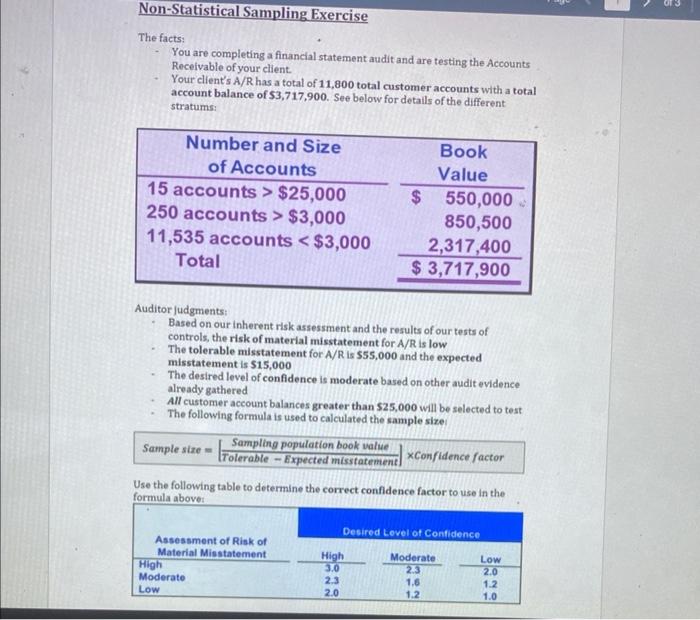

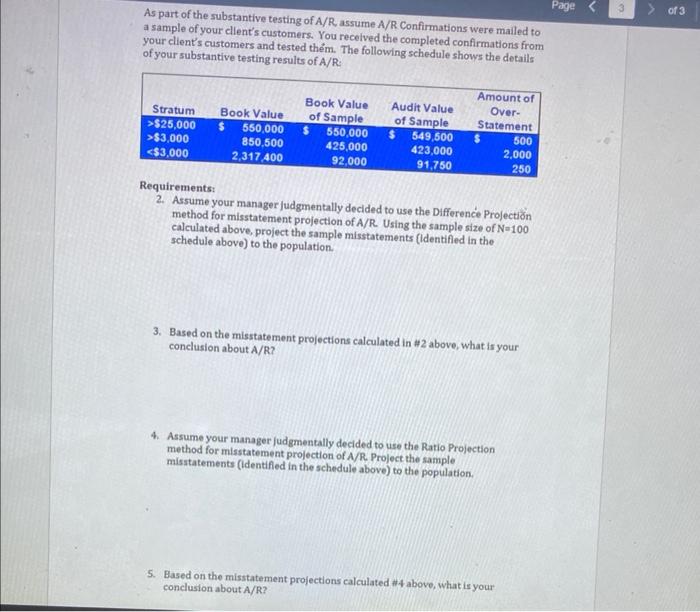

The facts: - You are completing a financial statement audit and are testing the Accounts Receivable of your client. - Your client's A/R has a total of 11,800 total customer accounts with a total account balance of 53,717,900. See below for details of the different stratums: Auditor judgments: - Based on our inherent risk assessment and the results of our tests of controls, the risic of material misstatement for A/R is low - The tolerable misstatement for A/R is $55,000 and the expected misstatement is $15,000 - The desired level of confidence is moderate based on other audit evidence already gathered All customer account balances greater than $25,000 will be selected to test - The following formula is used to calculated the sample size Use the following table to determine the correct confidence factor to use in the formula abovet Requirement: 1. Calculate the sample size to be tested for each stratum. Suppose instead that your manager has pre-determined a Sample Size (N)= 100 in accordance with firm methodology. How should we allocate amongst the three strata? As part of the substantive testing of A/R assume A/R Confirmations were mailed to a sample of your cllent's customers. You recelved the completed confirmations from your client's customers and tested thm. The following schedule shows the details of your substantive testing results of A/R : Requirements: 2. Assume your manager judgmentally decided to use the Difference Projection method for misstatement projection of A/R. Using the sample size of N=100 calculated above, project the sample misstatements (identified in the schedule above) to the population. 3. Based on the misstatement projections calculated in #2 above, what is your conclusion about A/R ? 4. Assume your manager/udgmentally decided to use the Ratio Projection method for misstatement projection of A/R. Project the sample misstatements (identified in the schedule above) to the population. 5. Based on the misstatement projections calculated #4 above, what is your conclusion about A/R ? The facts: - You are completing a financial statement audit and are testing the Accounts Receivable of your client. - Your client's A/R has a total of 11,800 total customer accounts with a total account balance of 53,717,900. See below for details of the different stratums: Auditor judgments: - Based on our inherent risk assessment and the results of our tests of controls, the risic of material misstatement for A/R is low - The tolerable misstatement for A/R is $55,000 and the expected misstatement is $15,000 - The desired level of confidence is moderate based on other audit evidence already gathered All customer account balances greater than $25,000 will be selected to test - The following formula is used to calculated the sample size Use the following table to determine the correct confidence factor to use in the formula abovet Requirement: 1. Calculate the sample size to be tested for each stratum. Suppose instead that your manager has pre-determined a Sample Size (N)= 100 in accordance with firm methodology. How should we allocate amongst the three strata? As part of the substantive testing of A/R assume A/R Confirmations were mailed to a sample of your cllent's customers. You recelved the completed confirmations from your client's customers and tested thm. The following schedule shows the details of your substantive testing results of A/R : Requirements: 2. Assume your manager judgmentally decided to use the Difference Projection method for misstatement projection of A/R. Using the sample size of N=100 calculated above, project the sample misstatements (identified in the schedule above) to the population. 3. Based on the misstatement projections calculated in #2 above, what is your conclusion about A/R ? 4. Assume your manager/udgmentally decided to use the Ratio Projection method for misstatement projection of A/R. Project the sample misstatements (identified in the schedule above) to the population. 5. Based on the misstatement projections calculated #4 above, what is your conclusion about A/R