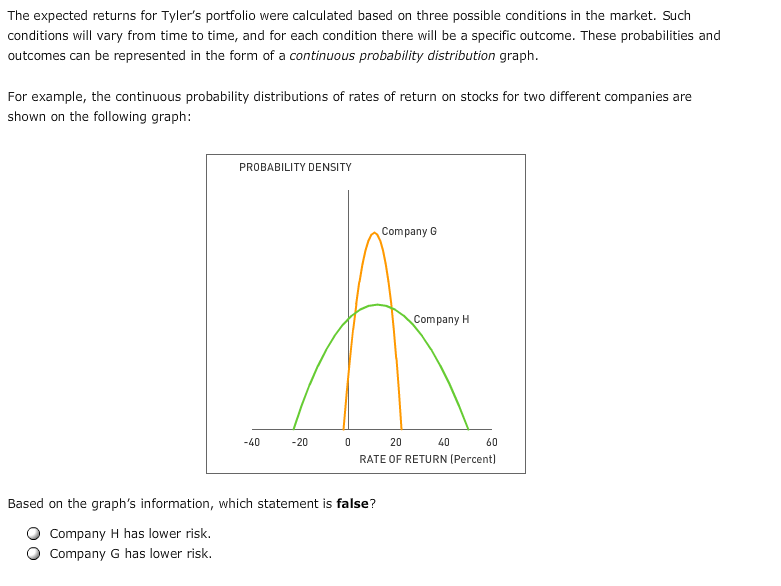

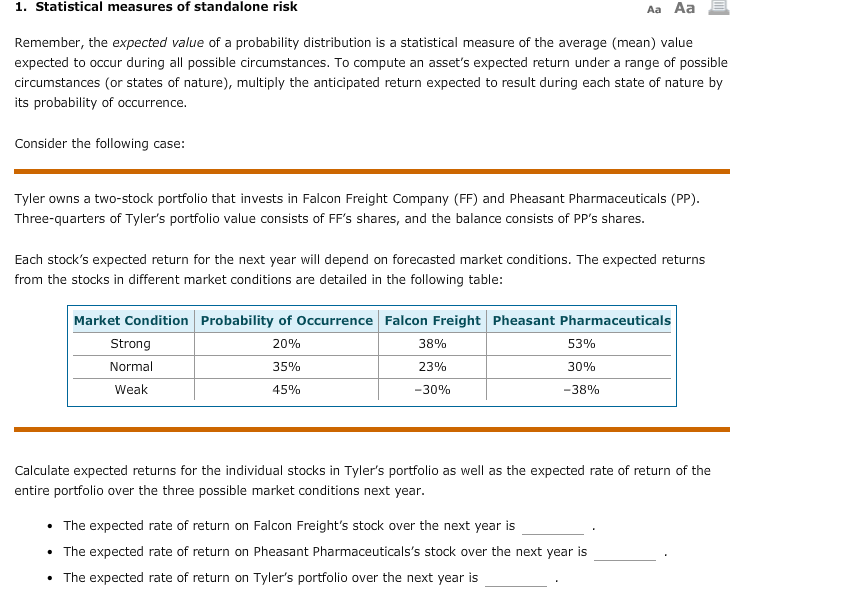

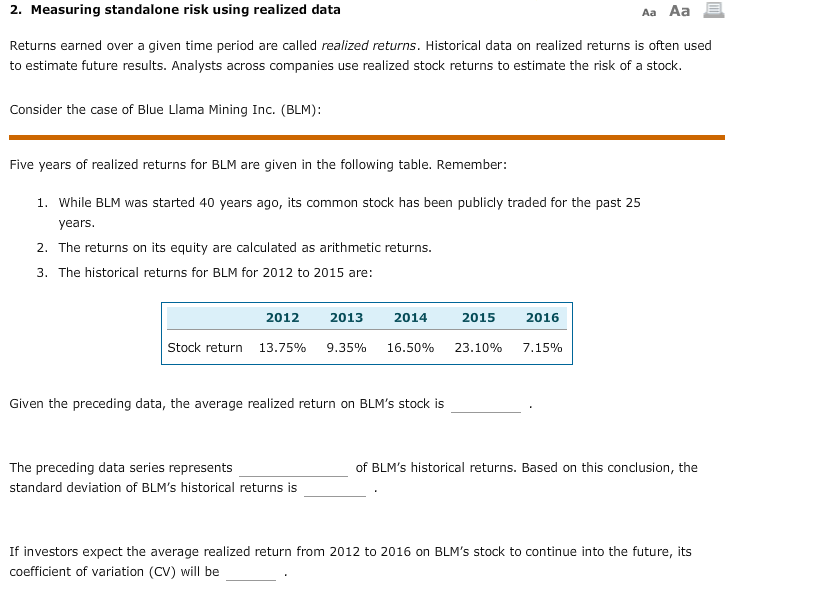

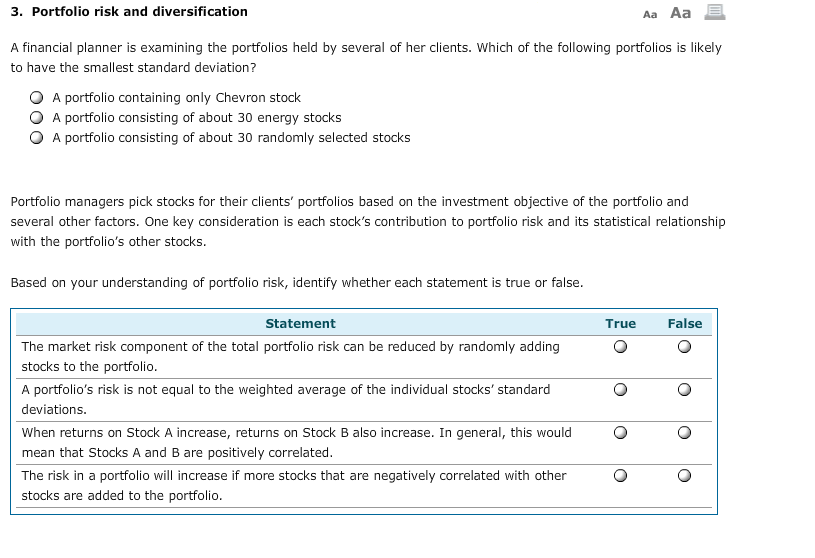

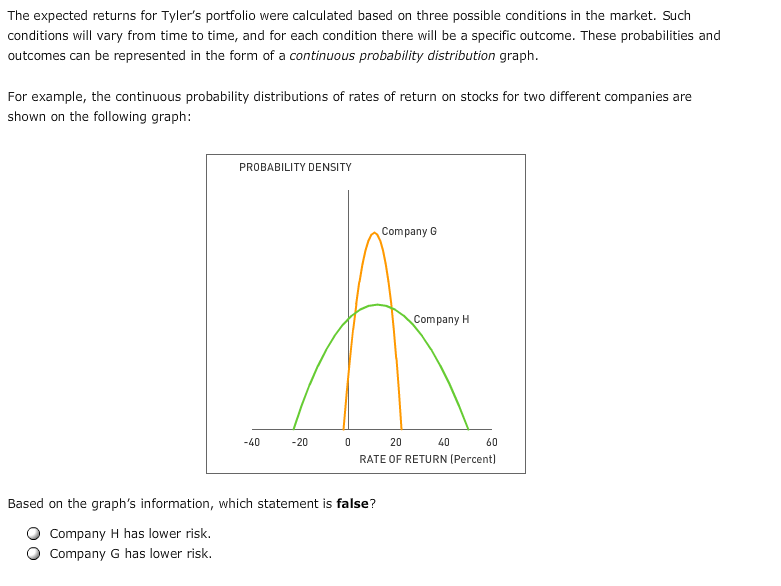

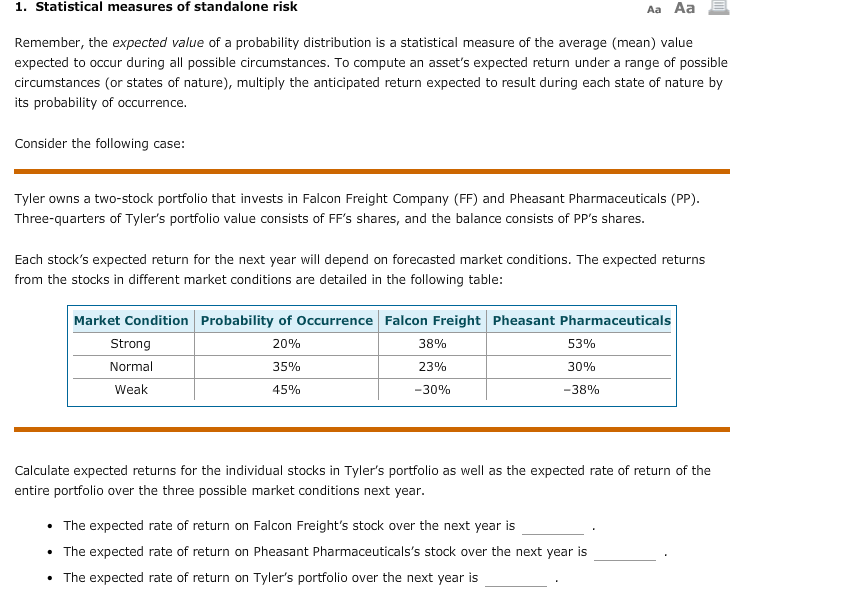

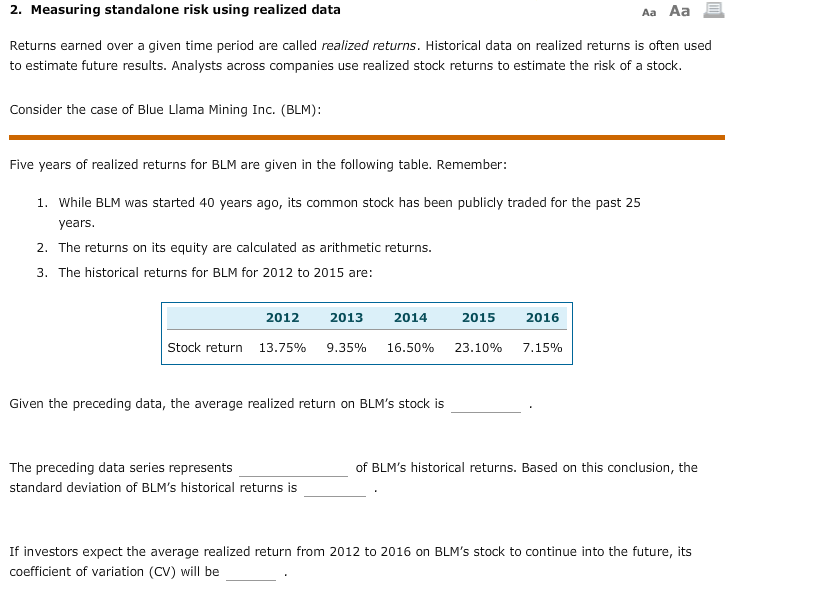

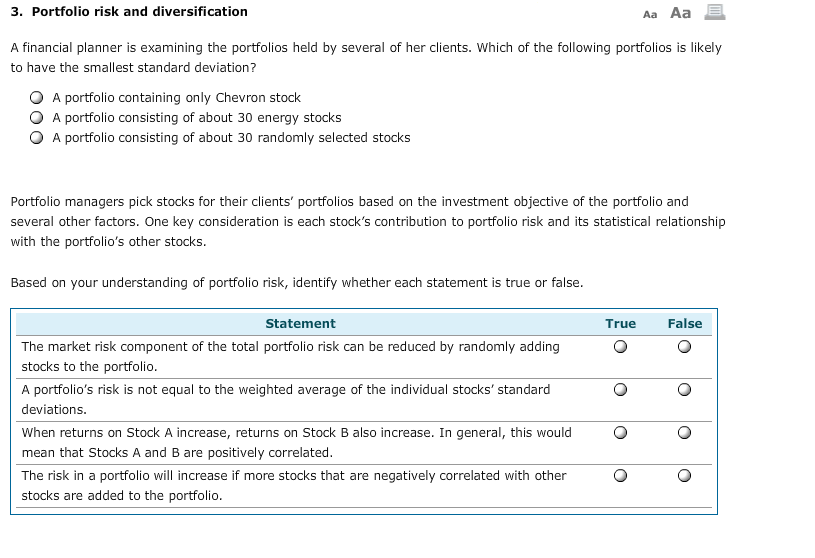

The expected returns for Tyler's portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph. For example, the continuous probability distributions of rates of return on stocks for two different companies are shown on the following graph: PROBABILITY DENSITY Company G Company H -40 -20 0 20 40 60 RATE OF RETURN (Percent) Based on the graph's information, which statement is false? Company H has lower risk. Company G has lower risk. 1. Statistical measures of standalone risk Aa Aa E Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence. Consider the following case: Tyler owns a two-stock portfolio that invests in Falcon Freight Company (FF) and Pheasant Pharmaceuticals (PP). Three-quarters of Tyler's portfolio value consists of FF's shares, and the balance consists of PP's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence Falcon Freight Pheasant Pharmaceuticals Strong 20% 38% 53% Normal 35% 23% 30% Weak 45% -30% -38% Calculate expected returns for the individual stocks in Tyler's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. The expected rate of return on Falcon Freight's stock over the next year is The expected rate of return on Pheasant Pharmaceuticals's stock over the next year is The expected rate of return on Tyler's portfolio over the next year is 2. Measuring standalone risk using realized data Aa Aa E Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Consider the case of Blue Llama Mining Inc. (BLM): Five years of realized returns for BLM are given in the following table. Remember: 1. While BLM was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on its equity are calculated as arithmetic returns. 3. The historical returns for BLM for 2012 to 2015 are: 2012 13.75% 2013 9.35% 2014 16.50% 2015 23.10% 2016 7.15% Stock return Given the preceding data, the average realized return on BLM's stock is of BLM's historical returns. Based on this conclusion, the The preceding data series represents standard deviation of BLM's historical returns is If investors expect the average realized return from 2012 to 2016 on BLM's stock to continue into the future, its coefficient of variation (CV) will be 3. Portfolio risk and diversification Aa Aa E A financial planner is examining the portfolios held by several of her clients. Which of the following portfolios is likely to have the smallest standard deviation? O O O A portfolio containing only Chevron stock A portfolio consisting of about 30 energy stocks A portfolio consisting of about 30 randomly selected stocks Portfolio managers pick stocks for their clients' portfolios based on the investment objective of the portfolio and several other factors. One key consideration is each stock's contribution to portfolio risk and its statistical relationship with the portfolio's other stocks. Based on your understanding of portfolio risk, identify whether each statement is true or false. True False O O Statement The market risk component of the total portfolio risk can be reduced by randomly adding stocks to the portfolio. A portfolio's risk is not equal to the weighted average of the individual stocks' standard deviations. When returns on Stock A increase, returns on Stock B also increase. In general, this would mean that Stocks A and B are positively correlated. The risk in a portfolio will increase if more stocks that are negatively correlated with other stocks are added to the portfolio. O The expected returns for Tyler's portfolio were calculated based on three possible conditions in the market. Such conditions will vary from time to time, and for each condition there will be a specific outcome. These probabilities and outcomes can be represented in the form of a continuous probability distribution graph. For example, the continuous probability distributions of rates of return on stocks for two different companies are shown on the following graph: PROBABILITY DENSITY Company G Company H -40 -20 0 20 40 60 RATE OF RETURN (Percent) Based on the graph's information, which statement is false? Company H has lower risk. Company G has lower risk. 1. Statistical measures of standalone risk Aa Aa E Remember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset's expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence. Consider the following case: Tyler owns a two-stock portfolio that invests in Falcon Freight Company (FF) and Pheasant Pharmaceuticals (PP). Three-quarters of Tyler's portfolio value consists of FF's shares, and the balance consists of PP's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence Falcon Freight Pheasant Pharmaceuticals Strong 20% 38% 53% Normal 35% 23% 30% Weak 45% -30% -38% Calculate expected returns for the individual stocks in Tyler's portfolio as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. The expected rate of return on Falcon Freight's stock over the next year is The expected rate of return on Pheasant Pharmaceuticals's stock over the next year is The expected rate of return on Tyler's portfolio over the next year is 2. Measuring standalone risk using realized data Aa Aa E Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Consider the case of Blue Llama Mining Inc. (BLM): Five years of realized returns for BLM are given in the following table. Remember: 1. While BLM was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on its equity are calculated as arithmetic returns. 3. The historical returns for BLM for 2012 to 2015 are: 2012 13.75% 2013 9.35% 2014 16.50% 2015 23.10% 2016 7.15% Stock return Given the preceding data, the average realized return on BLM's stock is of BLM's historical returns. Based on this conclusion, the The preceding data series represents standard deviation of BLM's historical returns is If investors expect the average realized return from 2012 to 2016 on BLM's stock to continue into the future, its coefficient of variation (CV) will be 3. Portfolio risk and diversification Aa Aa E A financial planner is examining the portfolios held by several of her clients. Which of the following portfolios is likely to have the smallest standard deviation? O O O A portfolio containing only Chevron stock A portfolio consisting of about 30 energy stocks A portfolio consisting of about 30 randomly selected stocks Portfolio managers pick stocks for their clients' portfolios based on the investment objective of the portfolio and several other factors. One key consideration is each stock's contribution to portfolio risk and its statistical relationship with the portfolio's other stocks. Based on your understanding of portfolio risk, identify whether each statement is true or false. True False O O Statement The market risk component of the total portfolio risk can be reduced by randomly adding stocks to the portfolio. A portfolio's risk is not equal to the weighted average of the individual stocks' standard deviations. When returns on Stock A increase, returns on Stock B also increase. In general, this would mean that Stocks A and B are positively correlated. The risk in a portfolio will increase if more stocks that are negatively correlated with other stocks are added to the portfolio. O