The excel spreadsheet provides you data from Exhibit 3 and a portion of Exhibit 4. Use Excel functions and the relevant formula and show how

The excel spreadsheet provides you data from Exhibit 3 and a portion of Exhibit 4. Use Excel

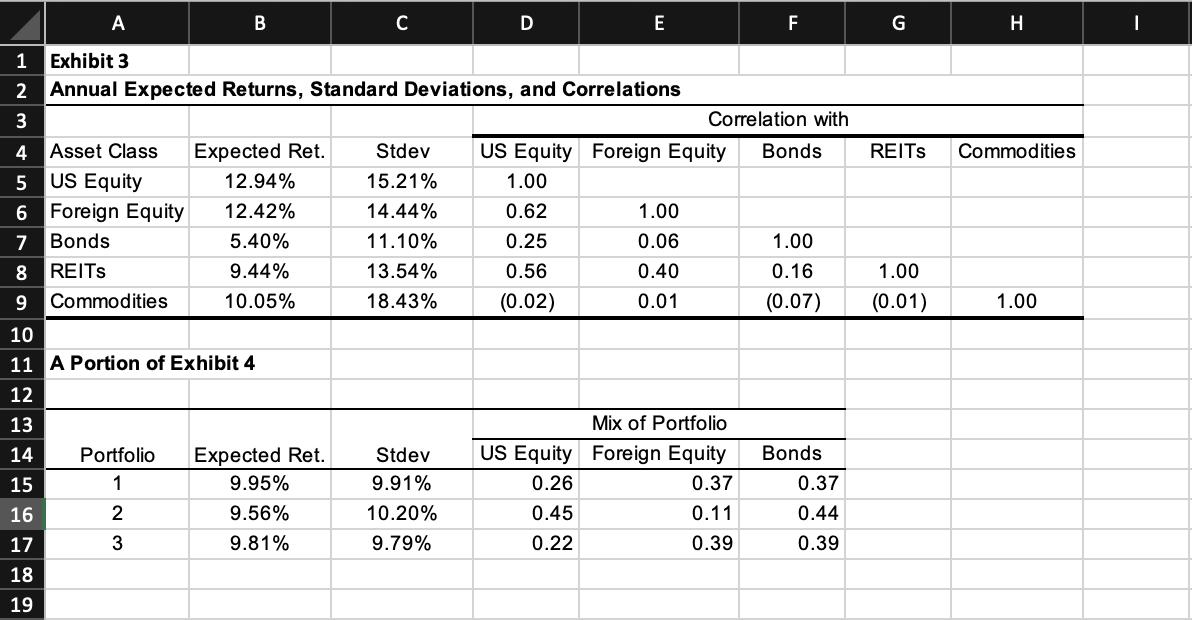

A 1 Exhibit 3 2 Annual Expected Returns, Standard Deviations, and Correlations 3 456 B Asset Class Expected Ret. US Equity 6 Foreign Equity 7 Bonds 8 REITS 9 Commodities 12.94% 12.42% 5.40% 9.44% 10.05% 10 11 A Portion of Exhibit 4 12 13 14 15 16 17 18 19 Portfolio Expected Ret. 1 2 3 C 9.95% 9.56% 9.81% D Stdev 9.91% 10.20% 9.79% E 1.00 0.62 0.25 0.56 (0.02) Stdev US Equity Foreign Equity Bonds 15.21% 14.44% 11.10% 13.54% 18.43% US Equity 0.26 0.45 0.22 1.00 0.06 0.40 0.01 F Correlation with Mix of Portfolio Foreign Equity 0.37 0.11 0.39 1.00 0.16 (0.07) Bonds 0.37 0.44 0.39 G H REITS Commodities 1.00 (0.01) 1.00 I

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

A Exhibit 3 This table provides the expected returns standard deviations and correlations of four asset classes US Equity Foreign Equity Bonds and REI...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started