Question

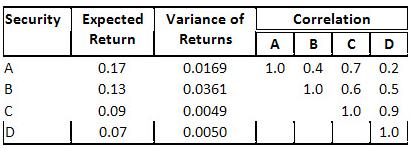

The expected returns, return variances, and the correlation between the returns of four securities are as follows. 1. Determine the expected return and variance for

The expected returns, return variances, and the correlation between the returns of four securities are as follows.  1. Determine the expected return and variance for a portfolio composed of 25% of security A and 75% of security B. 2. Determine the expected return and variance of a portfolio that contains 78% security A and 22% security B. Is this portfolio superior to that one in (a) above? 3. Calculate the expected return and variance of a portfolio that contains 60% security C and 40% security D. 4. If a risk-averse investor desires to hold a portfolio of only two securities and expects a return of 11%, what would you advise the investor to do? 5. Determine the expected return and variance of a portfolio that contains equal dollar amounts of the four securities. 6. If an investor were to select among the following three portfolios, which one would he or she prefer? An equally-weighted portfolio of securities A, B, and C. An equally-weighted portfolio of A, B, and D. An equally-weighted portfolio of B, C, and D

1. Determine the expected return and variance for a portfolio composed of 25% of security A and 75% of security B. 2. Determine the expected return and variance of a portfolio that contains 78% security A and 22% security B. Is this portfolio superior to that one in (a) above? 3. Calculate the expected return and variance of a portfolio that contains 60% security C and 40% security D. 4. If a risk-averse investor desires to hold a portfolio of only two securities and expects a return of 11%, what would you advise the investor to do? 5. Determine the expected return and variance of a portfolio that contains equal dollar amounts of the four securities. 6. If an investor were to select among the following three portfolios, which one would he or she prefer? An equally-weighted portfolio of securities A, B, and C. An equally-weighted portfolio of A, B, and D. An equally-weighted portfolio of B, C, and D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started