The expected return from previous is 10.4% or .1044

Please do 4-7and show the work. thank you!

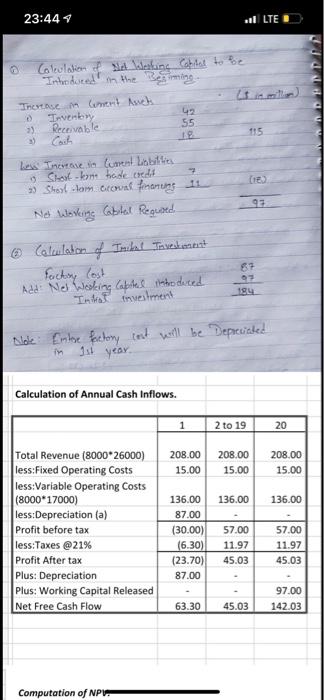

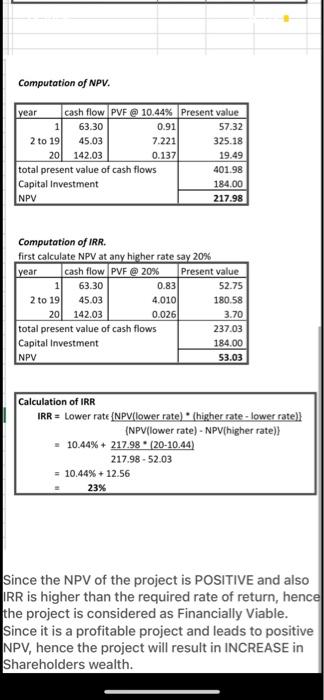

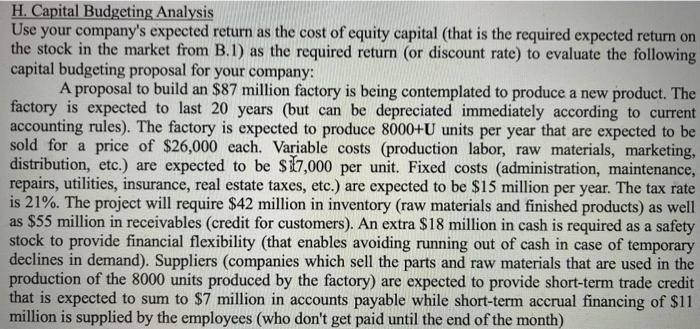

H. Capital Budgeting Analysis Use your company's expected return as the cost of equity capital (that is the required expected return on the stock in the market from B.1) as the required return (or discount rate) to evaluate the following capital budgeting proposal for your company: A proposal to build an $87 million factory is being contemplated to produce a new product. The factory is expected to last 20 years (but can be depreciated immediately according to current accounting rules). The factory is expected to produce 8000+U units per year that are expected to be sold for a price of $26,000 each. Variable costs (production labor, raw materials, marketing, distribution, etc.) are expected to be $ 17,000 per unit. Fixed costs (administration, maintenance, repairs, utilities, insurance, real estate taxes, etc.) are expected to be $15 million per year. The tax rate is 21%. The project will require $42 million in inventory (raw materials and finished products) as well as $55 million in receivables (credit for customers). An extra $18 million in cash is required as a safety stock to provide financial flexibility (that enables avoiding running out of cash in case of temporary declines in demand). Suppliers (companies which sell the parts and raw materials that are used in the production of the 8000 units produced by the factory) are expected to provide short-term trade credit that is expected to sum to $7 million in accounts payable while short-term accrual financing of $11 million is supplied by the employees (who don't get paid until the end of the month) 4. Determine if the project should be undertaken 5. Compute the Payback Period (and reevaluate the project if the company requires a Payback Period of 5 years) 6. Compute equivalent annual cash flow (EAC) and compare that to another project with an annual EAC of $12 million that can alternatively be selected and re-evaluate the project in this context) 7. Compute the NPV if demand is only half of the proiected 8000 units per year 23:44 vil E Calcolatie Werking Cabled to be Indied in the Beaming Increase in tinent Auch Teventy 42 3) Receivable 55 Cach 115 AND HDD (ies les Theros de com Liabile 13 Short - kom hade eredt Skool lom acoma finorting 11 Ne Waskine Gabbal Reguered. 93 Celulation of Tribal Tweakentant fucking lost Add: Nel Wooking laptel thatodered Intrat investment 194 Note Entere factory cost will be Depreciated in 1st year Calculation of Annual Cash Inflows. 1 2 to 19 20 208.00 15.00 208.00 15.00 208.00 15.00 136.00 136.00 Total Revenue (8000*26000) less:Fixed Operating Costs less:Variable Operating Costs (8000*17000) less:Depreciation (a) Profit before tax less:Taxes @21% Profit After tax Plus: Depreciation Plus: Working Capital Released Net Free Cash Flow 136.00 87.00 (30.00) (6.30) (23.70) 87.00 57.00 11.97 45.03 57.00 11.97 45.03 97.00 142.03 63.30 45.03 Computation of NPA Computation of NPV. year cash flow PVF @ 10.44% Present value 1 63.30 0.91 57.32 2 to 191 45.03 7.221 325.18 201 142.03 0.137 19.49 total present value of cash flows 401.98 Capital Investment 184.00 NPV 217.98 Computation of IRR. first calculate NPV at any higher rate say 20% year cash flow PVF @ 20% Present value 1 63.30 0.83 52.75 2 to 19 45.03 4.010 180.58 20 142.03 0.026 3.70 total present value of cash flows 237.03 Capital Investment 184.00 NPV 53.03 Calculation of IRR IRR = Lower rate {NPV(lower rate) (higher rate - lower rate)} INPVflower rate) - NPV higher rate)) - 10.44% + 217.98 . (20-10.44) 217.98 - 52.03 = 10.44% +12.56 23% Since the NPV of the project is POSITIVE and also IRR is higher than the required rate of return, hence the project is considered as Financially viable. Since it is a profitable project and leads to positive NPV, hence the project will result in INCREASE in Shareholders wealth