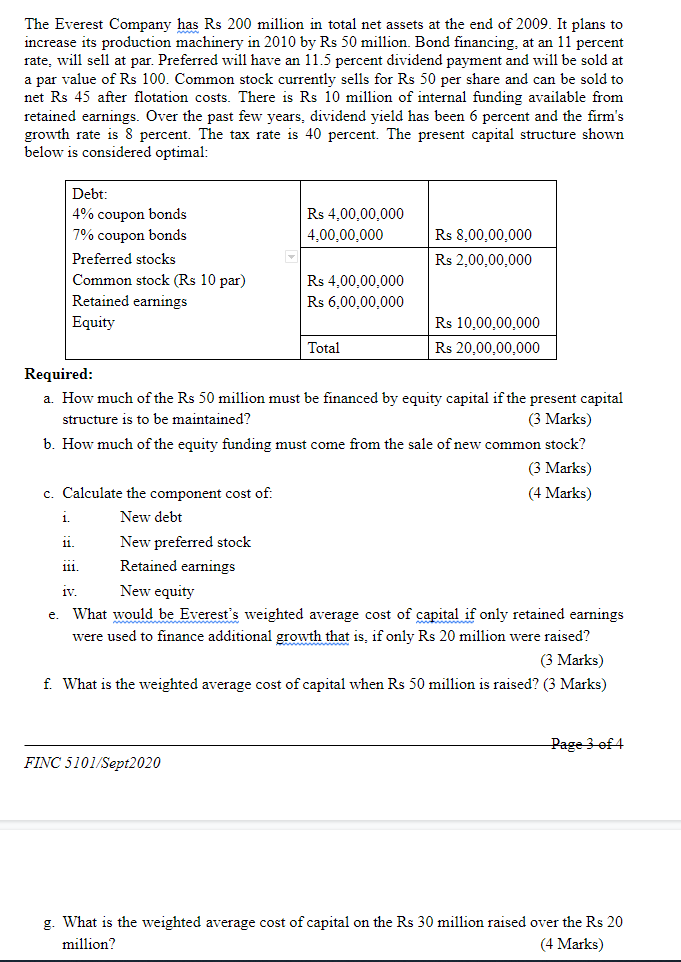

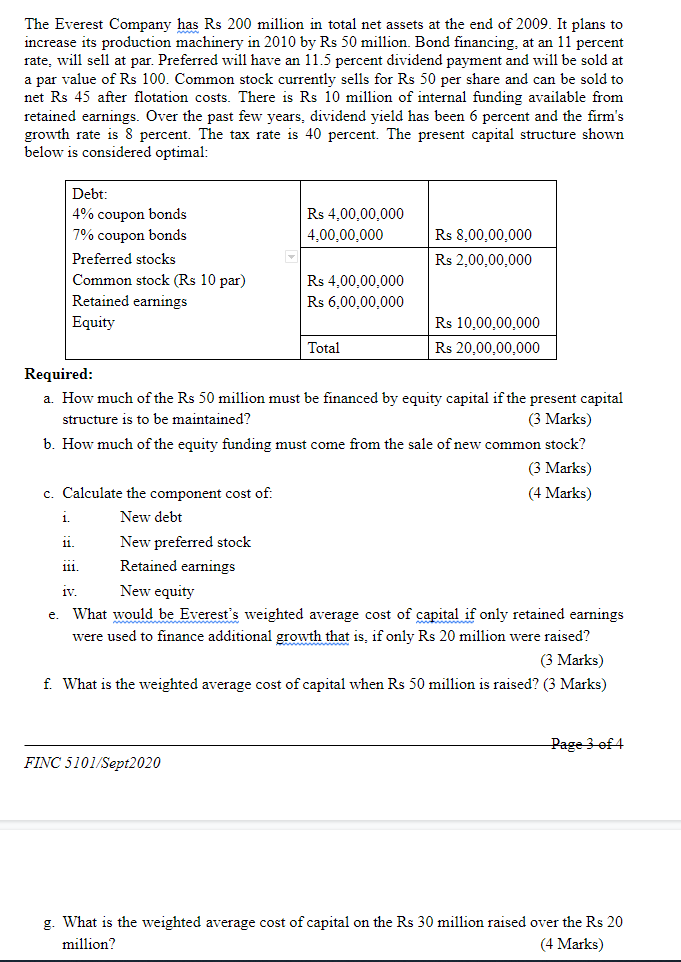

The Everest Company has Rs 200 million in total net assets at the end of 2009. It plans to increase its production machinery in 2010 by Rs 50 million. Bond financing, at an 11 percent rate, will sell at par. Preferred will have an 11.5 percent dividend payment and will be sold at a par value of Rs 100. Common stock currently sells for Rs 50 per share and can be sold to net Rs 45 after flotation costs. There is Rs 10 million of internal funding available from retained earnings. Over the past few years, dividend yield has been 6 percent and the firm's growth rate is 8 percent. The tax rate is 40 percent. The present capital structure shown below is considered optimal: Rs 4,00,00,000 4,00,00.000 Debt: 4% coupon bonds 7% coupon bonds Preferred stocks Common stock (Rs 10 par) Retained earnings Equity Rs 8.00.00.000 Rs 2.00.00.000 Rs 4,00,00,000 Rs 6.00.00.000 Rs 10,00.00.000 Rs 20.00.00.000 Total Required: a. How much of the Rs 50 million must be financed by equity capital if the present capital structure is to be maintained? (3 Marks) b. How much of the equity funding must come from the sale of new common stock? (3 Marks) c. Calculate the component cost of: (4 Marks) 1. New debt New preferred stock Retained earnings New equity What would be Everest's weighted average cost of capital if only retained earnings were used to finance additional growth that is, if only Rs 20 million were raised? (3 Marks) f. What is the weighted average cost of capital when Rs 50 million is raised? (3 Marks) 11. 111. IV. Page 3 of 4 FINC 5101/Sept2020 g. What is the weighted average cost of capital on the Rs 30 million raised over the Rs 20 million? (4 Marks) The Everest Company has Rs 200 million in total net assets at the end of 2009. It plans to increase its production machinery in 2010 by Rs 50 million. Bond financing, at an 11 percent rate, will sell at par. Preferred will have an 11.5 percent dividend payment and will be sold at a par value of Rs 100. Common stock currently sells for Rs 50 per share and can be sold to net Rs 45 after flotation costs. There is Rs 10 million of internal funding available from retained earnings. Over the past few years, dividend yield has been 6 percent and the firm's growth rate is 8 percent. The tax rate is 40 percent. The present capital structure shown below is considered optimal: Rs 4,00,00,000 4,00,00.000 Debt: 4% coupon bonds 7% coupon bonds Preferred stocks Common stock (Rs 10 par) Retained earnings Equity Rs 8.00.00.000 Rs 2.00.00.000 Rs 4,00,00,000 Rs 6.00.00.000 Rs 10,00.00.000 Rs 20.00.00.000 Total Required: a. How much of the Rs 50 million must be financed by equity capital if the present capital structure is to be maintained? (3 Marks) b. How much of the equity funding must come from the sale of new common stock? (3 Marks) c. Calculate the component cost of: (4 Marks) 1. New debt New preferred stock Retained earnings New equity What would be Everest's weighted average cost of capital if only retained earnings were used to finance additional growth that is, if only Rs 20 million were raised? (3 Marks) f. What is the weighted average cost of capital when Rs 50 million is raised? (3 Marks) 11. 111. IV. Page 3 of 4 FINC 5101/Sept2020 g. What is the weighted average cost of capital on the Rs 30 million raised over the Rs 20 million? (4 Marks)