Question

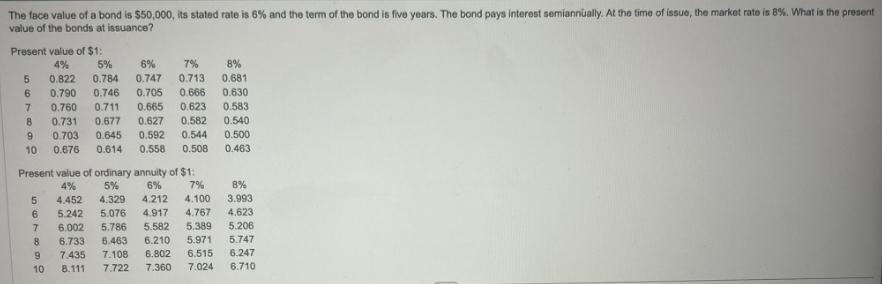

The face value of a bond is $50,000, its stated rate is 6% and the term of the bond is five years. The bond

The face value of a bond is $50,000, its stated rate is 6% and the term of the bond is five years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. What is the present value of the bonds at issuance? Present value of $1: 4% 5% 0.822 0.784 6% 7% 8% 0.747 0.713 0.681 5 6 0.790 0.746 0.705 0.666 0.630 7 0.760 0.711 0.665 0.623 0.583 8 0.731 0.677 0.627 0.582 0.703 0.645 0.592 0.544 9 10 0.676 0.614 0.558 0.508 0.540 0.500 0.463 Present value of ordinary annuity of $1: 4% 5% 6% 7% 4.452 4.329 4.212 4.100 5 6 7 8 9 10 8% 3.993 4.623 5.242 5,076 4.917 4.767 5.786 5.582 5.389 5.206 6.002 6.463 6.210 5.971 5.747 6.733 7.435 7.108 6.802 6.515 6.247 8.111 7.722 7.360 7.024 6.710

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answar PU CX 1 1nt r C 00 6 X 50000 2 r 008 20 004 004 f 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Operations Research

Authors: Frederick S. Hillier, Gerald J. Lieberman

10th edition

978-0072535105, 72535105, 978-1259162985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App