Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Falco Group is a holding company selling consumer durable goods. Falco Scooters is a division of the group selling one high-end scooter model.

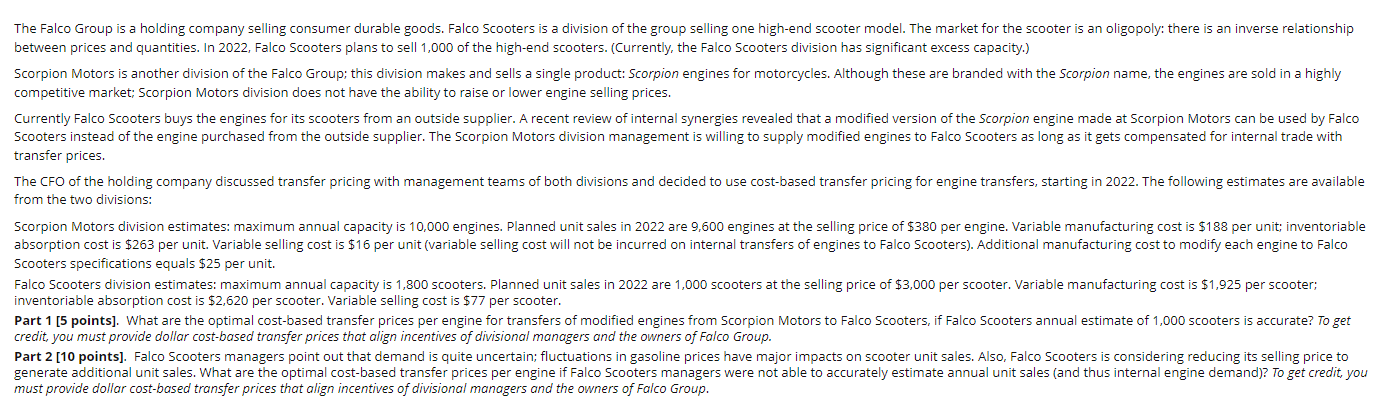

The Falco Group is a holding company selling consumer durable goods. Falco Scooters is a division of the group selling one high-end scooter model. The market for the scooter is an oligopoly: there is an inverse relationship between prices and quantities. In 2022, Falco Scooters plans to sell 1,000 of the high-end scooters. (Currently, the Falco Scooters division has significant excess capacity.) Scorpion Motors is another division of the Falco Group; this division makes and sells a single product: Scorpion engines for motorcycles. Although these are branded with the Scorpion name, the engines are sold in a highly competitive market; Scorpion Motors division does not have the ability to raise or lower engine selling prices. Currently Falco Scooters buys the engines for its scooters from an outside supplier. A recent review of internal synergies revealed that a modified version of the Scorpion engine made at Scorpion Motors can be used by Falco Scooters instead of the engine purchased from the outside supplier. The Scorpion Motors division management is willing to supply modified engines to Falco Scooters as long as it gets compensated for internal trade with transfer prices. The CFO of the holding company discussed transfer pricing with management teams of both divisions and decided to use cost-based transfer pricing for engine transfers, starting in 2022. The following estimates are available from the two divisions: Scorpion Motors division estimates: maximum annual capacity is 10,000 engines. Planned unit sales in 2022 are 9,600 engines at the selling price of $380 per engine. Variable manufacturing cost is $188 per unit; inventoriable absorption cost is $263 per unit. Variable selling cost is $16 per unit (variable selling cost will not be incurred on internal transfers of engines to Falco Scooters). Additional manufacturing cost to modify each engine to Falco Scooters specifications equals $25 per unit. Falco Scooters division estimates: maximum annual capacity is 1,800 scooters. Planned unit sales in 2022 are 1,000 scooters at the selling price of $3,000 per scooter. Variable manufacturing cost is $1,925 per scooter; inventoriable absorption cost is $2,620 per scooter. Variable selling cost is $77 per scooter. Part 1 [5 points). What are the optimal cost-based transfer prices per engine for transfers of modified engines from Scorpion Motors to Falco Scooters, if Falco Scooters annual estimate of 1,000 scooters is accurate? To get credit, you must provide dollar cost-based transfer prices that align incentives of divisional managers and the owners of Falco Group. Part 2 [10 points]. Falco Scooters managers point out that demand is quite uncertain; fluctuations in gasoline prices have major impacts on scooter unit sales. Also, Falco Scooters is considering reducing its selling price to generate additional unit sales. What are the optimal cost-based transfer prices per engine if Falco Scooters managers were not able to accurately estimate annual unit sales (and thus internal engine demand)? To get credit, you must provide dollar cost-based transfer prices that align incentives of divisional managers and the owners of Falco Group.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1Dollar costbased transfer prices that align incentives of divisional managers and the owners of Fal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started