Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The expected net realisable value of the non-current assets and the inventories are 3,000 and 2,000 respectively. In the event of liquidation, only 60% of

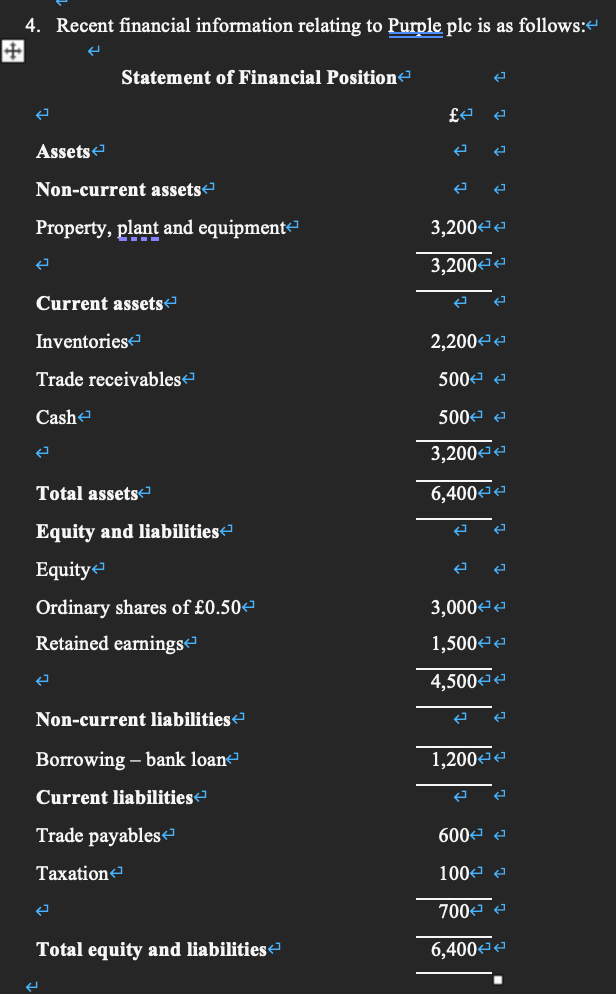

The expected net realisable value of the non-current assets and the inventories are 3,000 and 2,000 respectively. In the event of liquidation, only 60% of the receivables are expected to be collectible. The tax rate is 22%, the return on equity is 8%. Calculate the value of an ordinary shares of Purple plc using the net asset basis of valuation (liquidation basis).

4. Recent financial information relating to Purple plc is as follows: Statement of Financial Position e Assets Non-current assets Property, plant and equipment 3,2004 3,200 42 Current assets Inventories 2,200 Trade receivables 500 Cash 500 3,20044 Total assets 6,40040 Equity and liabilities Equity Ordinary shares of 0.504 Retained earnings 3,00042 >1,500 4,50040 Non-current liabilities Borrowing - bank loan 1,20042 Current liabilities Trade payables 6000 e Taxation 1000 e 700 Total equity and liabilities 6,40040Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started