Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Federal Reserve is about to make an interest rate decision next week on the Fed Funds Rate. The Federal Reserve sets the Fed Funds

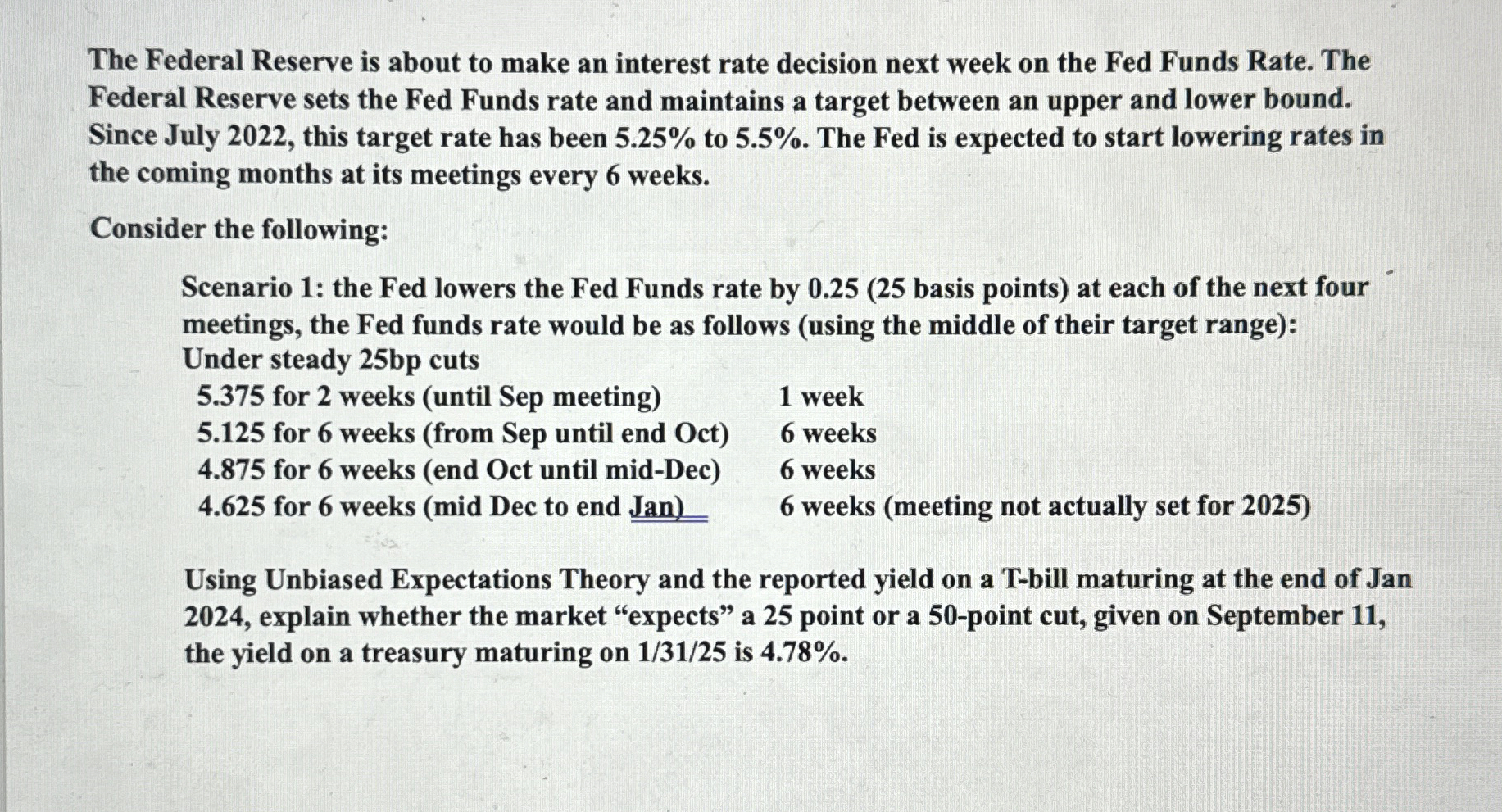

The Federal Reserve is about to make an interest rate decision next week on the Fed Funds Rate. The

Federal Reserve sets the Fed Funds rate and maintains a target between an upper and lower bound.

Since July this target rate has been to The Fed is expected to start lowering rates in

the coming months at its meetings every weeks.

Consider the following:

Scenario : the Fed lowers the Fed Funds rate by basis points at each of the next four

meetings, the Fed funds rate would be as follows using the middle of their target range:

Under steady bp cuts

for weeks until Sep meeting week

for weeks from Sep until end Oct weeks

for weeks end Oct until midDec weeks

for weeks mid Dec to end Jan weeks meeting not actually set for

Using Unbiased Expectations Theory and the reported yield on a Tbill maturing at the end of Jan

explain whether the market "expects" a point or a point cut, given on September

the yield on a treasury maturing on is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started