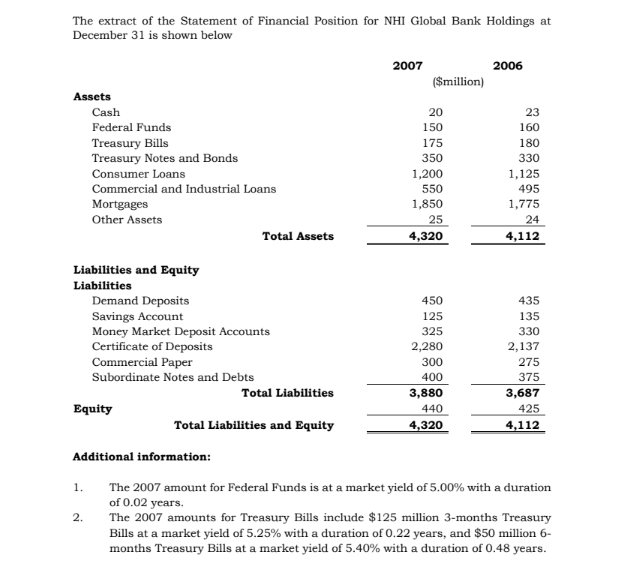

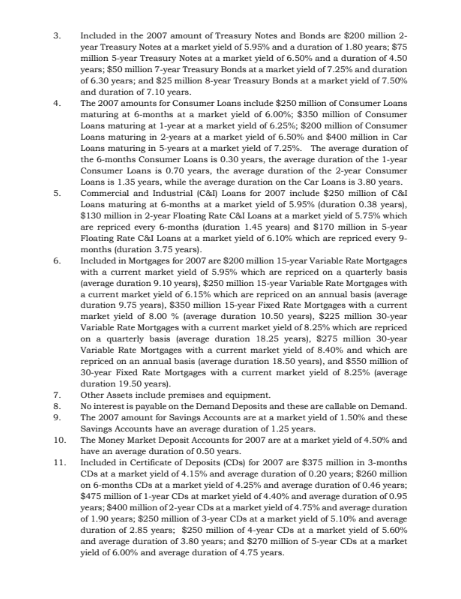

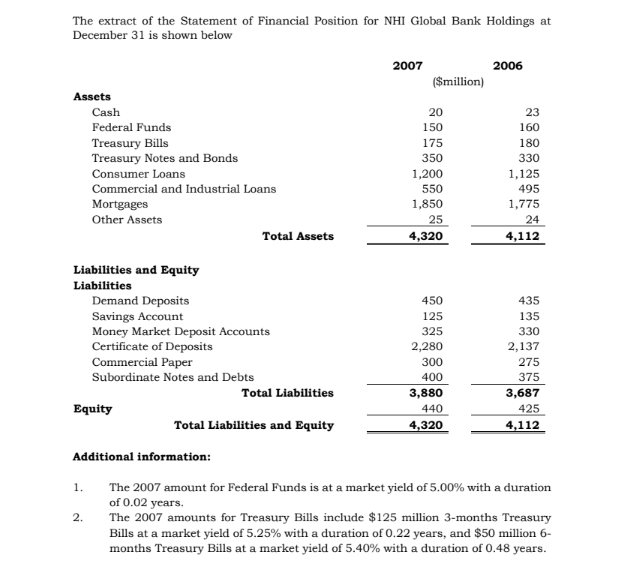

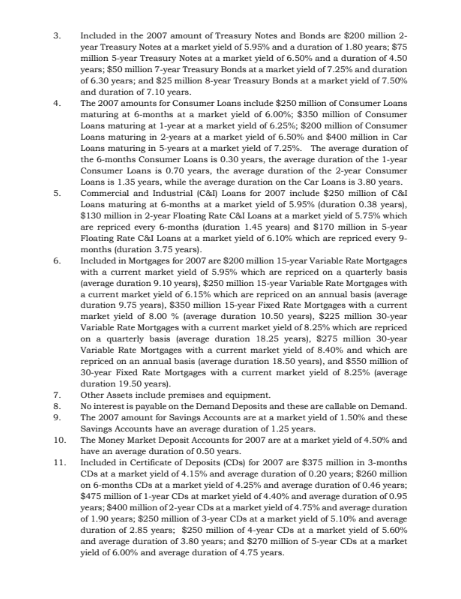

The extract of the Statement of Financial Position for NHI Global Bank Holdings at December 31 is shown below 2007 2006 ($million) Assets Cash Federal Funds Treasury Bills Treasury Notes and Bonds Consumer Loans Commercial and Industrial Loans Mortgages Other Assets Total Assets 20 150 175 350 1,200 550 1,850 25 4,320 23 160 180 330 1,125 495 1,775 24 4,112 Liabilities and Equity Liabilities Demand Deposits 450 435 Savings Account 125 135 Money Market Deposit Accounts 325 330 Certificate of Deposits 2,280 2,137 Commercial Paper 300 275 Subordinate Notes and Debts 400 375 Total Liabilities 3,880 3,687 Equity 440 425 Total Liabilities and Equity 4,320 4,112 Additional information: The 2007 amount for Federal Funds is at a market yield of 5.00% with a duration of 0.02 years. 2. The 2007 amounts for Treasury Bills include $125 million 3-months Treasury Bills at a market yield of 5.25% with a duration of 0.22 years, and $50 million 6- months Treasury Bills at a market yield of 5.40% with a duration of 0.48 years. 1. 3. 5. 6. Included in the 2007 amount of Treasury Notes and Bonds are $200 million 2- year Treasury Notes at a market yield of 5.95% and a duration of 1.80 years: $75 million 5-year Treasury Notes at a market yield of 6.50% and a duration of 4.50 years; $50 million 7-year Treasury Bonds at a market yield of 7.25% and duration of 6.30 years, and $25 million 8-year Treasury Bonds at a market yield of 7.50% and duration of 7.10 years. The 2007 amounts for Consumer Loans include $250 million of Consumer Loans maturing at 6-months at a market yield of 6.00%; $350 million of Consumer Loans maturing at 1-year at a market yield of 6.25%; $200 million of Consumer Loans maturing in 2-years at a market yield of 6.50% and $400 million in Car Loans maturing in 5 years at a market yield of 7.25%. The average duration of the 6- months Consumer Loans is 0.30 years, the average duration of the 1-year Consumer Loans is 0.70 years, the average duration of the 2-year Consumer Loans is 1.35 years, while the average duration on the Car Loans is 3.80 years. Commercial and Industrial (C&D) Loans for 2007 include $250 million of C&I Loans maturing at 6-months at a market yield of 5.95% (duration 0.38 years), $130 million in 2-year Floating Rate C&I Loans at a market yield of 5.75% which are repriced every 6-months (duration 1.45 years) and $170 million in 5-year Floating Rate C&I Loans at a market yield of 6.10% which are repriced every 9. months (duration 3.75 years) Included in Mortgages for 2007 are $200 million 15-year Variable Rate Mortgages with a current market yield of 5.95% which are repriced on a quarterly basis (average duration 9.10 years), $250 million 15-year Variable Rate Mortgages with a current market yield of 6.15% which are repriced on an annual basis (average duration 9.75 years), 8350 million 15-year Fixed Rate Mortgages with a current market yield of 8.00 % (average duration 10.50 years), $225 million 30-year Variable Rate Mortgages with a current market yield of 8.25% which are repriced on a quarterly basis (average duration 18.25 years), S275 million 30-year Variable Rate Mortgages with a current market yield of 8.40% and which are repriced on an annual basis (average duration 18.50 years), and $550 million of 30-year Fixed Rate Mortgages with a current market yield of 8.25% (average duration 19.50 years) Other Assets include premises and equipment. No interest is payable on the Demand Deposits and these are calable on Demand. The 2007 amount for Savings Accounts are at a market yield of 1.50% and these Savings Accounts have an average duration of 1.25 years. The Money Market Deposit Accounts for 2007 are at a market yield of 4.50% and have an average duration of 0.50 years. Included in Certificate of Deposits (CDs) for 2007 are $375 million in 3-months CDs at a market yield of 4.15% and average duration of 0.20 years: $260 million on 6-months CDs at a market yield of 4.25% and average duration of 0.46 years; $475 million of 1-year CDs at market yield of 4.40% and average duration of 0.95 years; $400 million of 2-year CDs at a market yield of 4.75% and average duration of 1.90 years: $250 million of 3-year CDs at a market yield of 5.10% and average duration of 2.85 years: $250 million of 4-year CDs at a market yield of 5.60% and average duration of 3.80 years; and $270 million of 5-year CDs at a market yield of 6.00% and average duration of 4.75 years, 7. 8. 9. 10. 11. The extract of the Statement of Financial Position for NHI Global Bank Holdings at December 31 is shown below 2007 2006 ($million) Assets Cash Federal Funds Treasury Bills Treasury Notes and Bonds Consumer Loans Commercial and Industrial Loans Mortgages Other Assets Total Assets 20 150 175 350 1,200 550 1,850 25 4,320 23 160 180 330 1,125 495 1,775 24 4,112 Liabilities and Equity Liabilities Demand Deposits 450 435 Savings Account 125 135 Money Market Deposit Accounts 325 330 Certificate of Deposits 2,280 2,137 Commercial Paper 300 275 Subordinate Notes and Debts 400 375 Total Liabilities 3,880 3,687 Equity 440 425 Total Liabilities and Equity 4,320 4,112 Additional information: The 2007 amount for Federal Funds is at a market yield of 5.00% with a duration of 0.02 years. 2. The 2007 amounts for Treasury Bills include $125 million 3-months Treasury Bills at a market yield of 5.25% with a duration of 0.22 years, and $50 million 6- months Treasury Bills at a market yield of 5.40% with a duration of 0.48 years. 1. 3. 5. 6. Included in the 2007 amount of Treasury Notes and Bonds are $200 million 2- year Treasury Notes at a market yield of 5.95% and a duration of 1.80 years: $75 million 5-year Treasury Notes at a market yield of 6.50% and a duration of 4.50 years; $50 million 7-year Treasury Bonds at a market yield of 7.25% and duration of 6.30 years, and $25 million 8-year Treasury Bonds at a market yield of 7.50% and duration of 7.10 years. The 2007 amounts for Consumer Loans include $250 million of Consumer Loans maturing at 6-months at a market yield of 6.00%; $350 million of Consumer Loans maturing at 1-year at a market yield of 6.25%; $200 million of Consumer Loans maturing in 2-years at a market yield of 6.50% and $400 million in Car Loans maturing in 5 years at a market yield of 7.25%. The average duration of the 6- months Consumer Loans is 0.30 years, the average duration of the 1-year Consumer Loans is 0.70 years, the average duration of the 2-year Consumer Loans is 1.35 years, while the average duration on the Car Loans is 3.80 years. Commercial and Industrial (C&D) Loans for 2007 include $250 million of C&I Loans maturing at 6-months at a market yield of 5.95% (duration 0.38 years), $130 million in 2-year Floating Rate C&I Loans at a market yield of 5.75% which are repriced every 6-months (duration 1.45 years) and $170 million in 5-year Floating Rate C&I Loans at a market yield of 6.10% which are repriced every 9. months (duration 3.75 years) Included in Mortgages for 2007 are $200 million 15-year Variable Rate Mortgages with a current market yield of 5.95% which are repriced on a quarterly basis (average duration 9.10 years), $250 million 15-year Variable Rate Mortgages with a current market yield of 6.15% which are repriced on an annual basis (average duration 9.75 years), 8350 million 15-year Fixed Rate Mortgages with a current market yield of 8.00 % (average duration 10.50 years), $225 million 30-year Variable Rate Mortgages with a current market yield of 8.25% which are repriced on a quarterly basis (average duration 18.25 years), S275 million 30-year Variable Rate Mortgages with a current market yield of 8.40% and which are repriced on an annual basis (average duration 18.50 years), and $550 million of 30-year Fixed Rate Mortgages with a current market yield of 8.25% (average duration 19.50 years) Other Assets include premises and equipment. No interest is payable on the Demand Deposits and these are calable on Demand. The 2007 amount for Savings Accounts are at a market yield of 1.50% and these Savings Accounts have an average duration of 1.25 years. The Money Market Deposit Accounts for 2007 are at a market yield of 4.50% and have an average duration of 0.50 years. Included in Certificate of Deposits (CDs) for 2007 are $375 million in 3-months CDs at a market yield of 4.15% and average duration of 0.20 years: $260 million on 6-months CDs at a market yield of 4.25% and average duration of 0.46 years; $475 million of 1-year CDs at market yield of 4.40% and average duration of 0.95 years; $400 million of 2-year CDs at a market yield of 4.75% and average duration of 1.90 years: $250 million of 3-year CDs at a market yield of 5.10% and average duration of 2.85 years: $250 million of 4-year CDs at a market yield of 5.60% and average duration of 3.80 years; and $270 million of 5-year CDs at a market yield of 6.00% and average duration of 4.75 years, 7. 8. 9. 10. 11