Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NDB granted 1,000 share appreciation rights (SARS) to each of its 5,000 employees on 1 July 2012. To be eligible for the rights, employees

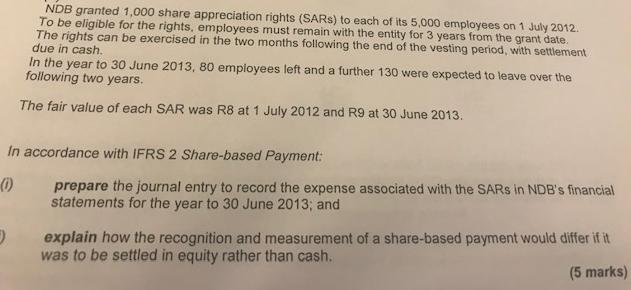

NDB granted 1,000 share appreciation rights (SARS) to each of its 5,000 employees on 1 July 2012. To be eligible for the rights, employees must remain with the entity for 3 years from the grant date. The rights can be exercised in the two months following the end of the vesting period, with settlement due in cash. In the year to 30 June 2013, 80 employees left and a further 130 were expected to leave over the following two years. The fair value of each SAR was R8 at 1 July 2012 and R9 at 30 June 2013. In accordance with IFRS 2 Share-based Payment: () prepare the journal entry to record the expense associated with the SARS in NDB's financial statements for the year to 30 June 2013; and explain how the recognition and measurement of a share-based payment would differ if it was to be settled in equity rather than cash. (5 marks)

Step by Step Solution

★★★★★

3.30 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Solution Cummulative Cummulative No of Employees Left Compenstatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started