Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The expected return on an asset you currently own is 12% and the required return is 9%. You should probably wait and see what

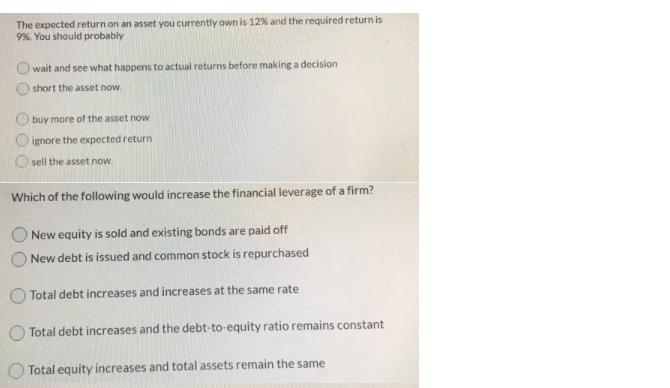

The expected return on an asset you currently own is 12% and the required return is 9%. You should probably wait and see what happens to actual returns before making a decision short the asset now. buy more of the asset now ignore the expected return sell the asset now. Which of the following would increase the financial leverage of a firm? New equity is sold and existing bonds are paid off New debt is issued and common stock is repurchased Total debt increases and increases at the same rate Total debt increases and the debt-to-equity ratio remains constant Total equity increases and total assets remain the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Based on the information provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started