Answered step by step

Verified Expert Solution

Question

1 Approved Answer

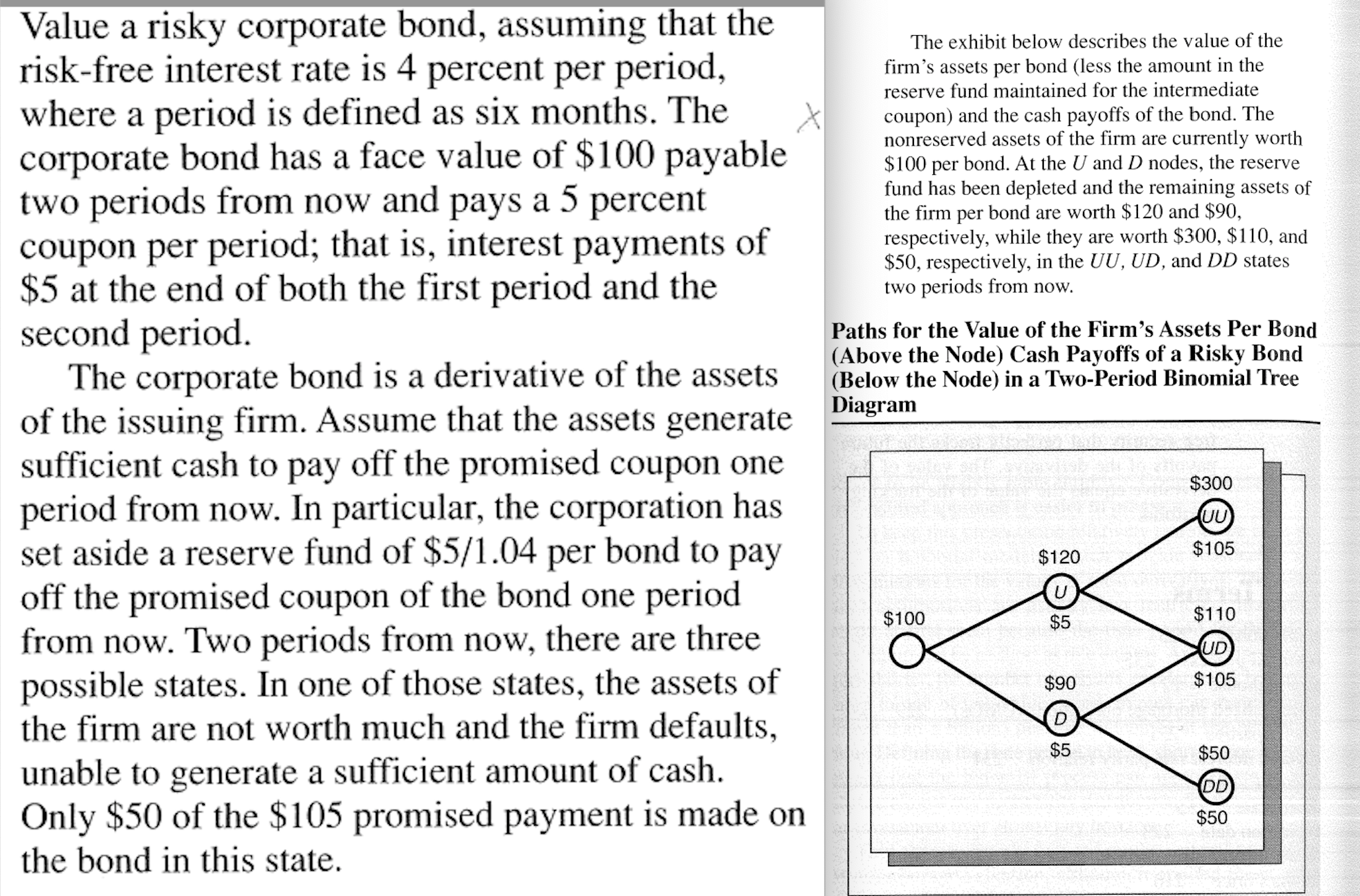

The exhibit below describes the value of the firm's assets per bond ( less the amount in the reserve fund maintained for the intermediate coupon

The exhibit below describes the value of the

firm's assets per bond less the amount in the

reserve fund maintained for the intermediate

coupon and the cash payoffs of the bond. The

nonreserved assets of the firm are currently worth

$ per bond. At the and nodes, the reserve

fund has been depleted and the remaining assets of

the firm per bond are worth $ and $

respectively, while they are worth $$ and

$ respectively, in the and states

two periods from now.

Paths for the Value of the Firm's Assets Per Bond

Above the Node Cash Payoffs of a Risky Bond

Below the Node in a TwoPeriod Binomial Tree

Diagram

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started