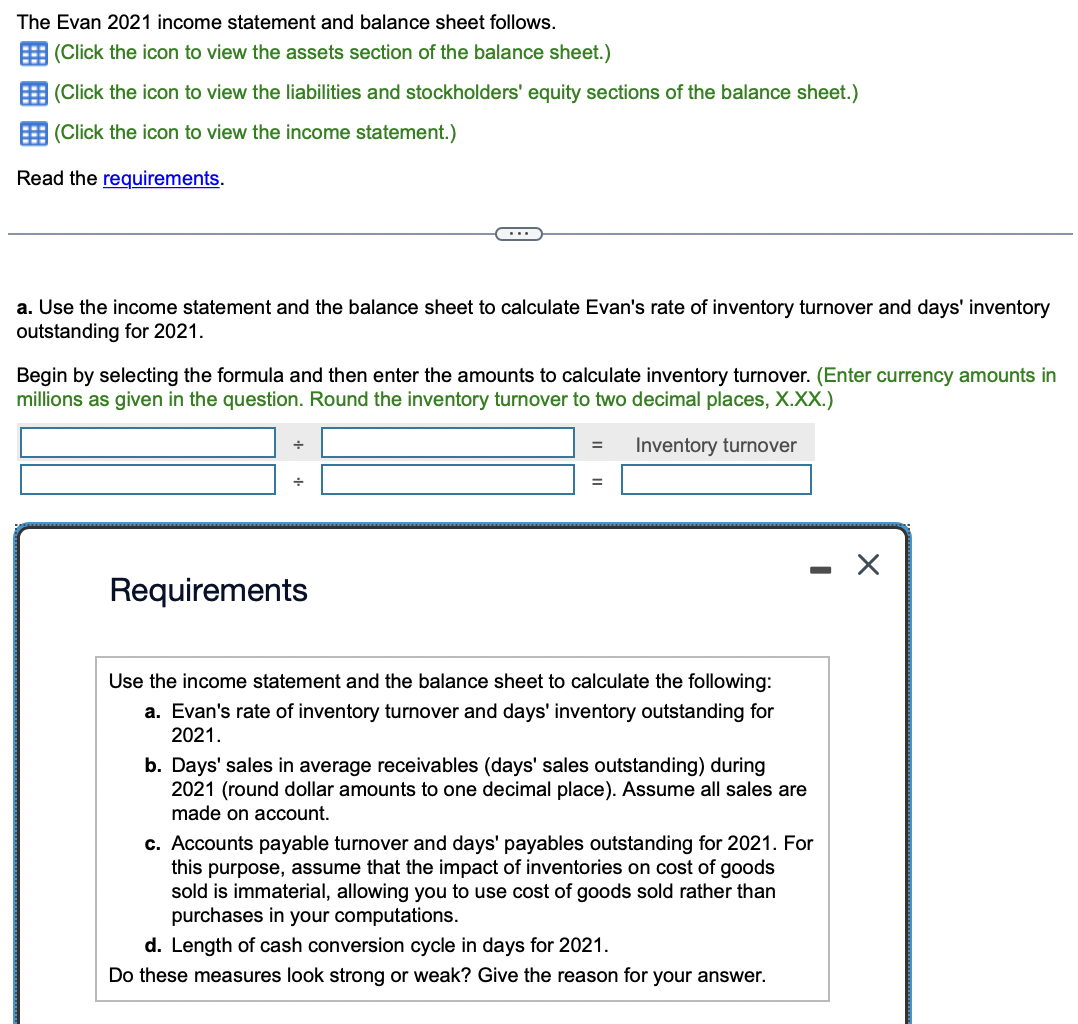

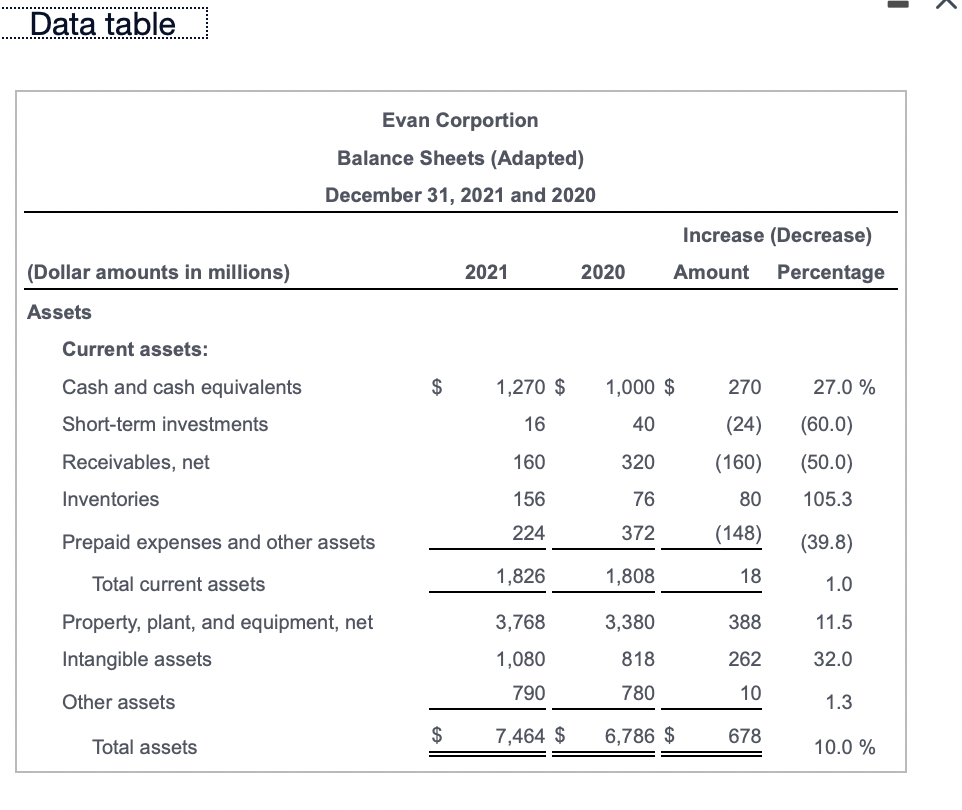

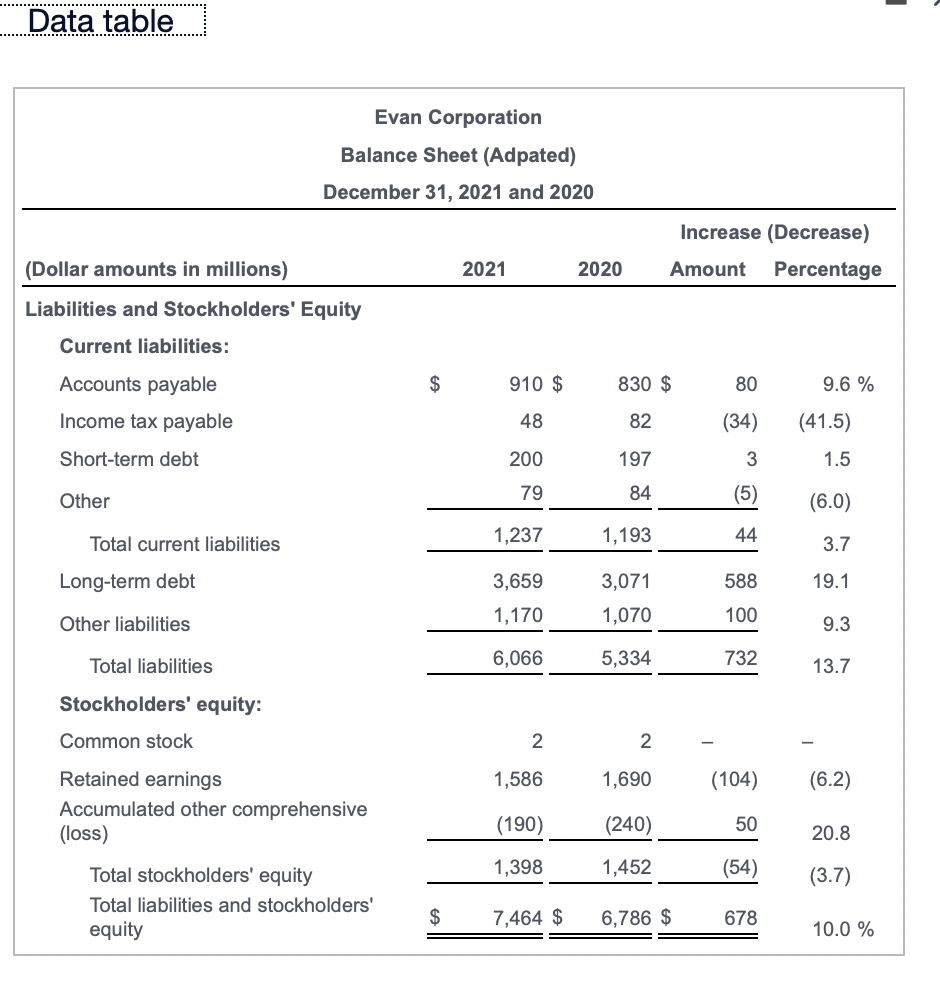

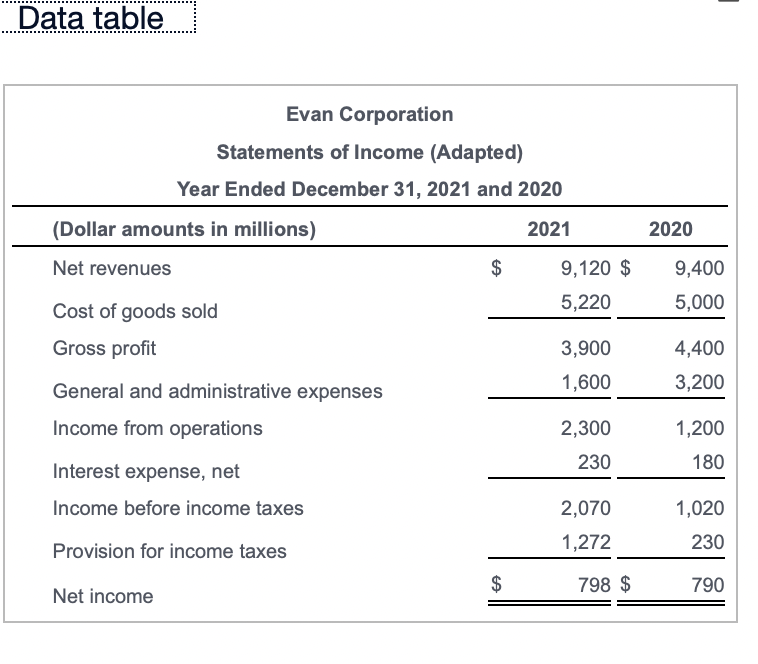

The Evan 2021 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) Read the requirements. a. Use the income statement and the balance sheet to calculate Evan's rate of inventory turnover and days' inventory outstanding for 2021. Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) Requirements Use the income statement and the balance sheet to calculate the following: a. Evan's rate of inventory turnover and days' inventory outstanding for 2021. b. Days' sales in average receivables (days' sales outstanding) during 2021 (round dollar amounts to one decimal place). Assume all sales are made on account. c. Accounts payable turnover and days' payables outstanding for 2021. For this purpose, assume that the impact of inventories on cost of goods sold is immaterial, allowing you to use cost of goods sold rather than purchases in your computations. d. Length of cash conversion cycle in days for 2021. Do these measures look strong or weak? Give the reason for your answer. Data table \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{EvanCorporationBalanceSheet(Adpated)December31,2021and2020} \\ \hline \multirow[b]{2}{*}{ (Dollar amounts in millions) } & \multirow{2}{*}{\multicolumn{2}{|c|}{2021}} & \multirow[b]{2}{*}{2020} & \multicolumn{2}{|c|}{ Increase (Decrease) } \\ \hline & & & & Amount & Percentage \\ \hline \multicolumn{6}{|l|}{ Liabilities and Stockholders' Equity } \\ \hline \multicolumn{6}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $ & 910$ & 830 & 80 & 9.6% \\ \hline Income tax payable & & 48 & 82 & (34) & (41.5) \\ \hline Short-term debt & & 200 & 197 & 3 & 1.5 \\ \hline Other & & 79 & 84 & (5) & (6.0) \\ \hline Total current liabilities & & 1,237 & 1,193 & 44 & 3.7 \\ \hline Long-term debt & & 3,659 & 3,071 & 588 & 19.1 \\ \hline Other liabilities & & 1,170 & 1,070 & 100 & 9.3 \\ \hline Total liabilities & & 6,066 & 5,334 & 732 & 13.7 \\ \hline \multicolumn{6}{|l|}{ Stockholders' equity: } \\ \hline Common stock & & 2 & 2 & - & - \\ \hline Retained earnings & & 1,586 & 1,690 & (104) & (6.2) \\ \hline Accumulatedothercomprehensive(loss) & & (190) & (240) & 50 & 20.8 \\ \hline Total stockholders' equity & & 1,398 & 1,452 & (54) & (3.7) \\ \hline Totalliabilitiesandstockholdersequity & $ & 7,464= & 6,786 & 678 & 10.0% \\ \hline \end{tabular} Data table Data table

The Evan 2021 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) Read the requirements. a. Use the income statement and the balance sheet to calculate Evan's rate of inventory turnover and days' inventory outstanding for 2021. Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) Requirements Use the income statement and the balance sheet to calculate the following: a. Evan's rate of inventory turnover and days' inventory outstanding for 2021. b. Days' sales in average receivables (days' sales outstanding) during 2021 (round dollar amounts to one decimal place). Assume all sales are made on account. c. Accounts payable turnover and days' payables outstanding for 2021. For this purpose, assume that the impact of inventories on cost of goods sold is immaterial, allowing you to use cost of goods sold rather than purchases in your computations. d. Length of cash conversion cycle in days for 2021. Do these measures look strong or weak? Give the reason for your answer. Data table \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{EvanCorporationBalanceSheet(Adpated)December31,2021and2020} \\ \hline \multirow[b]{2}{*}{ (Dollar amounts in millions) } & \multirow{2}{*}{\multicolumn{2}{|c|}{2021}} & \multirow[b]{2}{*}{2020} & \multicolumn{2}{|c|}{ Increase (Decrease) } \\ \hline & & & & Amount & Percentage \\ \hline \multicolumn{6}{|l|}{ Liabilities and Stockholders' Equity } \\ \hline \multicolumn{6}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $ & 910$ & 830 & 80 & 9.6% \\ \hline Income tax payable & & 48 & 82 & (34) & (41.5) \\ \hline Short-term debt & & 200 & 197 & 3 & 1.5 \\ \hline Other & & 79 & 84 & (5) & (6.0) \\ \hline Total current liabilities & & 1,237 & 1,193 & 44 & 3.7 \\ \hline Long-term debt & & 3,659 & 3,071 & 588 & 19.1 \\ \hline Other liabilities & & 1,170 & 1,070 & 100 & 9.3 \\ \hline Total liabilities & & 6,066 & 5,334 & 732 & 13.7 \\ \hline \multicolumn{6}{|l|}{ Stockholders' equity: } \\ \hline Common stock & & 2 & 2 & - & - \\ \hline Retained earnings & & 1,586 & 1,690 & (104) & (6.2) \\ \hline Accumulatedothercomprehensive(loss) & & (190) & (240) & 50 & 20.8 \\ \hline Total stockholders' equity & & 1,398 & 1,452 & (54) & (3.7) \\ \hline Totalliabilitiesandstockholdersequity & $ & 7,464= & 6,786 & 678 & 10.0% \\ \hline \end{tabular} Data table Data table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started