Question

The Evangelical Private School follows FASB standards of accounting and reporting. Cash contributions were received as follows: (a) $968,000 for any purpose desired by the

The Evangelical Private School follows FASB standards of accounting and reporting.

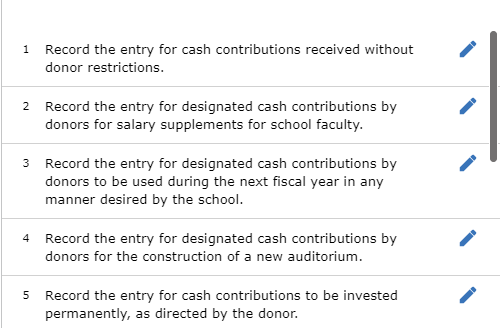

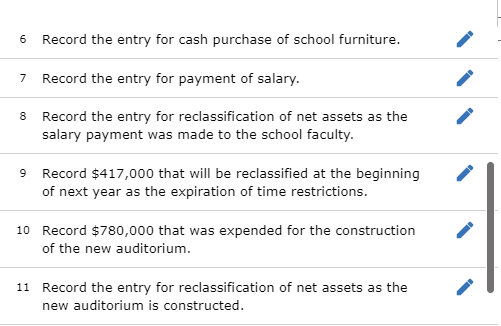

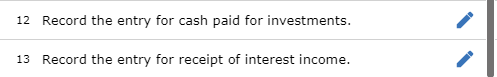

Cash contributions were received as follows: (a) $968,000 for any purpose desired by the school, (b) $300,000 designated by donors for salary supplements for school faculty, (c) $417,000 designated by donors to be used during the next fiscal year in any manner desired by the school, (d) $550,000 designated by donors for the construction of a new auditorium, and (e) $400,000 designated by donors to be invested permanently, with the income to be used as desired by the school. The schools policy is to record all restricted gifts as with donor restrictions and then reclassify when the restriction is lifted. The school expended $400,000 of the $968,000 mentioned in 1(a) for school furniture. The school expended the $280,000 for salary supplements as directed by the donor in 1(b). The $417,000 in 1(c) was retained for use next year, as directed by the donor. $780,000 was expended for the construction of the new auditorium. The $400,000 mentioned in 1(e) was invested permanently, as directed by the donor, and in the year ended June 30, 2020, the school received interest of $19,000, none of which was expended.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started