Question

The file contains the annual closing stock prices for Apple (AAPL) and Microsoft (MSFT) for the period 2012-2022. You will fill in each of the

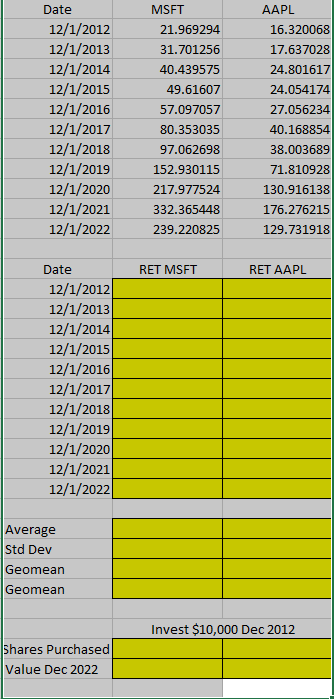

The file contains the annual closing stock prices for Apple (AAPL) and Microsoft (MSFT) for the period 2012-2022. You will fill in each of the yellow cells. 1. Compute the annual returns for each stock for each year. 2. Find the arithmetic average annual return, the standard deviation of annual returns, and the geometric mean annual return for each stock. 3. Which stock was the better investment over the 2012-2022 period? 4. If you invested $10,000 in each stock at the end of 2012, how much would each be worth at the end of 2022? (show excel steps)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started