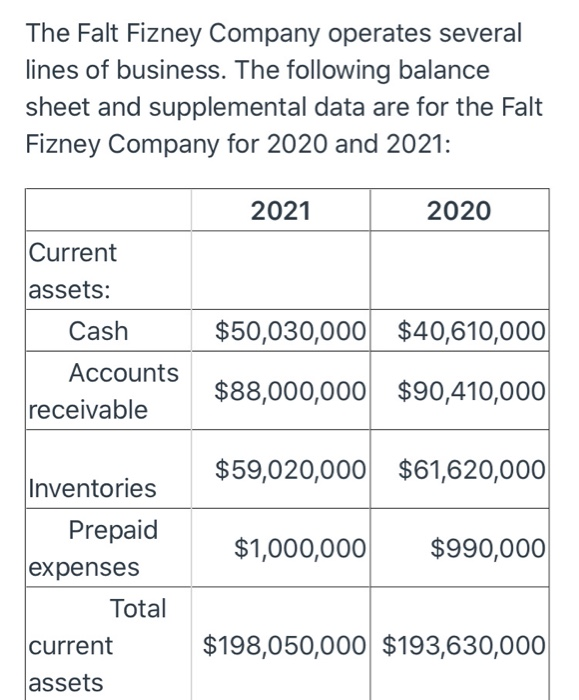

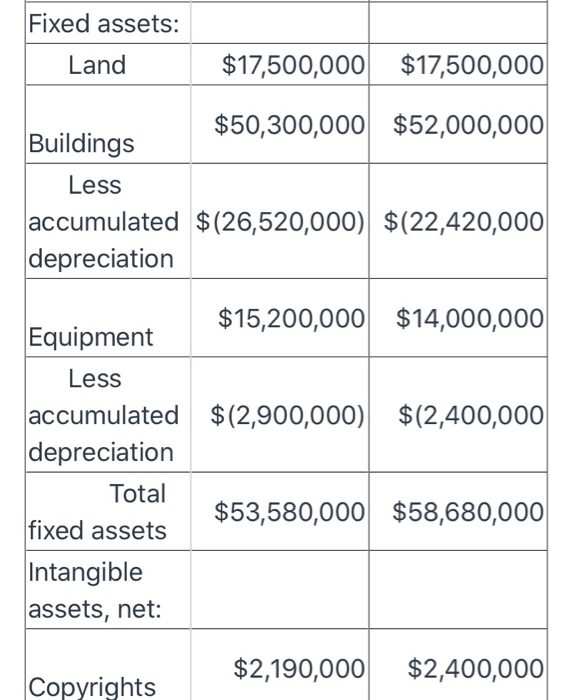

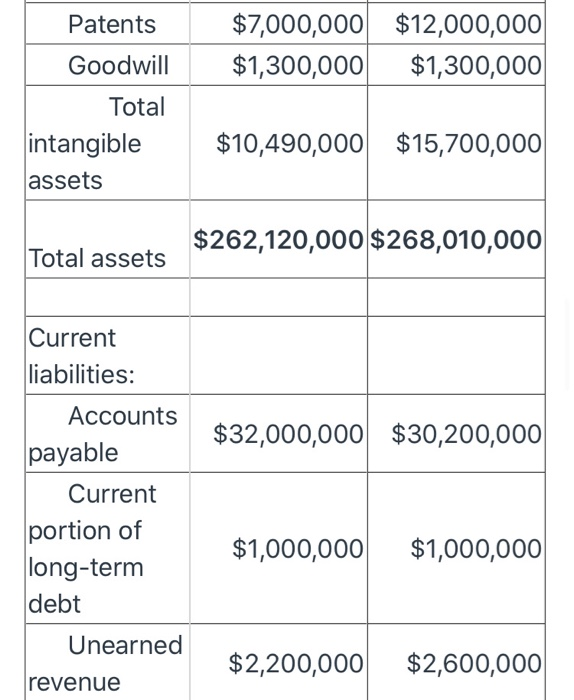

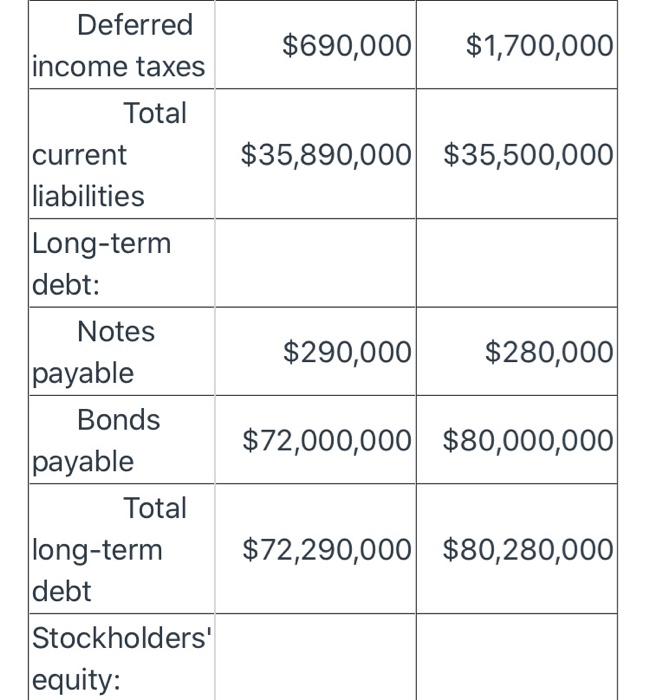

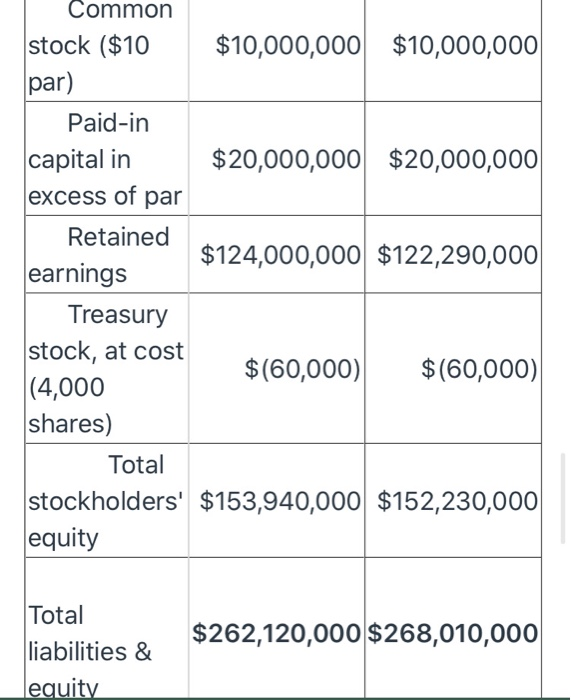

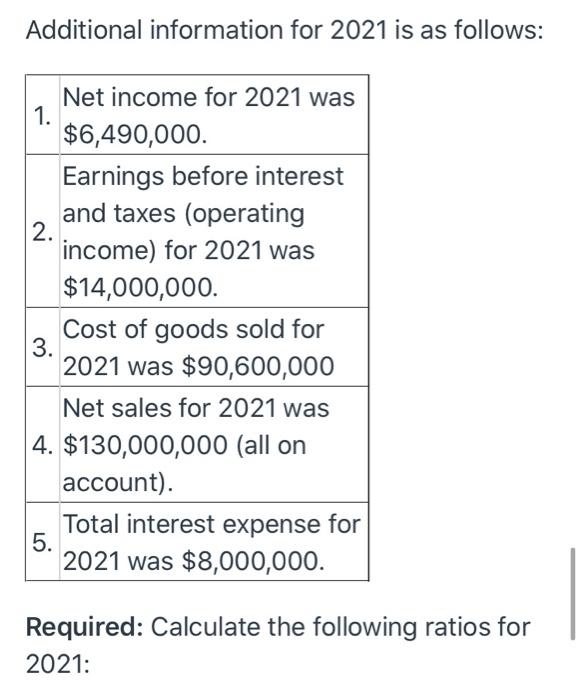

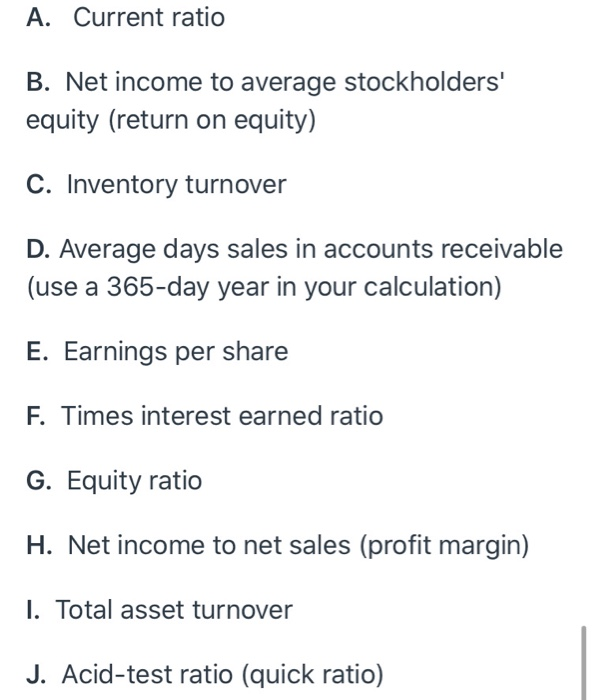

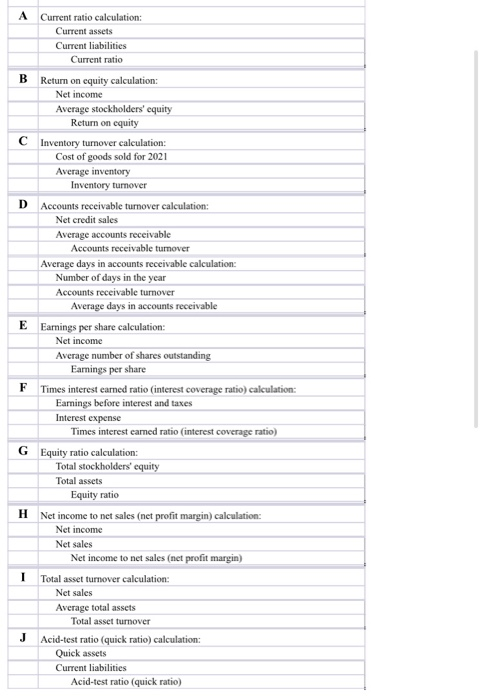

The Falt Fizney Company operates several lines of business. The following balance sheet and supplemental data are for the Falt Fizney Company for 2020 and 2021: 2021 2020 Current assets: Cash Accounts receivable $50,030,000 $40,610,000 $88,000,000 $90,410,000 $59,020,000 $61,620,000 Inventories $1,000,000 $990,000 Prepaid expenses Total current assets $198,050,000 $193,630,000 Fixed assets: Land $17,500,000 $17,500,000 $50,300,000 $52,000,000 Buildings Less accumulated $(26,520,000) $(22,420,000 depreciation $15,200,000 $14,000,000 $(2,900,000) $(2,400,000 Equipment Less accumulated depreciation Total fixed assets Intangible assets, net: $53,580,000 $58,680,000 $2,190,000 $2,400,000 Copyrights $7,000,000 $1,300,000 $12,000,000 $1,300,000 Patents Goodwill Total intangible assets $10,490,000 $15,700,000 $262,120,000 $268,010,000 Total assets Current liabilities: $32,000,000 $30,200,000 Accounts payable Current portion of long-term debt $1,000,000 $1,000,000 Unearned revenue $2,200,000 $2,600,000 $690,000 $1,700,000 $35,890,000 $35,500,000 Deferred income taxes Total current liabilities Long-term debt: Notes payable Bonds payable Total long-term debt Stockholders' equity: $290,000 $280,000 $72,000,000 $80,000,000 $72,290,000 $80,280,000 Common stock ($10 $10,000,000 $10,000,000 par) Paid-in capital in $20,000,000 $20,000,000 excess of par Retained $124,000,000 $122,290,000 earnings Treasury stock, at cost $(60,000) $(60,000) (4,000 shares) Total stockholders' $153,940,000 $152,230,000 equity Total liabilities & equity $262,120,000 $268,010,000 Additional information for 2021 is as follows: Net income for 2021 was "$6,490,000. Earnings before interest and taxes (operating income) for 2021 was $14,000,000. Cost of goods sold for 2021 was $90,600,000 Net sales for 2021 was 4. $130,000,000 (all on account). Total interest expense for 2021 was $8,000,000. Required: Calculate the following ratios for 2021: A. Current ratio B. Net income to average stockholders' equity (return on equity) C. Inventory turnover D. Average days sales in accounts receivable (use a 365-day year in your calculation) E. Earnings per share F. Times interest earned ratio G. Equity ratio H. Net income to net sales (profit margin) I. Total asset turnover J. Acid-test ratio (quick ratio) Current ratio calculation: Current assets Current liabilities Current ratio Return on equity calculation: Net income Average stockholders' equity Return on equity Inventory turnover calculation: Cost of goods sold for 2021 Average inventory Inventory turnover Accounts receivable turnover calculation: Net credit sales Average accounts receivable Accounts receivable tumover Average days in accounts receivable calculation: Number of days in the year Accounts receivable turnover Average days in accounts receivable Earnings per share calculation: Net income Average number of shares outstanding Earnings per share Times interest earned ratio interest coverage ratio) calculation: Earnings before interest and taxes Interest expense Times interest camed ratio interest coverage ratio) Equity ratio calculation: Total stockholders' equity Total assets Equity ratio G H Net income to net sales (net profit margin) calculation: Net income Net sales Net income to net sales (net profit margin) Total asset turnover calculation: Net sales Average total assets Total asset turnover Acid-test ratio (quick ratio) calculation: Quick assets Current liabilities Acid-test ratio (quick ratio)