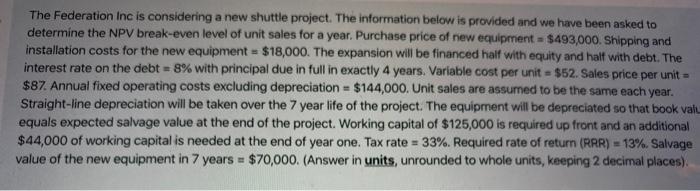

The Federation Inc is considering a new shuttle project. The information below is provided and we have been asked to determine the NPV break-even level of unit sales for a year. Purchase price of new equipment - $493,000. Shipping and installation costs for the new equipment = $18,000. The expansion will be financed half with equity and half with debt. The interest rate on the debt = 8% with principal due in full in exactly 4 years. Variable cost per unit - $52. Sales price per unit $87. Annual fixed operating costs excluding depreciation = $144,000. Unit sales are assumed to be the same each year. Straight-line depreciation will be taken over the 7 year life of the project. The equipment will be depreciated so that book valu equals expected salvage value at the end of the project. Working capital of $125,000 is required up front and an additional $44,000 of working capital is needed at the end of year one. Tax rate = 33%. Required rate of return (RAR) = 13%. Salvage value of the new equipment in 7 years = $70,000. (Answer in units, unrounded to whole units, keeping 2 decimal places). The Federation Inc is considering a new shuttle project. The information below is provided and we have been asked to determine the NPV break-even level of unit sales for a year. Purchase price of new equipment - $493,000. Shipping and installation costs for the new equipment = $18,000. The expansion will be financed half with equity and half with debt. The interest rate on the debt = 8% with principal due in full in exactly 4 years. Variable cost per unit - $52. Sales price per unit $87. Annual fixed operating costs excluding depreciation = $144,000. Unit sales are assumed to be the same each year. Straight-line depreciation will be taken over the 7 year life of the project. The equipment will be depreciated so that book valu equals expected salvage value at the end of the project. Working capital of $125,000 is required up front and an additional $44,000 of working capital is needed at the end of year one. Tax rate = 33%. Required rate of return (RAR) = 13%. Salvage value of the new equipment in 7 years = $70,000. (Answer in units, unrounded to whole units, keeping 2 decimal places)