Question

The family has heard of the German Federal Governments 2020 Green Federal Security initiative, and asks your opinion on whether the fixed income holding should

The family has heard of the German Federal Governments 2020 Green Federal Security initiative, and asks your opinion on whether the fixed income holding should be divided in two, and half of the fixed income portion of the wealth portfolio now invested in these new German bunds?

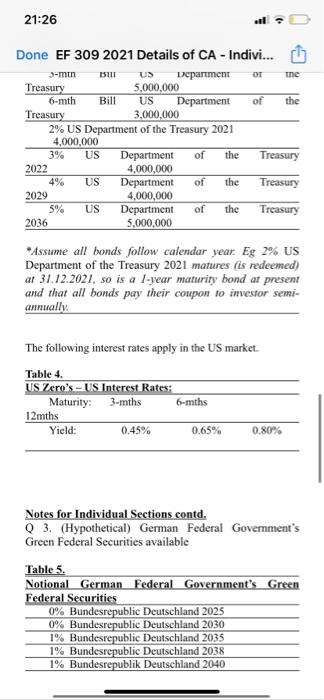

Analyse this investment proposition, make a recommendation to the family and explain your reasoning, supported by data analysis. Table 4. below sets out the details of the German Federal Government Green Securities which could be invested in.

Q 3. (Hypothetical) German Federal Governments Green Federal Securities available

Table 5.

Notional German Federal Governments Green Federal Securities

0% Bundesrepublic Deutschland 2025

0% Bundesrepublic Deutschland 2030

1% Bundesrepublic Deutschland 2035

1% Bundesrepublic Deutschland 2038

1% Bundesrepublik Deutschland 2040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started