Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The fieldwork for the December 31, 2016 audit of Treble Corporation ended on March 17, 2017. The financial statements and auditor's report were issued and

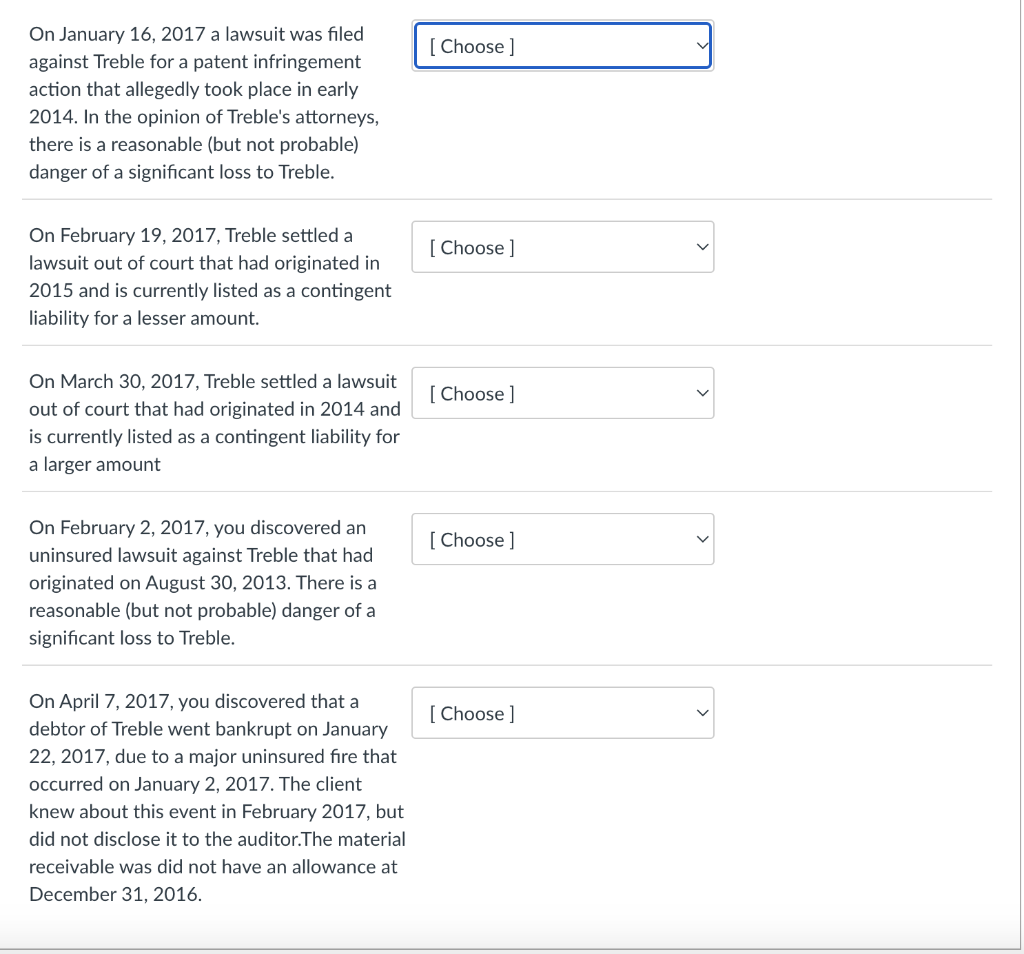

The fieldwork for the December 31, 2016 audit of Treble Corporation ended on March 17, 2017. The financial statements and auditor's report were issued and mailed to stockholders on March 29, 2017. In each of the material situations below, indicate the appropriate action. The possible actions are as follows:

On January 16, 2017 a lawsuit was filed against Treble for a patent infringement action that allegedly took place in early 2014. In the opinion of Treble's attorneys, there is a reasonable (but not probable) danger of a significant loss to Treble. On February 19, 2017, Treble settled a lawsuit out of court that had originated in 2015 and is currently listed as a contingent liability for a lesser amount. On March 30, 2017, Treble settled a lawsuit out of court that had originated in 2014 and is currently listed as a contingent liability for a larger amount On February 2, 2017, you discovered an uninsured lawsuit against Treble that had originated on August 30,2013 . There is a reasonable (but not probable) danger of a significant loss to Treble. On April 7, 2017, you discovered that a debtor of Treble went bankrupt on January 22, 2017, due to a major uninsured fire that occurred on January 2, 2017. The client knew about this event in February 2017, but did not disclose it to the auditor.The material receivable was did not have an allowance at December 31, 2016. Disclose the information in a footnote in the December 31, 2016 financial statements. Adjust the December 31, 2016 financial statements. No action is required. Request the client revise and reissue the December 31, 2016 financial statements. The revision should involve the addition of a On January 16, 2017 a lawsuit was filed against Treble for a patent infringement action that allegedly took place in early 2014. In the opinion of Treble's attorneys, there is a reasonable (but not probable) danger of a significant loss to Treble. On February 19, 2017, Treble settled a lawsuit out of court that had originated in 2015 and is currently listed as a contingent liability for a lesser amount. On March 30, 2017, Treble settled a lawsuit out of court that had originated in 2014 and is currently listed as a contingent liability for a larger amount On February 2, 2017, you discovered an uninsured lawsuit against Treble that had originated on August 30,2013 . There is a reasonable (but not probable) danger of a significant loss to Treble. On April 7, 2017, you discovered that a debtor of Treble went bankrupt on January 22, 2017, due to a major uninsured fire that occurred on January 2, 2017. The client knew about this event in February 2017, but did not disclose it to the auditor.The material receivable was did not have an allowance at December 31, 2016. Disclose the information in a footnote in the December 31, 2016 financial statements. Adjust the December 31, 2016 financial statements. No action is required. Request the client revise and reissue the December 31, 2016 financial statements. The revision should involve the addition of a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started