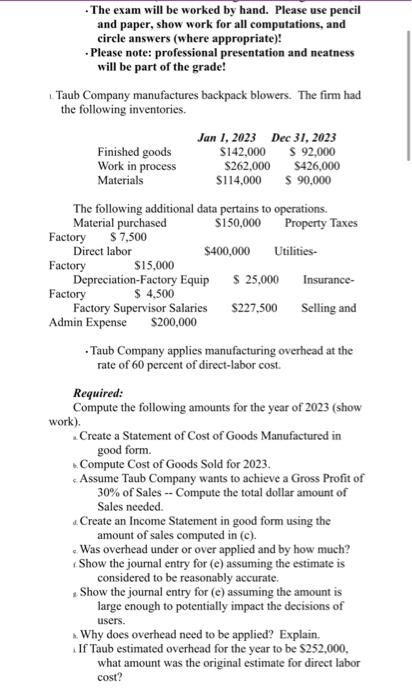

- The exam will be worked by hand. Please use pencil and paper, show work for all computations, and circle answers (where appropriate)! - Please note: professional presentation and neatness will be part of the grade! . Taub Company manufactures backpack blowers. The firm had the following inventories. - Taub Company applies manufacturing overhead at the rate of 60 pereent of direct-labor cost. Required: Compute the following amounts for the year of 2023 (show work). - Create a Statement of Cost of Goods Manufactured in good form. 4. Compute Cost of Goods Sold for 2023. c. Assume Taub Company wants to achieve a Gross Profit of 30% of Sales -- Compute the total dollar amount of Sales needed. . Create an Income Statement in good form using the amount of sales computed in (c). e. Was overhead under or over applied and by how much? Show the journal entry for (e) assuming the estimate is considered to be reasonably accurate. 1. Show the journal entry for (e) assuming the amount is large enough to potentially impact the decisions of users. . Why does overhead need to be applied? Explain. If Taub estimated overhead for the year to be $252,000, what amount was the original estimate for direct labor cost? - The exam will be worked by hand. Please use pencil and paper, show work for all computations, and circle answers (where appropriate)! - Please note: professional presentation and neatness will be part of the grade! . Taub Company manufactures backpack blowers. The firm had the following inventories. - Taub Company applies manufacturing overhead at the rate of 60 pereent of direct-labor cost. Required: Compute the following amounts for the year of 2023 (show work). - Create a Statement of Cost of Goods Manufactured in good form. 4. Compute Cost of Goods Sold for 2023. c. Assume Taub Company wants to achieve a Gross Profit of 30% of Sales -- Compute the total dollar amount of Sales needed. . Create an Income Statement in good form using the amount of sales computed in (c). e. Was overhead under or over applied and by how much? Show the journal entry for (e) assuming the estimate is considered to be reasonably accurate. 1. Show the journal entry for (e) assuming the amount is large enough to potentially impact the decisions of users. . Why does overhead need to be applied? Explain. If Taub estimated overhead for the year to be $252,000, what amount was the original estimate for direct labor cost