Answered step by step

Verified Expert Solution

Question

1 Approved Answer

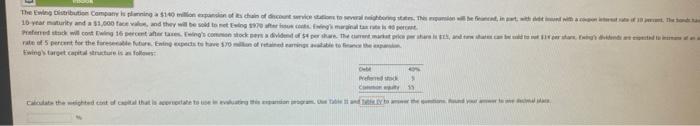

The Ewing distribution company is planning a 140 million expansion of its chain of discount service stations to several neighboring states. This expansion will be

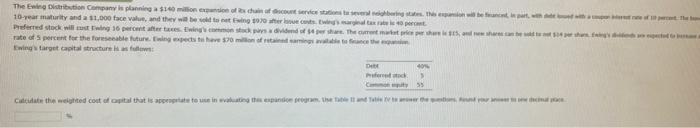

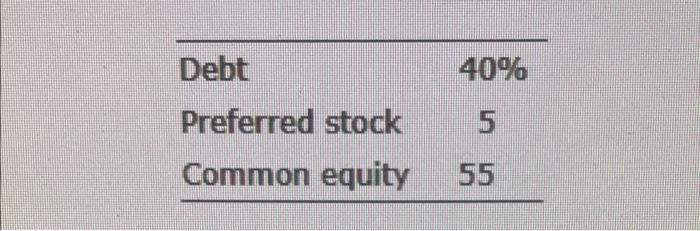

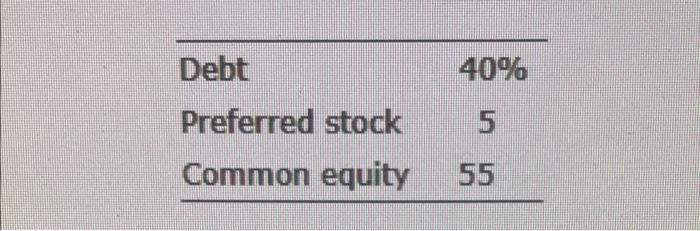

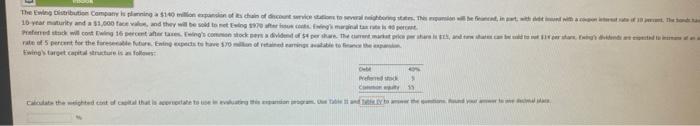

The Ewing distribution company is planning a 140 million expansion of its chain of discount service stations to several neighboring states. This expansion will be financed, in part, with debt issued with a coupon interest rate of 10%. The bonds have a 10 year maturity and a $1000 face value, and they will be sold sold to net Ewing $970 after issue cost. Ewings marginal rate tax rate is 40%. Preferred stock will cost Ewing 16% after taxes. Ewings common stocks pays a dividend of four dollars per share. The current market price per share is $15, and new shares can be sold to net $14 per share. Ewing's dividends are expected to increase at an annual rate of 5% for the foreseeable future. Ewings expects to have 70 million of retained earnings available to finance expansion. Evenings target capital structure is as follows (see picture)

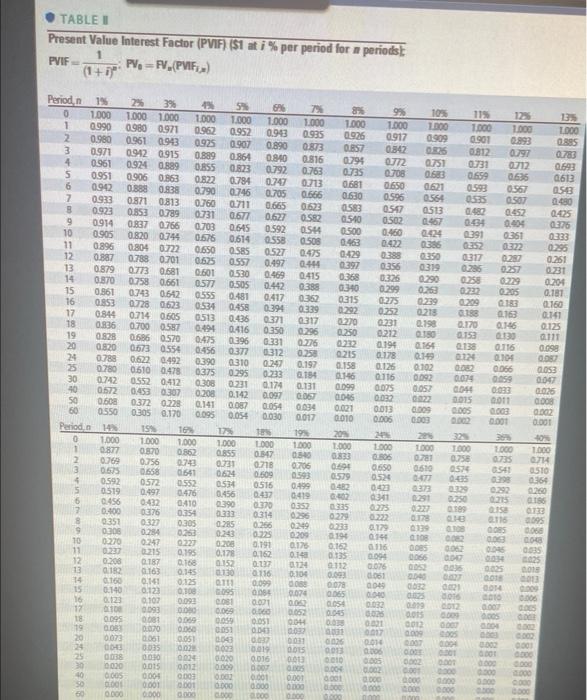

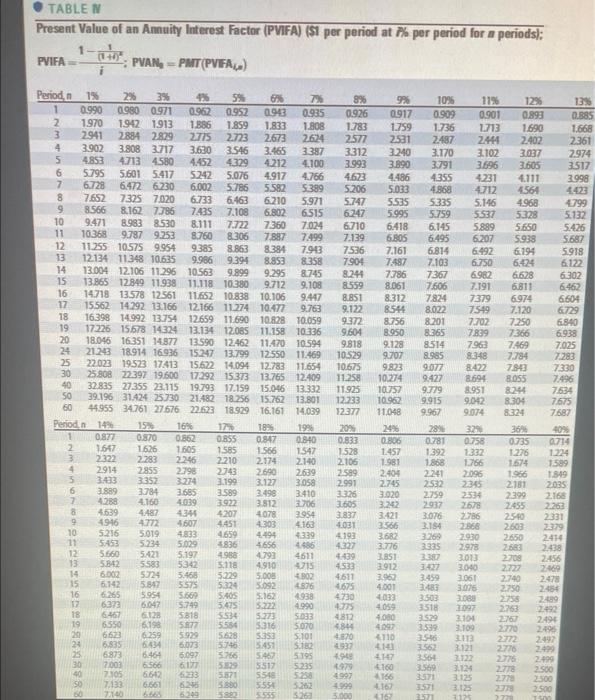

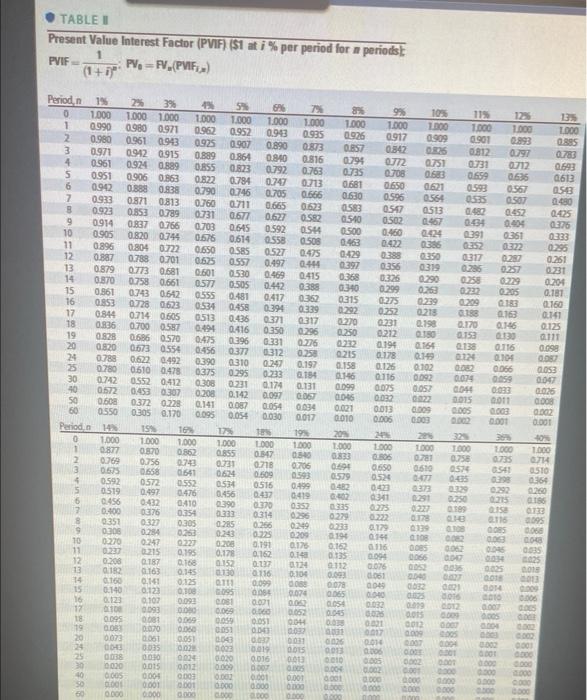

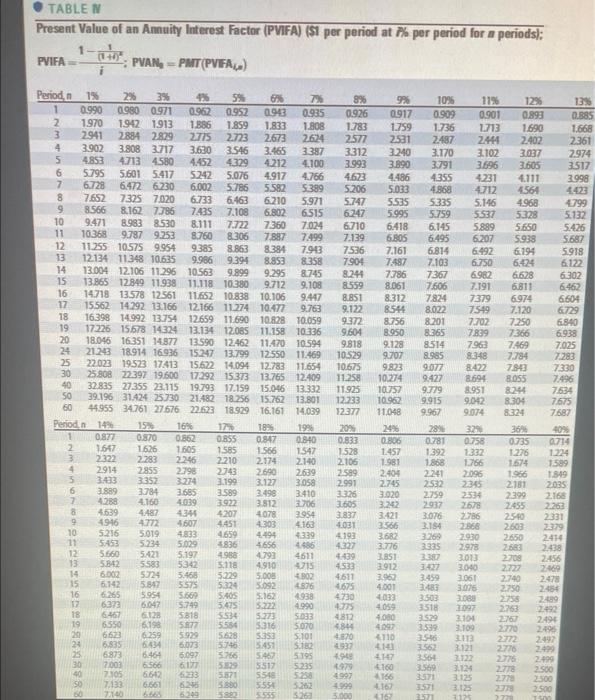

Fining a target capital structure H at fultwit \begin{tabular}{lc} \hline Debt & 40% \\ Preferred stock & 5 \\ Common equity & 55 \\ \hline \end{tabular} Present Value Interest Factor (PVIF) IS1 at i \% per period for n periodst Present Value of an Annuity Interest Factor (PVIFA) (S1 per period at 7 s per period for n periods): fiwing tarset capit al structure is an followst calculate the weighted cost of capital that is appropriate to use in evaluating this expansion program.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started