Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The executive management of a multinational corporation plan to raise funds. They believe that their share price is highly overvalued and that they could access

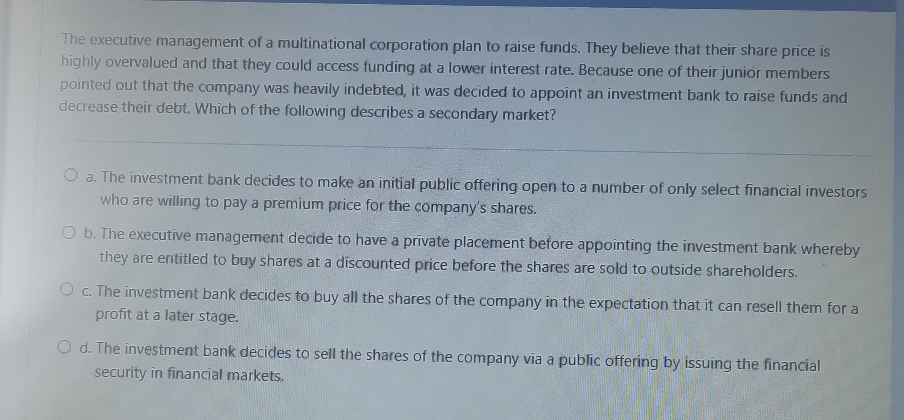

The executive management of a multinational corporation plan to raise funds. They believe that their share price is highly overvalued and that they could access funding at a lower interest rate. Because one of their junior members pointed out that the company was heavily indebted, it was decided to appoint an investment bank to raise funds and decrease their debt. Which of the following describes a secondary market?

a The investment bank decides to make an initial public offering open to a number of only select financial investors who are willing to pay a premium price for the company's shares.

b The executive management decide to have a private placement before appointing the investment bank whereby they are entitled to buy shares at a discounted price before the shares are sold to outside shareholders.

c The investment bank decides to buy all the shares of the company in the expectation that it can resell them for a profit at a later stage.

d The investment bank decides to sell the shares of the company via a public offering by issuing the financial security in financial markets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started