Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the exercises are full without any missed information ,who solve them ,he is super expert in accounting Exercise CFS_1 - Conselidation effect and entries (at

the exercises are full without any missed information ,who solve them ,he is super expert in accounting

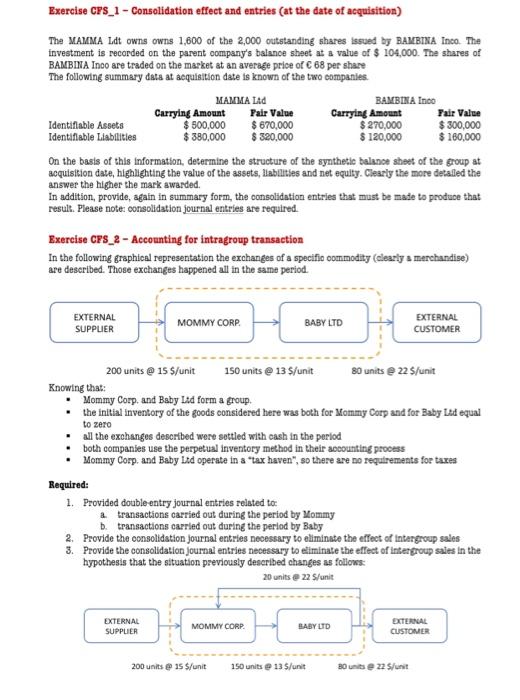

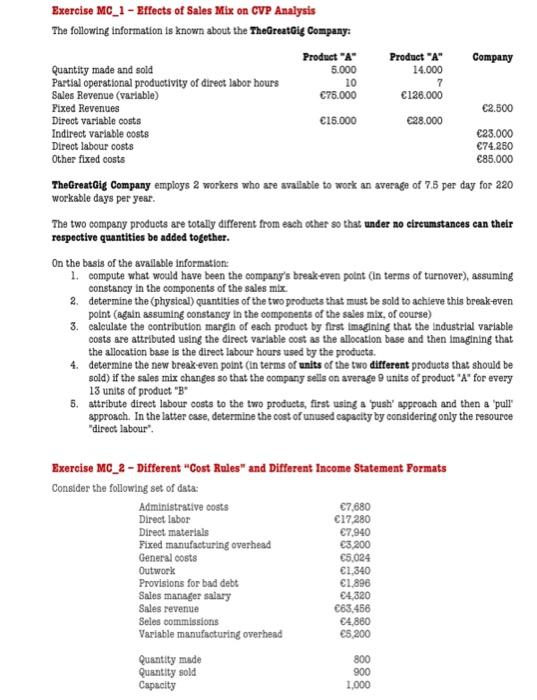

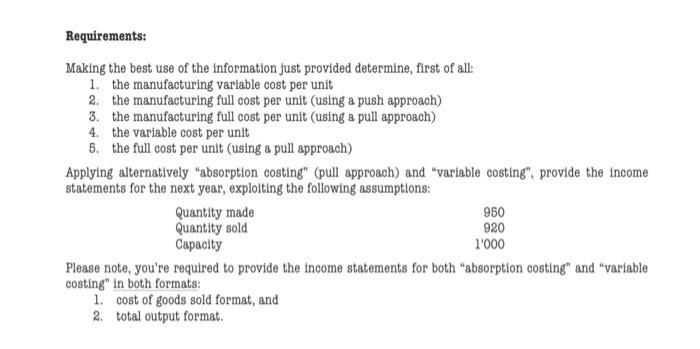

Exercise CFS_1 - Conselidation effect and entries (at the date of acquisition) The MAMMA Ldt owns owns 1,600 of the 2,000 outstanding shares issued by BAMBINA Inco. The investment is recorded on the parent eompany's balance sheet at a value of $104,000. The shares of BAMBINA Inoo are traded on the market at an average price of C68 per share The following summary dsts at aequisition date is known of the two eompanies. On the basis of this information, determine the structure of the synthetic balance sheet of the group at acquisition date, highlighting the value of the assets, llabllitles and net equity. Clearly the more detalled the answer the higher the mark awarded. In addition, provide, again in summary form, the consolidation entries that must be made to produce that resulh. Please notes consolidation journal entries are required. Exercise CFS_2 - Accounting for intragroup transaction In the following graphical representation the exchanges of a specifio oommodity (clearly a menchandise) are described. Those exchanges happened all in the same period. Knowing that: - Mommy Corp, and Baby Lid form a group. - the initial inventory of the goods considered here was both for Mommy Corp and for Baby Lad equal to zero - all the exchanges described were sottled with cash in the period - both companies use the perpetual inventory method in their aooounting process - Mommy Corp, and Baby Lid operate in a "tax haven", so there are no requirements for taxes Required: 1. Provided double entry journal entries related to: a. transactions carried out during the period by Mommy b. transactions carried out during the period by Baby 2. Provide the ocnsolidation journal entries necessary to eliminate the effect of intungroup sales 3. Provide the consolidation journal entries necessary to eliminate the effect of intergroup sales in the hypothesis that the situation previousiy described changes as follows: Exercise MC_1 - Effects of Sales Mix on CVP Analysis The following information is known about the TheCreatelg Company: TheGreattig Company employs 2 workers who are avallable to work an average of 7.5 per day for 220 workable days per year. The two company products are totally different from each ocher so that under no eireumstances can their respective quantities be added together. On the basis of the avallable informstion: 1. compute what would have been the company's breakeven point (in terms of turnover), assuming constancy in the components of the sales mix. 2. determine the (physieal) quantities of the tro products that must be sold to achieve this breakeven point (again assuming constancy in the components of the sales mix, of course) 3. ealculate the contribution margin of each product by first imagining that the industrial variable oosts are attributed using the direct variable cost as the allocation base and then imagining that the allocation base is the direct labour hours used by the products. 4. determine the new breakeven point (in terms of units of the two different products that should be sold) if the sales mix changes so that the company sells on average 9 units of product " A " for every 13 units of produet " B " 5. attribute direct labour costs to the tro products, first using a 'push' apprcach and then a 'pull' approach. In the latter case, deternine the cost of unused eapacity by considering only the resouree "direct labour". Exercise MC_2 - Different "Cost Rules" and Different Income Statement Pormats Consider the following set of data: Requirements: Making the best use of the information just provided determine, first of all: 1. the manufacturing variable cost per unit 2. the manufacturing full cost per unit (using a push approach) 3. the manufacturing full cost per unit (using a pull approach) 4. the variable cost per unit 5. the full cost per unit (using a pull approach) Applying alternatively "absorption costing" (pull approach) and "variable costing", provide the income statements for the next year, exploiting the following assumptions: Please note, you're required to provide the income statements for both "absorption costing" and "variable costing" in both formats: 1. cost of goods sold format, and 2. total output format. Exercise CFS_1 - Conselidation effect and entries (at the date of acquisition) The MAMMA Ldt owns owns 1,600 of the 2,000 outstanding shares issued by BAMBINA Inco. The investment is recorded on the parent eompany's balance sheet at a value of $104,000. The shares of BAMBINA Inoo are traded on the market at an average price of C68 per share The following summary dsts at aequisition date is known of the two eompanies. On the basis of this information, determine the structure of the synthetic balance sheet of the group at acquisition date, highlighting the value of the assets, llabllitles and net equity. Clearly the more detalled the answer the higher the mark awarded. In addition, provide, again in summary form, the consolidation entries that must be made to produce that resulh. Please notes consolidation journal entries are required. Exercise CFS_2 - Accounting for intragroup transaction In the following graphical representation the exchanges of a specifio oommodity (clearly a menchandise) are described. Those exchanges happened all in the same period. Knowing that: - Mommy Corp, and Baby Lid form a group. - the initial inventory of the goods considered here was both for Mommy Corp and for Baby Lad equal to zero - all the exchanges described were sottled with cash in the period - both companies use the perpetual inventory method in their aooounting process - Mommy Corp, and Baby Lid operate in a "tax haven", so there are no requirements for taxes Required: 1. Provided double entry journal entries related to: a. transactions carried out during the period by Mommy b. transactions carried out during the period by Baby 2. Provide the ocnsolidation journal entries necessary to eliminate the effect of intungroup sales 3. Provide the consolidation journal entries necessary to eliminate the effect of intergroup sales in the hypothesis that the situation previousiy described changes as follows: Exercise MC_1 - Effects of Sales Mix on CVP Analysis The following information is known about the TheCreatelg Company: TheGreattig Company employs 2 workers who are avallable to work an average of 7.5 per day for 220 workable days per year. The two company products are totally different from each ocher so that under no eireumstances can their respective quantities be added together. On the basis of the avallable informstion: 1. compute what would have been the company's breakeven point (in terms of turnover), assuming constancy in the components of the sales mix. 2. determine the (physieal) quantities of the tro products that must be sold to achieve this breakeven point (again assuming constancy in the components of the sales mix, of course) 3. ealculate the contribution margin of each product by first imagining that the industrial variable oosts are attributed using the direct variable cost as the allocation base and then imagining that the allocation base is the direct labour hours used by the products. 4. determine the new breakeven point (in terms of units of the two different products that should be sold) if the sales mix changes so that the company sells on average 9 units of product " A " for every 13 units of produet " B " 5. attribute direct labour costs to the tro products, first using a 'push' apprcach and then a 'pull' approach. In the latter case, deternine the cost of unused eapacity by considering only the resouree "direct labour". Exercise MC_2 - Different "Cost Rules" and Different Income Statement Pormats Consider the following set of data: Requirements: Making the best use of the information just provided determine, first of all: 1. the manufacturing variable cost per unit 2. the manufacturing full cost per unit (using a push approach) 3. the manufacturing full cost per unit (using a pull approach) 4. the variable cost per unit 5. the full cost per unit (using a pull approach) Applying alternatively "absorption costing" (pull approach) and "variable costing", provide the income statements for the next year, exploiting the following assumptions: Please note, you're required to provide the income statements for both "absorption costing" and "variable costing" in both formats: 1. cost of goods sold format, and 2. total output format Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started