Answered step by step

Verified Expert Solution

Question

1 Approved Answer

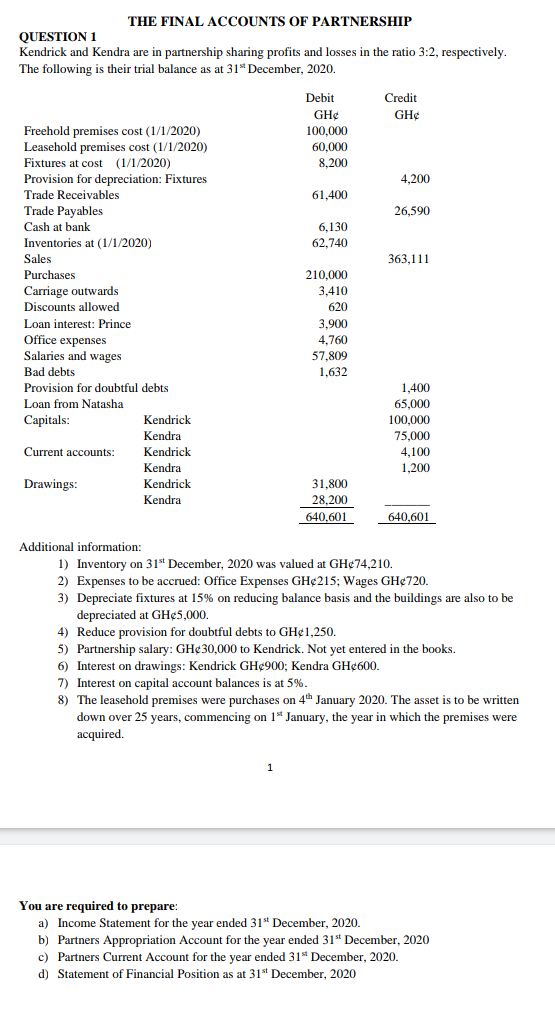

THE FINAL ACCOUNTS OF PARTNERSHIP QUESTION 1 Kendrick and Kendra are in partnership sharing profits and losses in the ratio 3:2, respectively. The following is

THE FINAL ACCOUNTS OF PARTNERSHIP QUESTION 1 Kendrick and Kendra are in partnership sharing profits and losses in the ratio 3:2, respectively. The following is their trial balance as at 31 December, 2020. Credit GH Debit GH 100,000 60,000 8,200 4,200 61,400 26,590 6,130 62.740 363,111 Purchases 210,000 3,410 Freehold premises cost (1/1/2020) Leasehold premises cost (1/1/2020) Fixtures at cost (1/1/2020) Provision for depreciation: Fixtures Trade Receivables Trade Payables Cash at bank Inventories at (1/1/2020) Sales Cara Carriage outwards Discounts allowed Loan interest: Prince Office expenses Salaries and wages Bad debts Provision for doubtful debts Loan from Natasha Capitals: Kendrick Kendra Current accounts: Kendrick Kendra Drawings: Kendra 620 3,900 4,760 57.809 1.632 1,400 65,000 100,000 75,000 4.100 1,200 Kendrick 31,800 28,200 640.601 640,601 Additional information: 1) Inventory on 31st December, 2020 was valued at GH74,210. 2) Expenses to be accrued: Office Expenses GH215; Wages GH720. 3) Depreciate fixtures at 15% on reducing balance basis and the buildings are also to be depreciated at GH5,000 4) Reduce provision for doubtful debts to GH1,250. 5) Partnership salary: GH30,000 to Kendrick. Not yet entered in the books. 6) Interest on drawings: Kendrick GH900; Kendra GH600. 7) Interest on capital account balances is at 5%. 8) The leasehold premises were purchases on 4th January 2020. The asset is to be written down over 25 years, commencing on 15 January, the year in which the premises were acquired. You are required to prepare: a) Income Statement for the year ended 31st December, 2020. b) Partners Appropriation Account for the year ended 315 December, 2020 c) Partners Current Account for the year ended 31 December, 2020. d) Statement of Financial Position as at 31st December, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started