Question

The expected return of the market portfolio (M) is 10% pa, the risk free rate of return (r f ) is 4% pa. Based on

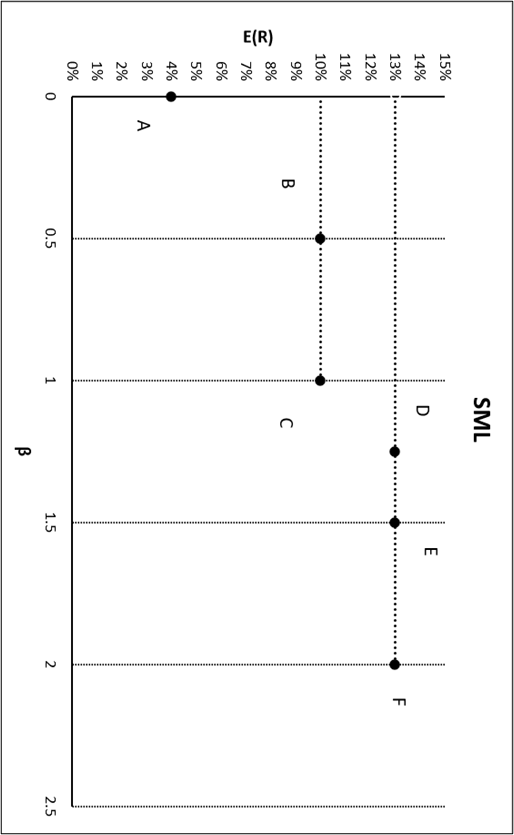

The expected return of the market portfolio (M) is 10% pa, the risk free rate of return (rf) is 4% pa. Based on this information, Robert attemted to draw the Securities Market Line (SML) to identify investment opportunities in the market. Along with risk-free return (rf) and the market portfolio (M) Robert places four securities on the graph based on their risk and return characteristics. However, he left the chart incomplete, as shown below.

In the incomplete SML graph above, there are six securities A, B, C, D, E, and F. Identify which one of these is

- the risk-free return (rf)

- the market portfolio (M)

- If Robert wants to earn 3% alpha from his investment which one of the securities (among A, B, C, D, E and F) he should select? Justify your answer with calculations of alpha for your chosen security.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started