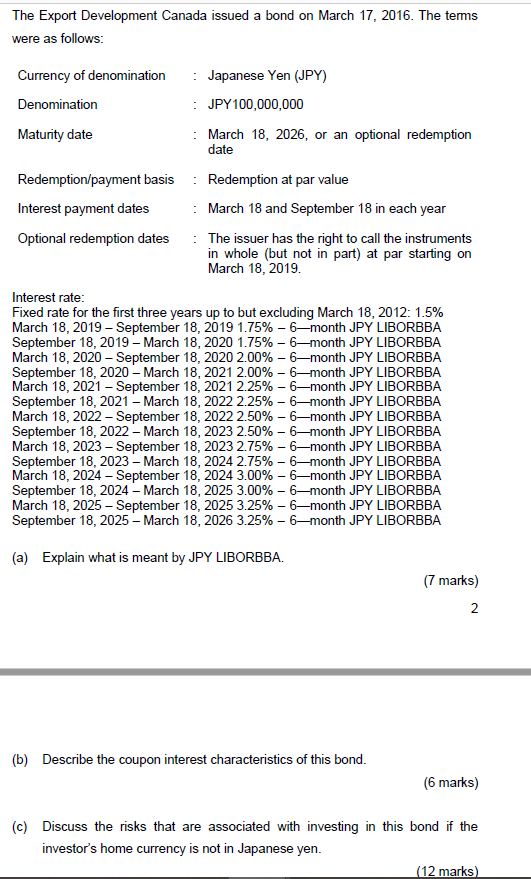

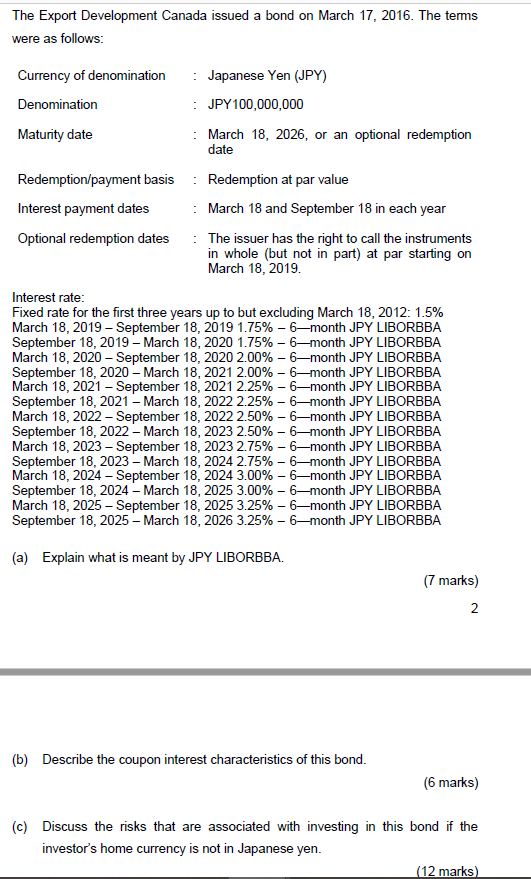

The Export Development Canada issued a bond on March 17, 2016. The terms were as follows: Currency of denomination Japanese Yen (JPY) Denomination : JPY100,000,000 Maturity date : March 18, 2026, or an optional redemption date Redemption/payment basis : Redemption at par value Interest payment dates : March 18 and September 18 in each year Optional redemption dates The issuer has the right to call the instruments in whole (but not in part) at par starting on March 18, 2019. Interest rate: Fixed rate for the first three years up to but excluding March 18, 2012: 1.5% March 18, 2019 - September 18, 2019 1.75% - 6-month JPY LIBORBBA September 18, 2019 - March 18, 2020 1.75% - 6-month JPY LIBORBBA March 18, 2020 - September 18, 2020 2.00% - 6month JPY LIBORBBA September 18, 2020 - March 18, 2021 2.00% - 6-month JPY LIBORBBA March 18, 2021 - September 18, 2021 2.25% - 6-month JPY LIBORBBA September 18, 2021 - March 18, 2022 2.25% - 6month JPY LIBORBBA March 18, 2022 - September 18, 2022 2.50% -6month JPY LIBORBBA September 18, 2022 - March 18, 2023 2.50% - 6-month JPY LIBORBBA March 18, 2023 - September 18, 2023 2.75% -6month JPY LIBORBBA September 18, 2023 - March 18, 2024 2.75% - 6-month JPY LIBORBBA March 18, 2024 - September 18, 2024 3.00% - 6month JPY LIBORBBA September 18, 2024 - March 18, 2025 3.00% - 6-month JPY LIBORBBA March 18, 2025 - September 18, 2025 3.25% - 6-month JPY LIBORBBA September 18, 2025 - March 18, 2026 3.25% - 6-month JPY LIBORBBA (a) Explain what is meant by JPY LIBORBBA. (7 marks) 2 (b) Describe the coupon interest characteristics of this bond. (6 marks) (c) Discuss the risks that are associated with investing in this bond if the investor's home currency is not in Japanese yen. (12 marks) The Export Development Canada issued a bond on March 17, 2016. The terms were as follows: Currency of denomination Japanese Yen (JPY) Denomination : JPY100,000,000 Maturity date : March 18, 2026, or an optional redemption date Redemption/payment basis : Redemption at par value Interest payment dates : March 18 and September 18 in each year Optional redemption dates The issuer has the right to call the instruments in whole (but not in part) at par starting on March 18, 2019. Interest rate: Fixed rate for the first three years up to but excluding March 18, 2012: 1.5% March 18, 2019 - September 18, 2019 1.75% - 6-month JPY LIBORBBA September 18, 2019 - March 18, 2020 1.75% - 6-month JPY LIBORBBA March 18, 2020 - September 18, 2020 2.00% - 6month JPY LIBORBBA September 18, 2020 - March 18, 2021 2.00% - 6-month JPY LIBORBBA March 18, 2021 - September 18, 2021 2.25% - 6-month JPY LIBORBBA September 18, 2021 - March 18, 2022 2.25% - 6month JPY LIBORBBA March 18, 2022 - September 18, 2022 2.50% -6month JPY LIBORBBA September 18, 2022 - March 18, 2023 2.50% - 6-month JPY LIBORBBA March 18, 2023 - September 18, 2023 2.75% -6month JPY LIBORBBA September 18, 2023 - March 18, 2024 2.75% - 6-month JPY LIBORBBA March 18, 2024 - September 18, 2024 3.00% - 6month JPY LIBORBBA September 18, 2024 - March 18, 2025 3.00% - 6-month JPY LIBORBBA March 18, 2025 - September 18, 2025 3.25% - 6-month JPY LIBORBBA September 18, 2025 - March 18, 2026 3.25% - 6-month JPY LIBORBBA (a) Explain what is meant by JPY LIBORBBA. (7 marks) 2 (b) Describe the coupon interest characteristics of this bond. (6 marks) (c) Discuss the risks that are associated with investing in this bond if the investor's home currency is not in Japanese yen. (12 marks)