Question

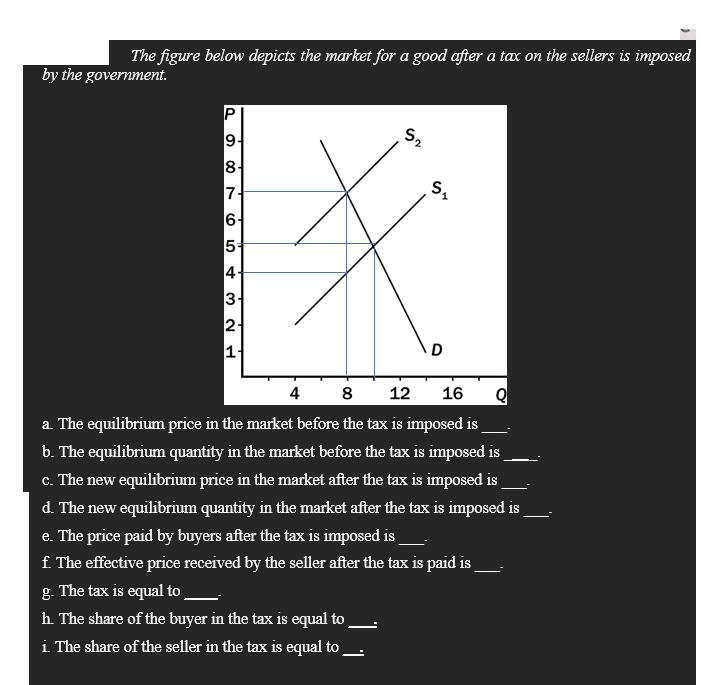

The figure below depicts the market for a good after a tax on the sellers is imposed by the government. P 9- 880 8-

The figure below depicts the market for a good after a tax on the sellers is imposed by the government. P 9- 880 8- 7 6- 5 43 4- 3- 2 T S S 4 8 12 16 Q a. The equilibrium price in the market before the tax is imposed is b. The equilibrium quantity in the market before the tax is imposed is c. The new equilibrium price in the market after the tax is imposed is d. The new equilibrium quantity in the market after the tax is imposed is e. The price paid by buyers after the tax is imposed is f The effective price received by the seller after the tax is paid is g. The tax is equal to h. The share of the buyer in the tax is equal to i. The share of the seller in the tax is equal to

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

From the given graph we can derive the answers as follows a The equilibrium price in the market befo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App