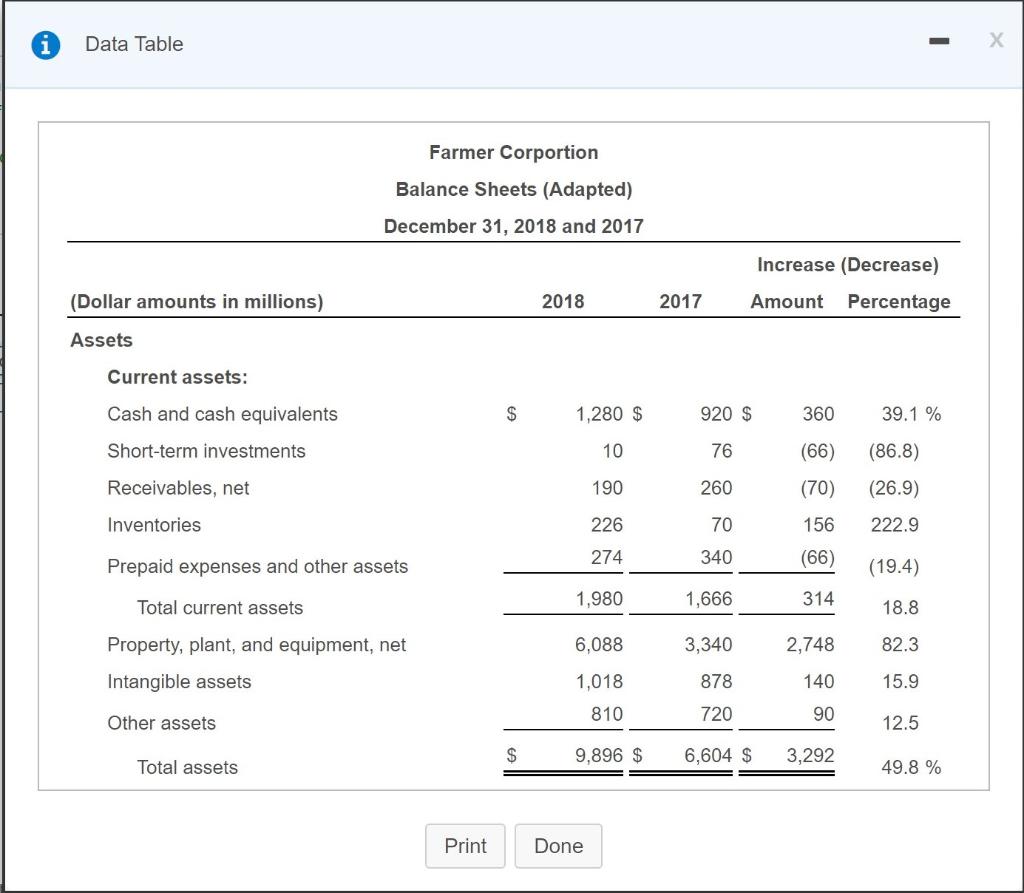

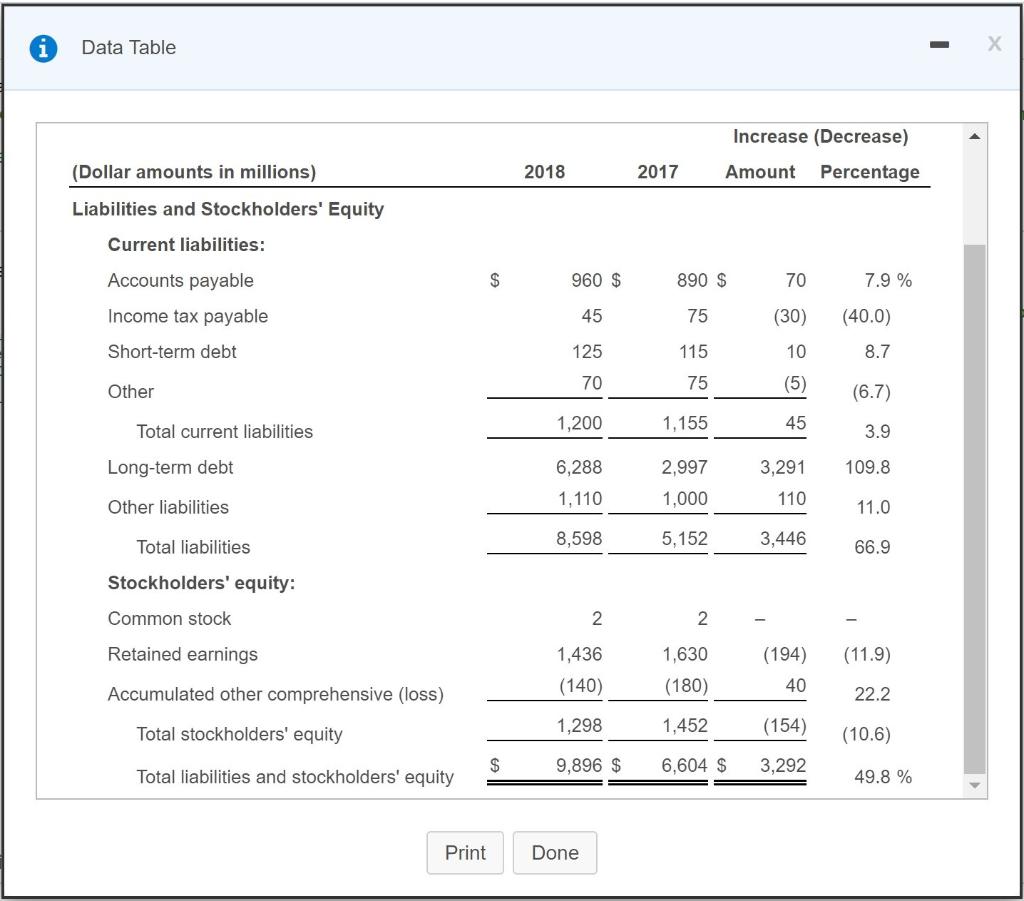

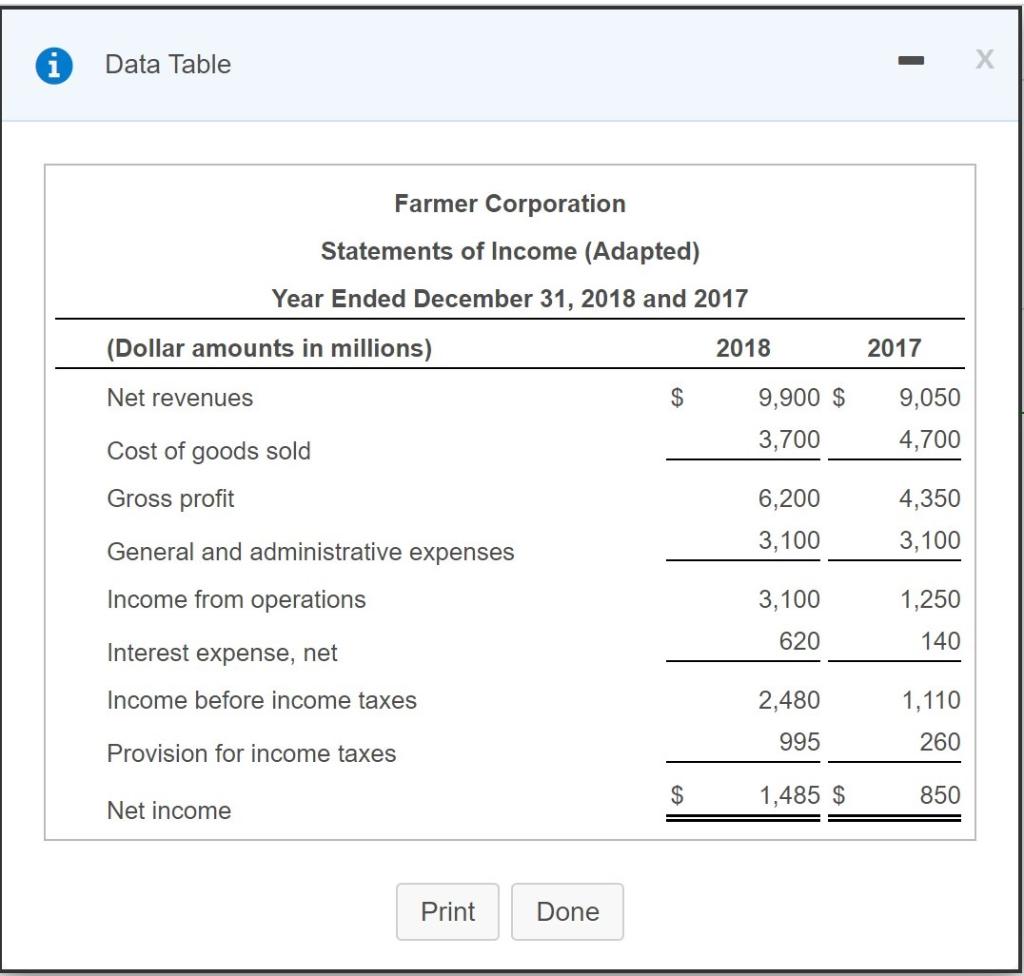

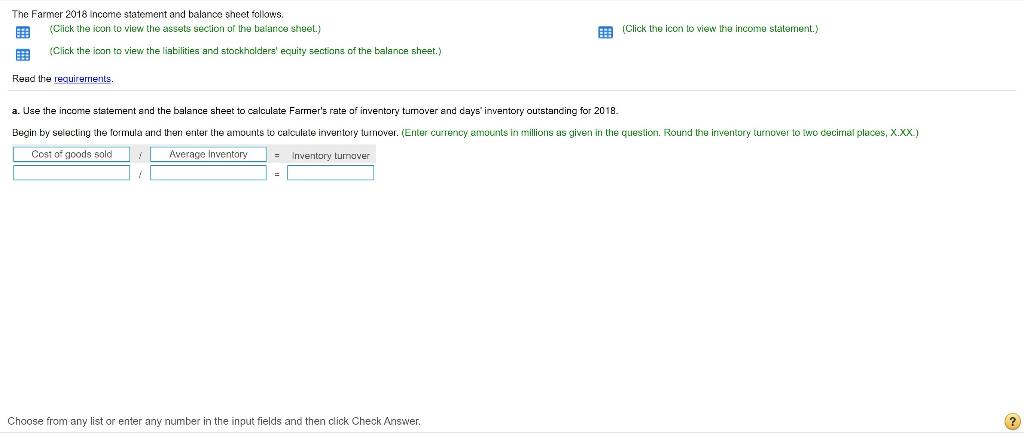

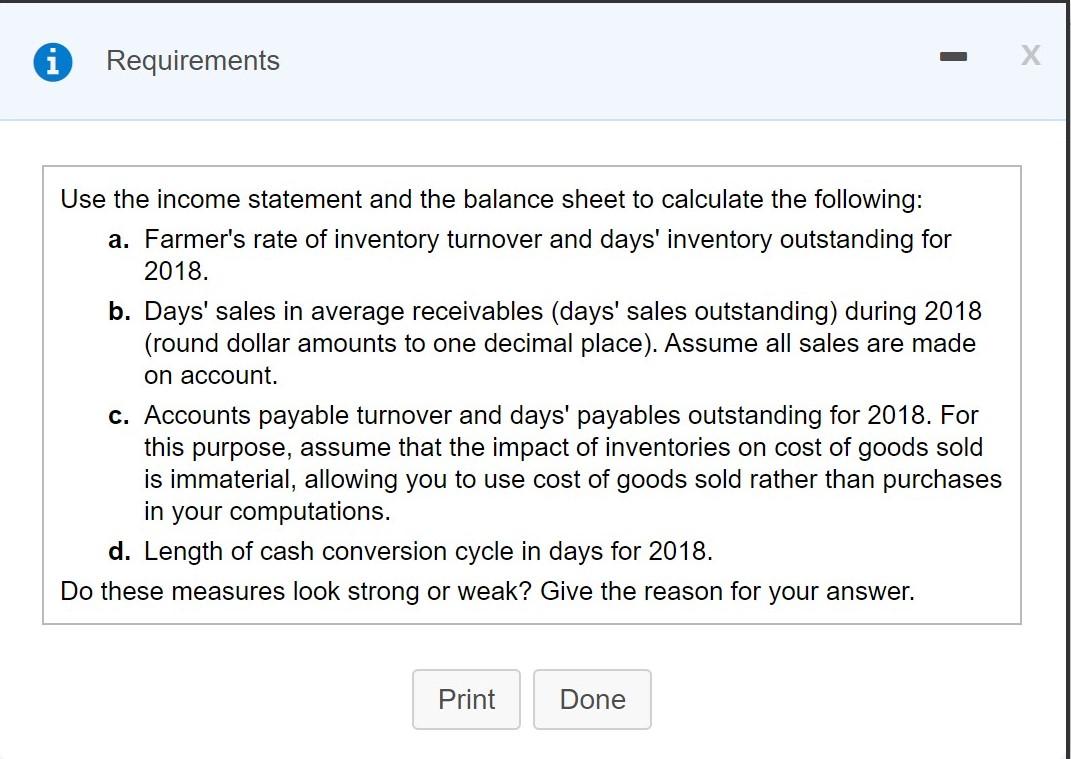

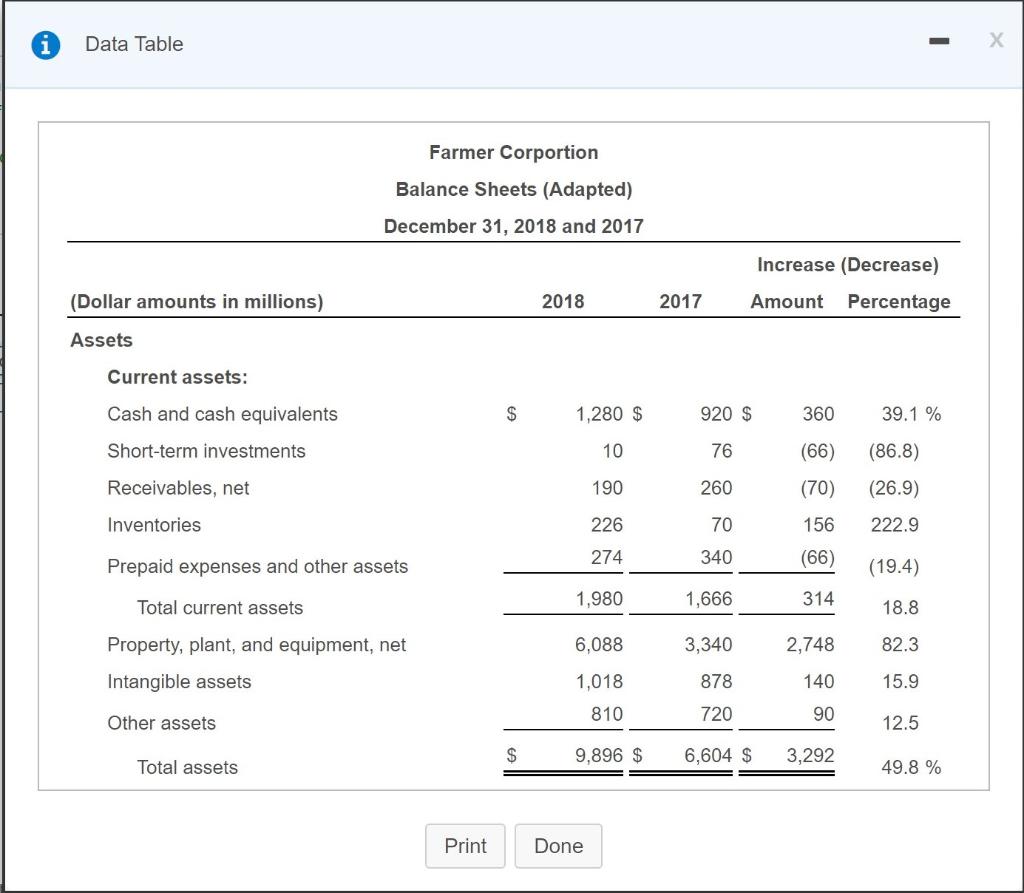

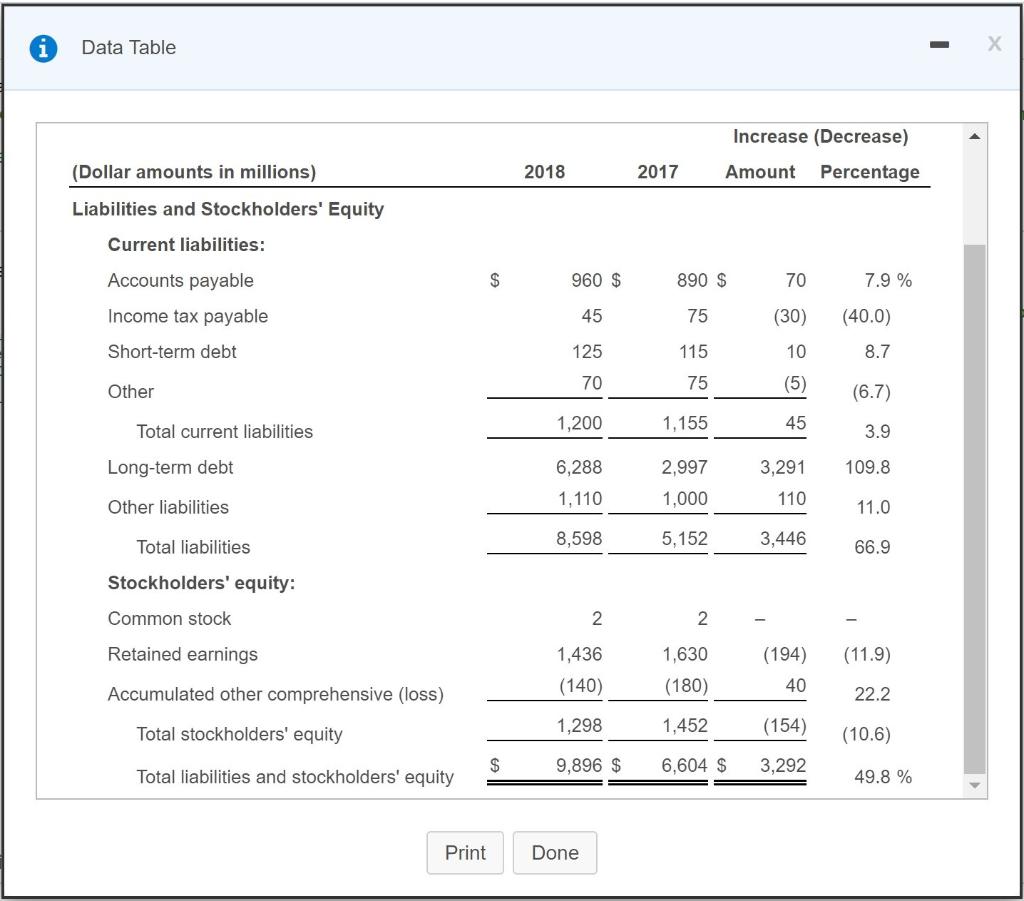

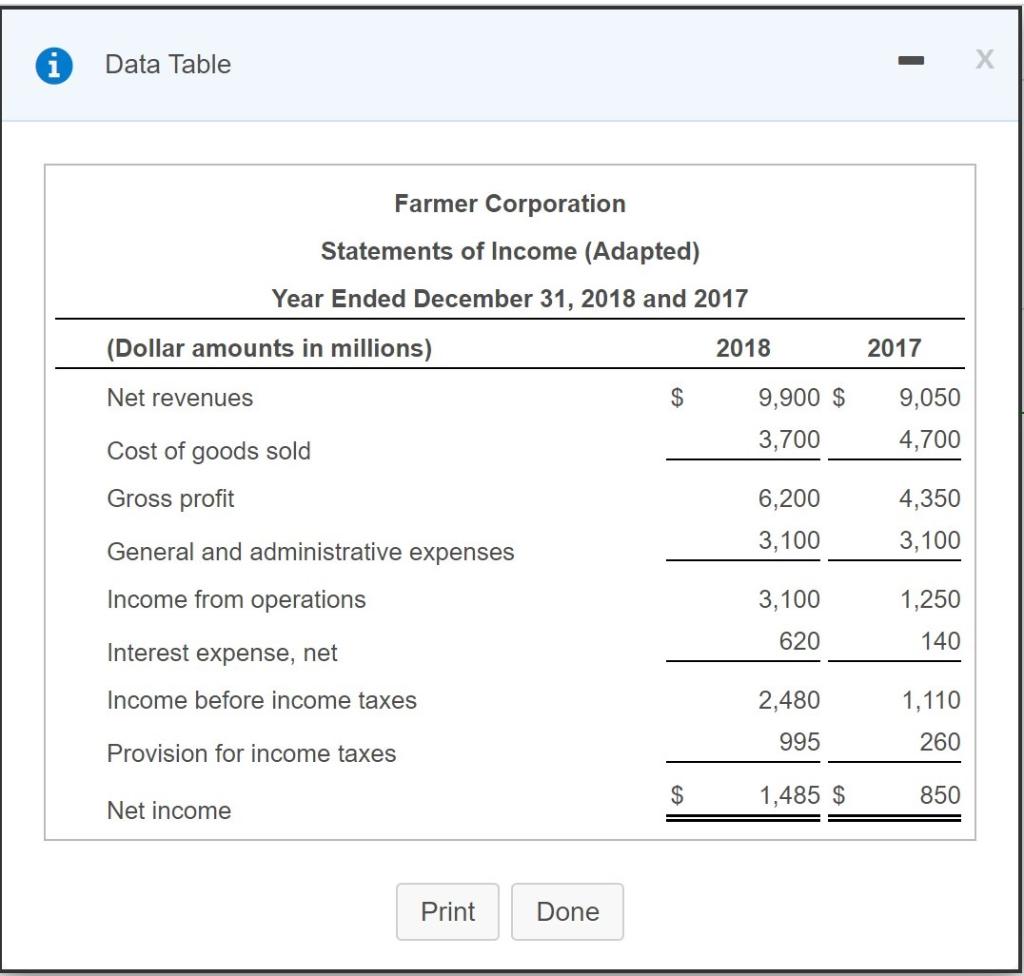

The Farmer 2018 income statement and balance sheet follows. (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the income statement.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) Read the requirements, a. Use the income statement and the balance sheet calculate Farmer's rate of inventory tumover and days'inventory outstanding for 2018. Begin by selecting the formula and then enter the amounts to calculate inventory tumover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) Cost of goods sold Average inventory Inventory turnover Choose from any list or enter any number in the input fields and then click Check Answer. ? i Requirements Use the income statement and the balance sheet to calculate the following: a. Farmer's rate of inventory turnover and days' inventory outstanding for 2018. b. Days' sales in average receivables (days' sales outstanding) during 2018 (round dollar amounts to one decimal place). Assume all sales are made on account. c. Accounts payable turnover and days' payables outstanding for 2018. For this purpose, assume that the impact of inventories on cost of goods sold is immaterial, allowing you to use cost of goods sold rather than purchases in your computations. d. Length of cash conversion cycle in days for 2018. Do these measures look strong or weak? Give the reason for your answer. Print Done Data Table Farmer Corportion Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) (Dollar amounts in millions) 2018 2017 Amount Percentage Assets Current assets: Cash and cash equivalents $ 1,280 $ 920 $ 360 39.1 % Short-term investments 10 76 (66) (86.8) Receivables, net 190 260 (70) (26.9) Inventories 226 222.9 70 340 156 (66) 274 Prepaid expenses and other assets (19.4) 1,980 1,666 314 Total current assets 18.8 Property, plant, and equipment, net 6,088 3,340 2,748 82.3 Intangible assets 1,018 878 140 15.9 810 720 90 Other assets 12.5 $ 9,896 $ 6,604 $ 3,292 Total assets 49.8 % Print Done Data Table Increase (Decrease) Amount Percentage (Dollar amounts in millions) 2018 2017 Liabilities and Stockholders' Equity Current liabilities: $ 960 $ 890 $ 70 7.9 % Accounts payable Income tax payable 45 75 (30) (40.0) Short-term debt 125 115 10 8.7 70 75 Other (5) (6.7) 1,200 Total current liabilities 1,155 45 3.9 Long-term debt 6,288 3,291 109.8 2,997 1,000 1.110 110 Other liabilities 11.0 Total liabilities 8,598 5,152 3,446 66.9 Stockholders' equity: Common stock 2 2 Retained earnings 1,630 (11.9) 1,436 (140) (194) 40 Accumulated other comprehensive (loss) (180) 22.2. Total stockholders' equity 1,298 1,452 (154 (10.6) $ 9,896 $ 3,292 Total liabilities and stockholders' equity 6,604 $ 49.8 % Print Done i Data Table Farmer Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 (Dollar amounts in millions) 2018 2017 Net revenues $ 9,900 $ 3,700 9,050 4,700 Cost of goods sold Gross profit 6,200 3,100 4,350 3,100 General and administrative expenses Income from operations 3,100 1,250 620 140 Interest expense, net Income before income taxes 2,480 995 1,110 260 Provision for income taxes $ 1,485 $ 850 Net income Print Done