Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Fielding family own Fielding Educational Toys Inc. (FET), a manufacturer of educational toys for children up to age 12. FET has been very

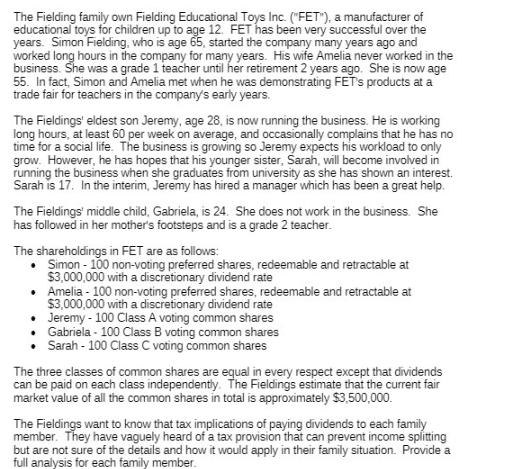

The Fielding family own Fielding Educational Toys Inc. ("FET"), a manufacturer of educational toys for children up to age 12. FET has been very successful over the years. Simon Fielding, who is age 65, started the company many years ago and worked long hours in the company for many years. His wife Amelia never worked in the business. She was a grade 1 teacher until her retirement 2 years ago. She is now age 55. In fact, Simon and Amelia met when he was demonstrating FET's products at a trade fair for teachers in the company's early years. The Fieldings' eldest son Jeremy, age 28, is now running the business. He is working long hours, at least 60 per week on average, and occasionally complains that he has no time for a social life. The business is growing so Jeremy expects his workload to only grow. However, he has hopes that his younger sister, Sarah, will become involved in running the business when she graduates from university as she has shown an interest. Sarah is 17. In the interim, Jeremy has hired a manager which has been a great help. The Fieldings' middle child, Gabriela, is 24. She does not work in the business. She has followed in her mother's footsteps and is a grade 2 teacher. The shareholdings in FET are as follows: Simon - 100 non-voting preferred shares, redeemable and retractable at $3,000,000 with a discretionary dividend rate Amelia - 100 non-voting preferred shares, redeemable and retractable at $3,000,000 with a discretionary dividend rate Jeremy - 100 Class A voting common shares Gabriela - 100 Class B voting common shares Sarah - 100 Class C voting common shares The three classes of common shares are equal in every respect except that dividends can be paid on each class independently. The Fieldings estimate that the current fair market value of all the common shares in total is approximately $3,500,000. The Fieldings want to know that tax implications of paying dividends to each family member. They have vaguely heard of a tax provision that can prevent income splitting but are not sure of the details and how it would apply in their family situation. Provide a full analysis for each family member.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The tax provision that prevents income splitting is generally known as the kiddie tax or the Tax on Split Income TOSI rules in Canada The TOSI rules a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started