Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The final set of bullet points are the requirements for the assignment. PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021

The final set of bullet points are the requirements for the assignment.

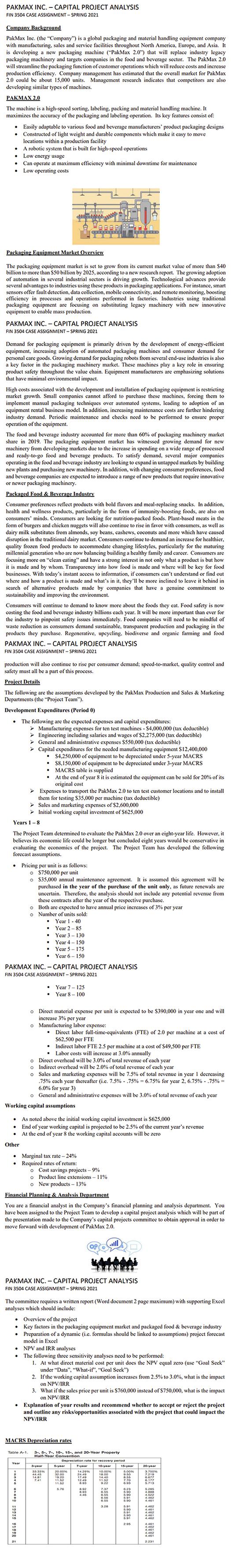

PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 Company Background PakMax Inc. (the "Company") is a global packaging and material handling equipment company with manufacturing, sales and service facilities throughout North America, Europe, and Asia. It is developing a new packaging machine ("PakMax 2.0") that will replace industry legacy packaging machinery and targets companies in the food and beverage sector. The PakMax 2.0 will streamline the packaging function of customer operations which will reduce costs and increase production efficiency. Company management has estimated that the overall market for PakMax 2.0 could be about 15,000 units. Management research indicates that competitors are also developing similar types of machines. PAKMAX 2.0 The machine is a high-speed sorting, labeling, packing and material handling machine. It maximizes the accuracy of the packaging and labeling operation. Its key features consist of: Easily adaptable to various food and beverage manufacturers' product packaging designs Constructed of light weight and durable components which make it easy to move locations within a production facility A robotic system that is built for high-speed operations Low energy usage Can operate at maximum efficiency with minimal downtime for maintenance Low operating costs Packaging Equipment Market Overview The packaging equipment market is set to grow from its current market value of more than $40 billion to more than $50 billion by 2025, according to a new research report. The growing adoption of automation in several industrial sectors is driving growth. Technological advances provide several advantages to industries using these products in packaging applications. For instance, smart sensors offer fault detection, data collection, mobile connectivity, and remote monitoring, boosting efficiency in processes and operations performed in factories. Industries using traditional packaging cquipment are focusing on substituting legacy machinery with new innovative equipment to enable mass production. PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 Demand for packaging equipment is primarily driven by the development of energy-efficient equipment, increasing adoption of automated packaging machines and consumer demand for personal care goods. Growing demand for packaging robots from several end-use industries is also a key factor in the packaging machinery market. These machines play a key role in ensuring product safety throughout the value chain. Equipment manufacturers are emphasizing solutions that have minimal environmental impact. High costs associated with the development and installation of packaging equipment is restricting market growth. Small companies cannot afford to purchase these machines, forcing them to implement manual packaging techniques over automated systems, leading to adoption of an equipment rental business model. In addition, increasing maintenance costs are further hindering industry demand. Periodic maintenance and checks need to be performed to ensure proper operation of the equipment. The food and beverage industry accounted for more than 60% of packaging machinery market share in 2019. The packaging equipment market has witnessed growing demand for new machinery from developing markets due to the increase in spending on a wide range of processed and ready-to-go food and beverage products. To satisfy demand, several major companies operating in the food and beverage industry are looking to expand in untapped markets by building new plants and purchasing new machinery. In addition, with changing consumer preferences, food and beverage companies are expected to introduce a range of new products that require innovative or newer packaging machinery. Packaged Food & Beverage Industry Consumer preferences reflect products with bold flavors and meal-replacing snacks. In addition, health and wellness products, particularly in the form of immunity-boosting foods, are also on consumers' minds. Consumers are looking for nutrition-packed foods. Plant-based meats in the form of burgers and chicken nuggets will also continue to rise in favor with consumers, as well as dairy milk substitutes from almonds, soy beans, cashews, coconuts and more which have caused disruption in the traditional dairy market. Consumers continue to demand an increase for healthier, quality frozen food products to accommodate changing lifestyles, particularly for the maturing millennial generation who are now balancing building a healthy family and career. Consumers are focusing more on clean eating" and have a I have a strong interest not only what a product is but how it is made and by whom. Transparency into how food is made and where will be key for food businesses. With today's instant access to information, if consumers can't understand or find out where and how a product is made and what's in it, they'll be more inclined to leave it behind in search of alternative products made by companies that have a genuine commitment to sustainability and improving the environment. Consumers will continue to demand to know more about the foods they eat. Food safety is now costing the food and beverage industry billions each year. It will be more important than ever for the industry to pinpoint safety issues immediately. Food companies will need to be mindful of waste reduction as consumers demand sustainable, transparent production and packaging in the products they purchase. Regenerative, upeycling, biodiverse and organic farming and food PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 production will also continue to rise per consumer demand; speed-to-market, quality control and safety must all be a part of this process. Project Details The following are the assumptions developed by the PakMax Production and Sales & Marketing Departments (the "Project Team"). Development Expenditures (Period 0) The following are the expected expenses and capital expenditures: Manufacturing expenses for ten test machines - $4,000,000 (tax deductible) Engineering including salaries and wages of S2,275,000 (tax deductible) General and administrative expenses $550,000 (tax deductible). Capital expenditures for the needed manufacturing equipment S12,400,000 $4,250,000 of of equipment to be depreciated under 5-year MACRS $8,150,000 of equipment to be depreciated under 3-year MACRS MACRS table is supplied At the end of year 8 it is estimated the equipment can be sold for 20% of its Expenses to to transport the PakMax 2.0 to ten test customer locations and to install them for testing $35,000 per machine (tax deductible) > Sales and marketing expenses of $2,600,000 Initial working capital investment of $625,000 Years 1-8 original cost The Project Team determined to evaluate the PakMax 2.0 over an eight-year life. However, it believes its economic life could be longer but concluded eight years would be conservative in evaluating the economics of the project. The Project Team has developed the following forecast assumptions. Pricing per unit is as follows: $750,000 per unit $35,000 annual maintenance agreement. It is assumed this agreement will be purchased in the year of the purchase of the unit only, as future renewals are uncertain. Therefore, the analysis should not include any potential revenue from these contracts after year of the respective purchase. Both are expected to have annual price increases of 3% per year Number of units sold: O Year 1 - 40 Year 2-85 Year 3 - 130 Year 4 - 150 Year 5 - 175 Year 6 - 150 PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 Year 7- 125 Year 8 - 100 o Direct material expense per unit is expected to be $390,000 in year one and will increase 3% per year o Manufacturing labor expense: Direct labor full-time-equivalents (FTE) of 2.0 per machine at a cost of $62,500 per FTE Indirect labor FTE 2.5 per machine at a cost of $49,500 per FTE . Labor Labor costs will increase at 3.0% annually o Direct overhead will be 3.0% of total revenue of each year Indirect overhead will be 2.0% of total revenue of each year o Sales and marketing expenses will be 7.5% of total revenue in year 1 decreasing .75% each year thereafter (i.c.7.5% -75% = 6.75% for year 2, 6.75% -75%- 6.0% for year 3) o General and administrative expenses will be 3.0% of total revenue of each year Working capital assumptions As noted above the initial working capital investment is $625,000 End of year working capital is projected to be 2.5% of the current year's revenue At the end of year 8 the working capital accounts will be zero Other Marginal tax rate - 24% Required rates of return: o Cost savings projects - 9% o Product line extensions - 11% New products - 13% Financial Planning & Analysis Department You are a financial analyst in the Company's financial planning and analysis department. You have been assigned to the Project Team to develop a capital project analysis which will be part of the presentation made to the Company's capital projects committee to obtain approval in order to move forward with development of PakMax 2.0. OPS) (.lll PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 The committee requires a written report (Word document 2 page maximum) with supporting Excel analyses which should include: Overview of the project Key factors in the packaging equipment market and packaged food & beverage industry Preparation n of a dynamic (i.c. formulas should be linked to assumptions) project forecast model in Excel NPV and IRR analyses The following three sensitivity analyses need to be performed: 1. At what direct material cost per unit does the NPV equal zero (use "Goal Seek" under "Data". "What-if", "Goal Seek") 2. If the working capital assumption increases from 2.5% to 3.0%, what is the impact 3. What if the sales price per unit is $760,000 instead of $750,000, what is the impact on NPV/IRR Explanation of your results and recommend whether to accept or reject the project and outline any risks/opportunities associated with the project that could impact the NPV/IRR on NPV/IRR MACRS Depreciation rates Table A-1 3., 5., 7., 10, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period 3-year 5-year 7 year 10-year 16-year You 20-year 10.00 9.90 112 3 6.03 5.71 5.76 . 13 6.23 4.40 320 6.01 4.400 2.05 2 233 PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 Company Background PakMax Inc. (the "Company") is a global packaging and material handling equipment company with manufacturing, sales and service facilities throughout North America, Europe, and Asia. It is developing a new packaging machine ("PakMax 2.0") that will replace industry legacy packaging machinery and targets companies in the food and beverage sector. The PakMax 2.0 will streamline the packaging function of customer operations which will reduce costs and increase production efficiency. Company management has estimated that the overall market for PakMax 2.0 could be about 15,000 units. Management research indicates that competitors are also developing similar types of machines. PAKMAX 2.0 The machine is a high-speed sorting, labeling, packing and material handling machine. It maximizes the accuracy of the packaging and labeling operation. Its key features consist of: Easily adaptable to various food and beverage manufacturers' product packaging designs Constructed of light weight and durable components which make it easy to move locations within a production facility A robotic system that is built for high-speed operations Low energy usage Can operate at maximum efficiency with minimal downtime for maintenance Low operating costs Packaging Equipment Market Overview The packaging equipment market is set to grow from its current market value of more than $40 billion to more than $50 billion by 2025, according to a new research report. The growing adoption of automation in several industrial sectors is driving growth. Technological advances provide several advantages to industries using these products in packaging applications. For instance, smart sensors offer fault detection, data collection, mobile connectivity, and remote monitoring, boosting efficiency in processes and operations performed in factories. Industries using traditional packaging cquipment are focusing on substituting legacy machinery with new innovative equipment to enable mass production. PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 Demand for packaging equipment is primarily driven by the development of energy-efficient equipment, increasing adoption of automated packaging machines and consumer demand for personal care goods. Growing demand for packaging robots from several end-use industries is also a key factor in the packaging machinery market. These machines play a key role in ensuring product safety throughout the value chain. Equipment manufacturers are emphasizing solutions that have minimal environmental impact. High costs associated with the development and installation of packaging equipment is restricting market growth. Small companies cannot afford to purchase these machines, forcing them to implement manual packaging techniques over automated systems, leading to adoption of an equipment rental business model. In addition, increasing maintenance costs are further hindering industry demand. Periodic maintenance and checks need to be performed to ensure proper operation of the equipment. The food and beverage industry accounted for more than 60% of packaging machinery market share in 2019. The packaging equipment market has witnessed growing demand for new machinery from developing markets due to the increase in spending on a wide range of processed and ready-to-go food and beverage products. To satisfy demand, several major companies operating in the food and beverage industry are looking to expand in untapped markets by building new plants and purchasing new machinery. In addition, with changing consumer preferences, food and beverage companies are expected to introduce a range of new products that require innovative or newer packaging machinery. Packaged Food & Beverage Industry Consumer preferences reflect products with bold flavors and meal-replacing snacks. In addition, health and wellness products, particularly in the form of immunity-boosting foods, are also on consumers' minds. Consumers are looking for nutrition-packed foods. Plant-based meats in the form of burgers and chicken nuggets will also continue to rise in favor with consumers, as well as dairy milk substitutes from almonds, soy beans, cashews, coconuts and more which have caused disruption in the traditional dairy market. Consumers continue to demand an increase for healthier, quality frozen food products to accommodate changing lifestyles, particularly for the maturing millennial generation who are now balancing building a healthy family and career. Consumers are focusing more on clean eating" and have a I have a strong interest not only what a product is but how it is made and by whom. Transparency into how food is made and where will be key for food businesses. With today's instant access to information, if consumers can't understand or find out where and how a product is made and what's in it, they'll be more inclined to leave it behind in search of alternative products made by companies that have a genuine commitment to sustainability and improving the environment. Consumers will continue to demand to know more about the foods they eat. Food safety is now costing the food and beverage industry billions each year. It will be more important than ever for the industry to pinpoint safety issues immediately. Food companies will need to be mindful of waste reduction as consumers demand sustainable, transparent production and packaging in the products they purchase. Regenerative, upeycling, biodiverse and organic farming and food PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 production will also continue to rise per consumer demand; speed-to-market, quality control and safety must all be a part of this process. Project Details The following are the assumptions developed by the PakMax Production and Sales & Marketing Departments (the "Project Team"). Development Expenditures (Period 0) The following are the expected expenses and capital expenditures: Manufacturing expenses for ten test machines - $4,000,000 (tax deductible) Engineering including salaries and wages of S2,275,000 (tax deductible) General and administrative expenses $550,000 (tax deductible). Capital expenditures for the needed manufacturing equipment S12,400,000 $4,250,000 of of equipment to be depreciated under 5-year MACRS $8,150,000 of equipment to be depreciated under 3-year MACRS MACRS table is supplied At the end of year 8 it is estimated the equipment can be sold for 20% of its Expenses to to transport the PakMax 2.0 to ten test customer locations and to install them for testing $35,000 per machine (tax deductible) > Sales and marketing expenses of $2,600,000 Initial working capital investment of $625,000 Years 1-8 original cost The Project Team determined to evaluate the PakMax 2.0 over an eight-year life. However, it believes its economic life could be longer but concluded eight years would be conservative in evaluating the economics of the project. The Project Team has developed the following forecast assumptions. Pricing per unit is as follows: $750,000 per unit $35,000 annual maintenance agreement. It is assumed this agreement will be purchased in the year of the purchase of the unit only, as future renewals are uncertain. Therefore, the analysis should not include any potential revenue from these contracts after year of the respective purchase. Both are expected to have annual price increases of 3% per year Number of units sold: O Year 1 - 40 Year 2-85 Year 3 - 130 Year 4 - 150 Year 5 - 175 Year 6 - 150 PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 Year 7- 125 Year 8 - 100 o Direct material expense per unit is expected to be $390,000 in year one and will increase 3% per year o Manufacturing labor expense: Direct labor full-time-equivalents (FTE) of 2.0 per machine at a cost of $62,500 per FTE Indirect labor FTE 2.5 per machine at a cost of $49,500 per FTE . Labor Labor costs will increase at 3.0% annually o Direct overhead will be 3.0% of total revenue of each year Indirect overhead will be 2.0% of total revenue of each year o Sales and marketing expenses will be 7.5% of total revenue in year 1 decreasing .75% each year thereafter (i.c.7.5% -75% = 6.75% for year 2, 6.75% -75%- 6.0% for year 3) o General and administrative expenses will be 3.0% of total revenue of each year Working capital assumptions As noted above the initial working capital investment is $625,000 End of year working capital is projected to be 2.5% of the current year's revenue At the end of year 8 the working capital accounts will be zero Other Marginal tax rate - 24% Required rates of return: o Cost savings projects - 9% o Product line extensions - 11% New products - 13% Financial Planning & Analysis Department You are a financial analyst in the Company's financial planning and analysis department. You have been assigned to the Project Team to develop a capital project analysis which will be part of the presentation made to the Company's capital projects committee to obtain approval in order to move forward with development of PakMax 2.0. OPS) (.lll PAKMAX INC. - CAPITAL PROJECT ANALYSIS FIN 3504 CASE ASSIGNMENT - SPRING 2021 The committee requires a written report (Word document 2 page maximum) with supporting Excel analyses which should include: Overview of the project Key factors in the packaging equipment market and packaged food & beverage industry Preparation n of a dynamic (i.c. formulas should be linked to assumptions) project forecast model in Excel NPV and IRR analyses The following three sensitivity analyses need to be performed: 1. At what direct material cost per unit does the NPV equal zero (use "Goal Seek" under "Data". "What-if", "Goal Seek") 2. If the working capital assumption increases from 2.5% to 3.0%, what is the impact 3. What if the sales price per unit is $760,000 instead of $750,000, what is the impact on NPV/IRR Explanation of your results and recommend whether to accept or reject the project and outline any risks/opportunities associated with the project that could impact the NPV/IRR on NPV/IRR MACRS Depreciation rates Table A-1 3., 5., 7., 10, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period 3-year 5-year 7 year 10-year 16-year You 20-year 10.00 9.90 112 3 6.03 5.71 5.76 . 13 6.23 4.40 320 6.01 4.400 2.05 2 233

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started