Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The finance director has estimated the following: The business's cost of capital is expected to remain at 15% per annum. Selling prices would be constant

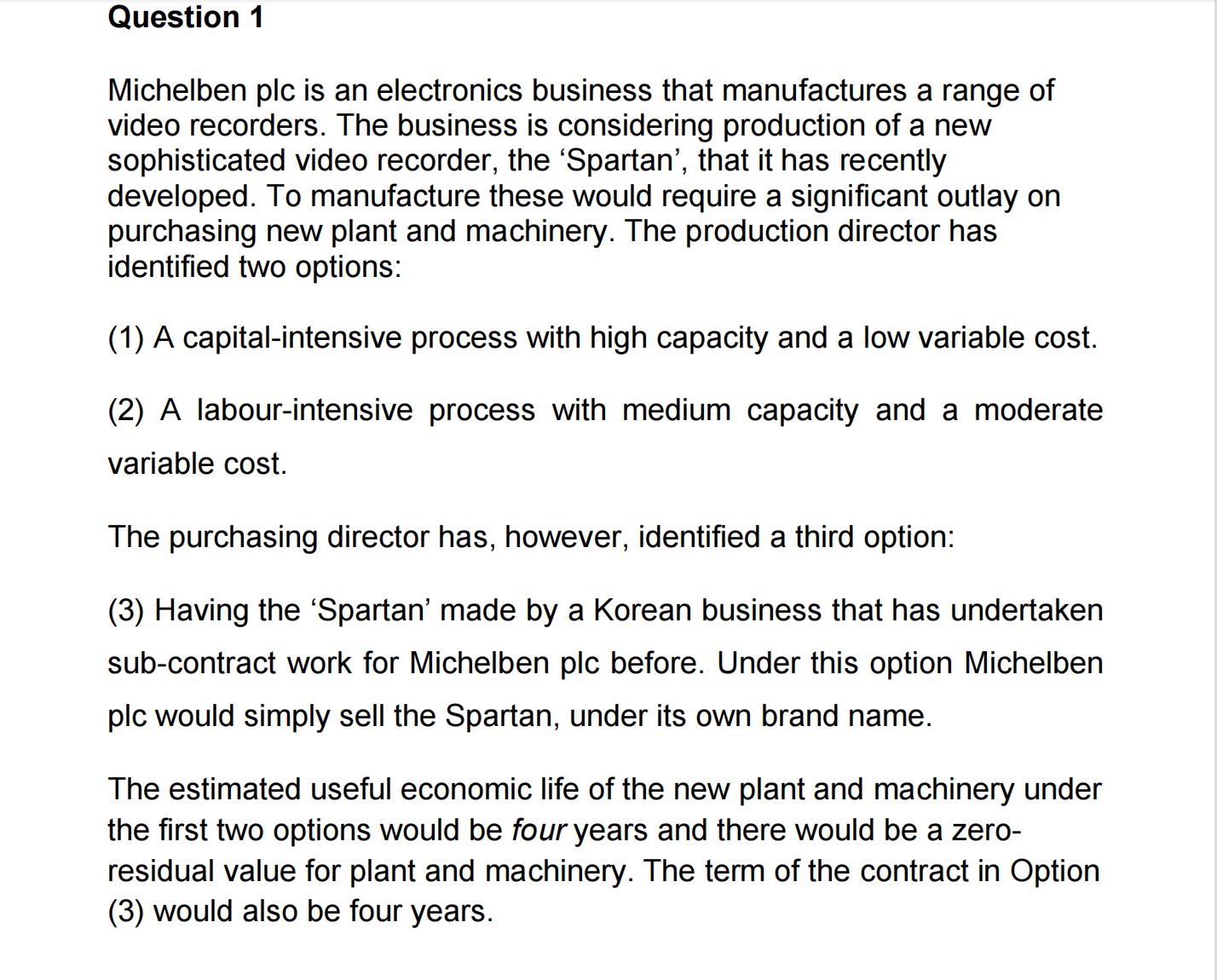

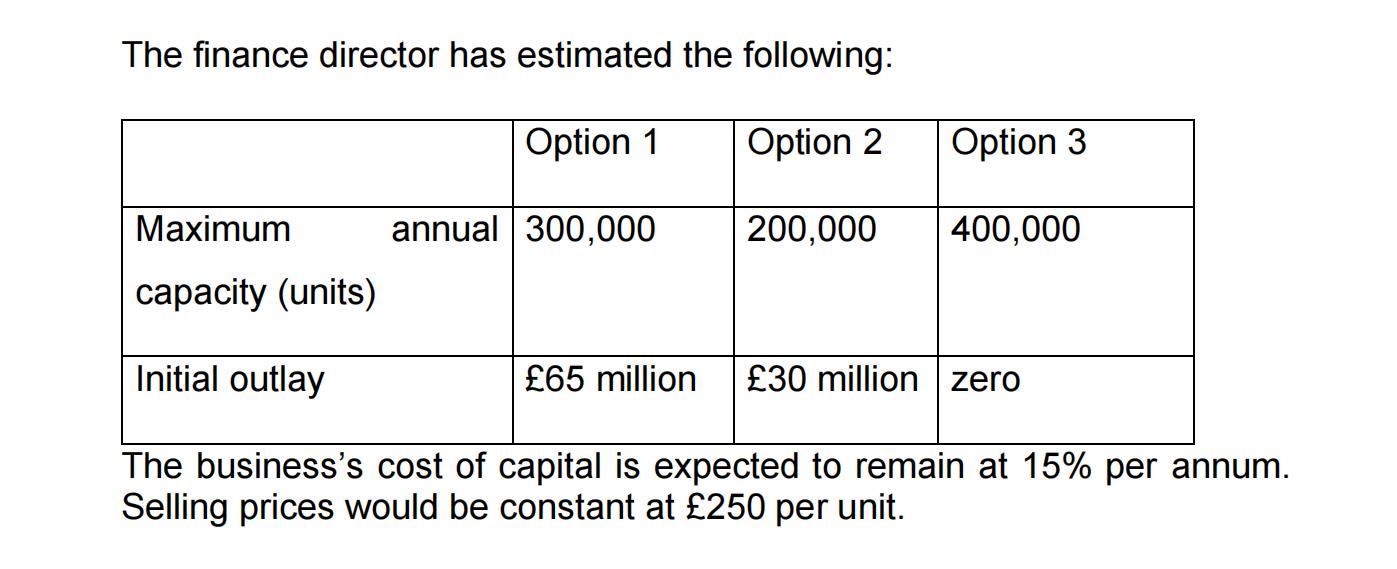

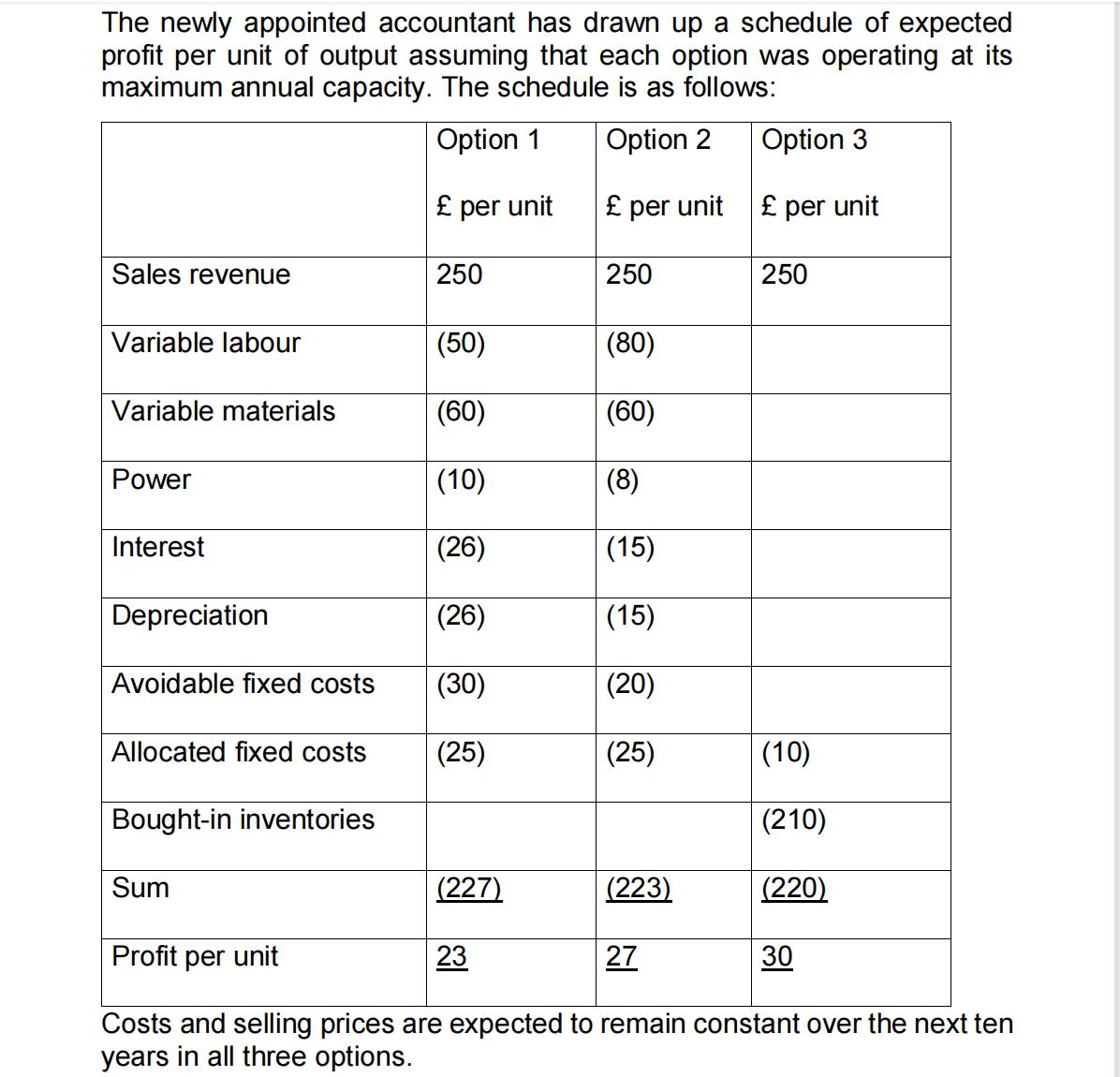

The finance director has estimated the following: The business's cost of capital is expected to remain at 15% per annum. Selling prices would be constant at 250 per unit. Michelben plc is an electronics business that manufactures a range of video recorders. The business is considering production of a new sophisticated video recorder, the 'Spartan', that it has recently developed. To manufacture these would require a significant outlay on purchasing new plant and machinery. The production director has identified two options: (1) A capital-intensive process with high capacity and a low variable cost. (2) A labour-intensive process with medium capacity and a moderate variable cost. The purchasing director has, however, identified a third option: (3) Having the 'Spartan' made by a Korean business that has undertaken sub-contract work for Michelben plc before. Under this option Michelben plc would simply sell the Spartan, under its own brand name. The estimated useful economic life of the new plant and machinery under the first two options would be four years and there would be a zeroresidual value for plant and machinery. The term of the contract in Option (3) would also be four years. The marketing director has pointed out that the accountant's assumption of using maximum output is inappropriate. She argued that the calculations should be based upon preliminary market research, which showed that expected annual sales volume would be 250,000 units, throughout the ten years. The accountant agreed that any investment appraisal of the three possibilities should correct for this error in his schedule (above) and take account of the fact that the three options do not have the same maximum output. Production would commence on 1 January next year and this would also be the date on which payment would be made for the initial outlay on capital machinery. It can be assumed that all operating cash flows will occur at year ends. Required: (a) Determine the net present value of the three options on 1 January next year. [30 MARKS] (b) Consider the other factors that the directors of Michelben plc may take into consideration before coming to a final decision on the optimal manner of supplying Spatan. [10 MARKS] The newly appointed accountant has drawn up a schedule of expected profit per unit of output assuming that each option was operating at its en years in all three options

The finance director has estimated the following: The business's cost of capital is expected to remain at 15% per annum. Selling prices would be constant at 250 per unit. Michelben plc is an electronics business that manufactures a range of video recorders. The business is considering production of a new sophisticated video recorder, the 'Spartan', that it has recently developed. To manufacture these would require a significant outlay on purchasing new plant and machinery. The production director has identified two options: (1) A capital-intensive process with high capacity and a low variable cost. (2) A labour-intensive process with medium capacity and a moderate variable cost. The purchasing director has, however, identified a third option: (3) Having the 'Spartan' made by a Korean business that has undertaken sub-contract work for Michelben plc before. Under this option Michelben plc would simply sell the Spartan, under its own brand name. The estimated useful economic life of the new plant and machinery under the first two options would be four years and there would be a zeroresidual value for plant and machinery. The term of the contract in Option (3) would also be four years. The marketing director has pointed out that the accountant's assumption of using maximum output is inappropriate. She argued that the calculations should be based upon preliminary market research, which showed that expected annual sales volume would be 250,000 units, throughout the ten years. The accountant agreed that any investment appraisal of the three possibilities should correct for this error in his schedule (above) and take account of the fact that the three options do not have the same maximum output. Production would commence on 1 January next year and this would also be the date on which payment would be made for the initial outlay on capital machinery. It can be assumed that all operating cash flows will occur at year ends. Required: (a) Determine the net present value of the three options on 1 January next year. [30 MARKS] (b) Consider the other factors that the directors of Michelben plc may take into consideration before coming to a final decision on the optimal manner of supplying Spatan. [10 MARKS] The newly appointed accountant has drawn up a schedule of expected profit per unit of output assuming that each option was operating at its en years in all three options Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started