Answered step by step

Verified Expert Solution

Question

1 Approved Answer

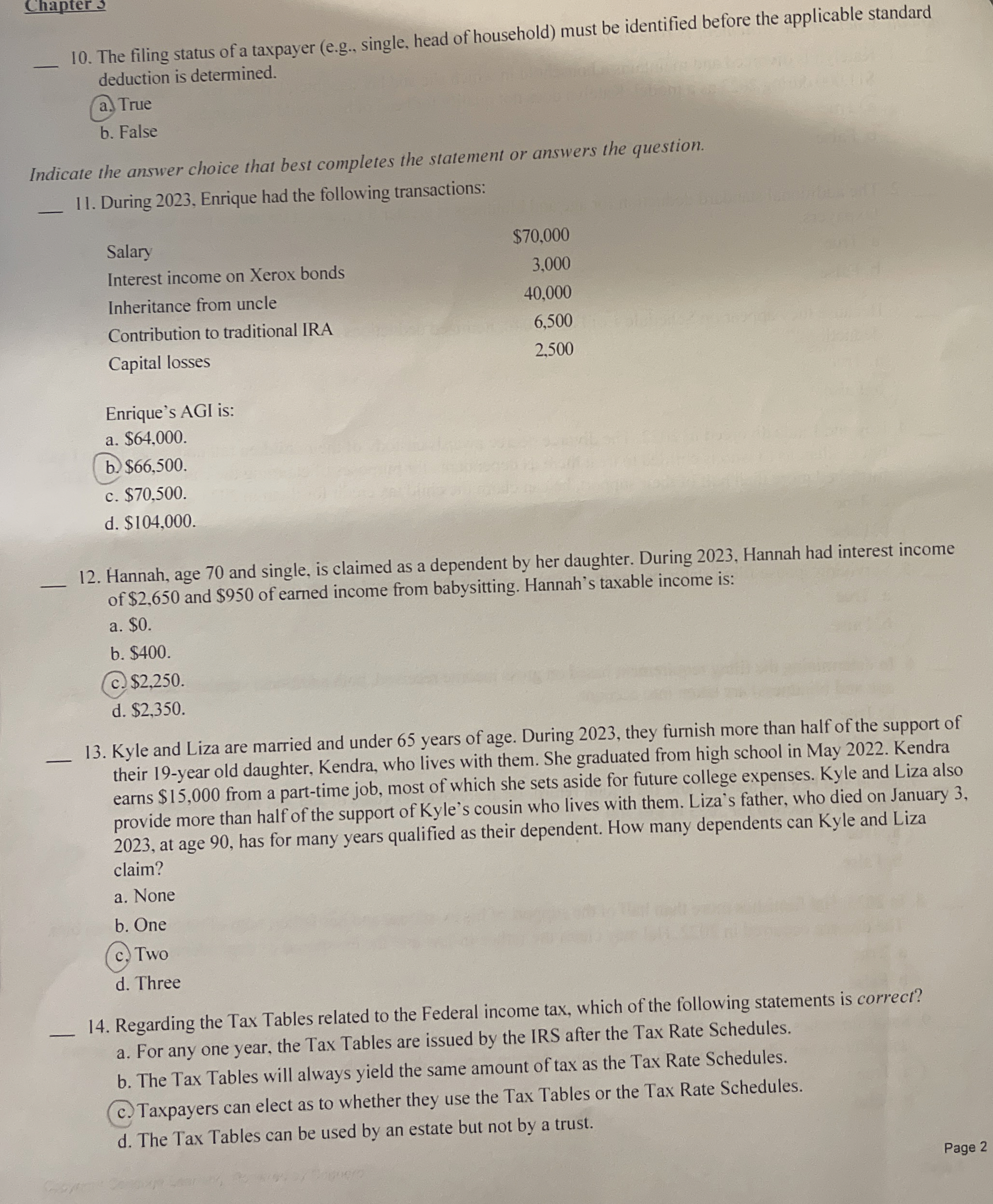

The filing status of a taxpayer ( e . g . , single, head of household ) must be identified before the applicable standard deduction

The filing status of a taxpayer eg single, head of household must be identified before the applicable standard deduction is determined.

a True

b False

Indicate the answer choice that best completes the statement or answers the question.

During Enrique had the following transactions:

Enrique's AGI is:

a $

b $

c $

d $

Hannah, age and single, is claimed as a dependent by her daughter. During Hannah had interest income of $ and $ of earned income from babysitting. Hannah's taxable income is:

a $

b $

c $

d $

Kyle and Liza are married and under years of age. During they furnish more than half of the support of their year old daughter, Kendra, who lives with them. She graduated from high school in May Kendra earns $ from a parttime job, most of which she sets aside for future college expenses. Kyle and Liza also provide more than half of the support of Kyle's cousin who lives with them. Liza's father, who died on January at age has for many years qualified as their dependent. How many dependents can Kyle and Liza

claim?

a None

b One

c Two

d Three

Regarding the Tax Tables related to the Federal income tax, which of the following statements is correct?

a For any one year, the Tax Tables are issued by the IRS after the Tax Rate Schedules.

b The Tax Tables will always yield the same amount of tax as the Tax Rate Schedules.

c Taxpayers can elect as to whether they use the Tax Tables or the Tax Rate Schedules.

d The Tax Tables can be used by an estate but not by a trust.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started