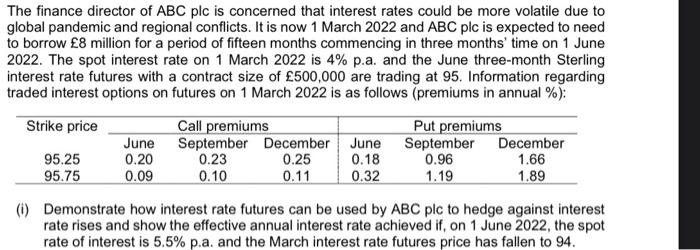

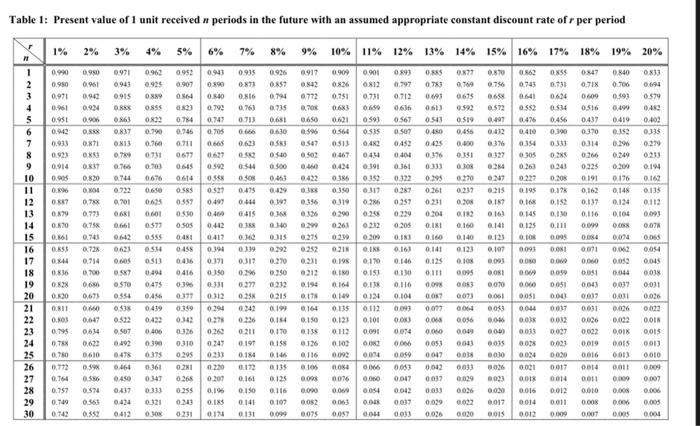

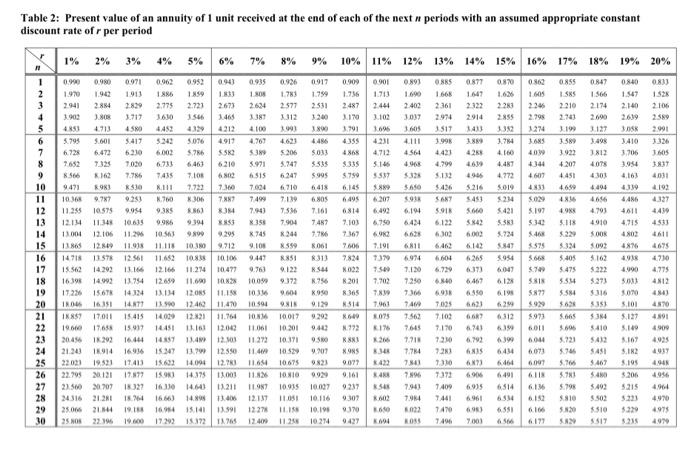

The finance director of ABC plc is concerned that interest rates could be more volatile due to global pandemic and regional conflicts. It is now 1 March 2022 and ABC plc is expected to need to borrow 8 million for a period of fifteen months commencing in three months' time on 1 June 2022. The spot interest rate on 1 March 2022 is 4% p.a. and the June three-month Sterling interest rate futures with a contract size of 500,000 are trading at 95. Information regarding traded interest options on futures on 1 March 2022 is as follows (premiums in annual %): Strike price 95.25 95.75 June 0.20 0.09 Call premiums Put premiums September December June September December 0.23 0.25 0.18 0.96 1.66 0.10 0.11 0.32 1.89 1.19 (1) Demonstrate how interest rate futures can be used by ABC plc to hedge against interest rate rises and show the effective annual interest rate achieved if, on 1 June 2022, the spot rate of interest is 5.5% p.a, and the March interest rate futures price has fallen to 94. Table 1: Present value of 1 unit received a periods in the future with an assumed appropriate constant discount rate of r per period 1% %! 2% 3% %E 4% 5% 7% 1060 LUXO 2980 0.990 0.950 0.971 1 2 3 4 5 0971 0943 0915 0.952 0.907 0.90 0961 0942 0.934 0.905 092 0.925 ON OTEN 0.943 090 0.340 0792 0935 0x13 0.16 064 0772 6090 0961 SSKO 6.30 6.50 0784 0949 9 SESO 0713 0666 0.633 OTO 0.746 0.911 SECO 0.705 0.665 ENSO 7 8 0.951 0.90 0.933 0.923 0.914 0.05 OR CSO 0.871 0.85 081 0.820 0.163 ORT OX13 0.7 0.766 0744 0.722 0.701 061 LLYD $190 6 we 1650 1610 10 EWO NO SITO 0544 oso 0.475 0.44 11 TOKO TO 0.614 OS 0559 0510 LETO 0.592 0.3 0529 0497 0400 0:42 LITO WO LINO ESCO SITO FOCO I 0.79 0.130 0.861 1998 SOSO 1 CHO 0x22 0.790 0.76 0.731 0.703 0.676 0.650 0635 0.001 0.577 0555 0534 0313 0.494 0.475 0456 0.419 0422 0.406 390 SICO NOI 0.642 0621 SO 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0917 0909 0893 085 0.870 0855 08470.840 0X13 0.859 0.42 0826 0812 0.797 073 0.769 0.756 0.743 0.731 0.706 0.004 0.794 0.751 0.731 0.712 0.001 0675 0,658 0641 0624 0.593 0.579 0935 0683 0.636 0.613 0.592 :52 0516 0.499 0480 0.651 0.650 0621 0593 0.567 050 0.519 0.491 0.476 0.456 0.437 0.419 0.40 0.630 0564 507 0.456 0:49 0.410 0.390 0370 0.152 0.542 0313 0.42 0452 0.425 0.400 0376 354 0331 0314 0.296 0.270 050 502 0467 044 0404 0196 0.151 305 0285 0.766 0.249 0.233 0.500 0.424 0.361 0.33 0303 0.24 0.363 0.243 0.325 0.300 0,463 0.432 0386 0.353 0.322 0.295 0270 0227 0.205 0.191 0.176 0.162 0350 0.287 0.261 195 0.17 0.162 0.148 0.135 0399 0.356 0319 0.26 0.231 0203 0157 016 0.152 0.137 0.134 0.112 01 0336 0.25 0229 0182 0163 0.145 0.13 0.116 0.104 0.003 140 0.29 0.261 0212 0.305 0.181 0.160 0.141 0125 0.111 0.09 0.071 0275 0.29 0.200 0.13) 0.160 0.140 0.125 0.084 0.074 0.055 0.292 0.252 0218 2.1 0.163 0.141 0123 0.107 0.093 DONI 0021 0.062 0.054 0.210 0.231 0.198 0.170 0.146 0.125 0.103 0.005 0.00 OVO 0.000 0.03 0.045 0.350 NO 0.153 10 0.111 0.051 0.051 0.044 0.038 0212 0.164 0.11 0.116 6083 2010 000 0.051 0.04) 0.037 0.001 0.215 0.178 0149 0.124 0.101 007 0073 0.061 0.051 0.00 0.017 0,031 0.036 0199 0.135 0.112 003 0077 00 0$ 0044 0037 0.031 0.06 0.003 0.154 0.150 0.123 0.101 0.06 0086 0.046 003 0.032 0.626 0.022 O.IN 0.170 0.135 0112 0.074 0049 000 0013 0.027 0.022 0,018 0,015 18 126 0102 0.053 0043 2015 0.021 0.015 001 0.146 116 0.092 0.014 0050 0.017 0.00 0.024 0020 0.016 0.013 0010 135 10 0.053 0042 0033 0021 0.017 0014 6011 . 0.076 0.000 0.007 0.023 0.018 0.014 0.011 0.007 0.00 0054 0.012 0.035 006 0.020 0.012 0.010 0.008 0.006 0.107 DOS2 0063 . 000 0.699 0.017 0014 0.011 0.00 0.00 0.005 0.099 0.075 0,097 0013 0036 0.030 2015 0.012 0.007 0.005 0.001 ISYO 0319 SOVO LICO 0.394 0.371 50 0331 ZITO ID SO 6500 57 STO 0554 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 ( 0.78% 0.773 0.75 0.74 0.72 0.714 0.700 0.686 0.675 00 0.647 0.614 0692 0.610 09 SS 0574 0.563 0.552 CICO 0:48 0:45 0.416 0416 0.396 0.377 0.150 0.343 326 0310 0.295 0.29 0277 0.25 0342 0.226 RESO 191 NEO CHOO 0X44 0.836 0.828 0.230 0.11 O.NO 0.795 0.78 0.780 0.772 0.764 0.759 0.749 0.143 0.322 0.507 0394 0275 0.262 0349 0233 TITO 1600 ERO 10 9900 store 6100 ( DO 1980 INCO OZO TO WATO 900 0.265 0340 0333 0.478 6.464 0.450 0:47 0.424 0.412 0301 0.196 0197 0.184 0.172 0.161 150 0.141 0131 0125 0.00 0.00 0629 9100 ICO 0.255 0.24 0231 SO 0.15 011 0.30 HOD 60 Table 2: Present value of an annuity of 1 unit received at the end of each of the next n periods with an assumed appropriate constant discount rate of r per period 3% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1% 2% 4% 5% 6% 7% 8% 9% 10% % 1060 CERO R 1 2 3 4 5 0.935 108 2634 1.713 2.444 0.009 1.756 2.487 3170 3.791 0885 1665 2361 0877 1641 2.322 2914 1525 2106 259 O 0.926 1.783 2577 1312 1991 4623 5.306 5.747 REY 0917 1.799 2531 1.200 1890 4436 5013 5555 0.893 1.690 2.402 30 360 4111 4564 160 2345 2.795 1274 ONS 094) 13 2.673 1465 4212 4911 SSKO 6210 62 7.300 787 1663 1517 3.995 0.870 1.626 221 2855 32 3.79 4.100 4.487 4.272 9 1095 4100 4.767 $389 5.971 SSC 1696 4231 4.712 5.145 0855 1.SXS 2210 2.70 3199 3.589 3922 4207 4.451 46.90 4846 49 4868 $335 1129 18 428 4639 4 5216 5453 4.799 409 344 4607 2012 SIS 5665 0545 LISS TOET 3 SAO 1326 16 337 4031 4192 327 4439 6710 6105 CERT MCP $426 SANT 9 6207 1165 5415 6805 7161 7.487 6.145 6495 6814 7.103 1566 (98 165 95 NOX ES SON 5.197 530 6.122 815 6.750 6962 TEST II DOC 7.06 7.596 7904 R344 8599 8851 0.122 372 7.191 $575 4675 0.99 0.9800971 0962 0.952 1.970 1.90 1.913 1886 1159 2941 2.884 2829 2.775 2.721 1903 . 3.717 3546 4851 4.713 4452 4.33 5.795 3.417 5243 5.076 6.725 6.472 6210 6002 5786 7652 7323 7030 6463 566 X2 7.76 1435 9491 9 RS 111 7.722 9353 M70 306 11.255 10.575 9.35 12.114 1134 10.635 9.96 9394 13004 12.106 11.29 10 SA 990 I1 11.118 10:30 14718 11578 12.561 1142 IONIS 15.562 14.292 13.166 12.166 11.214 16398 14.99 13.754 1265 11.69 1722 1568 14124 13.114 12. ONS IRO 16151 14877 1190 12.40 IKAS 17011 15 415 14000 12:21 1765 1523714451 20.454 1 292 1457 13.41 21.30 1914 16936 15347 13. 22023 19.521 15.632 14.094 22.795 2121 22.500 30707 127 16.30 14.6 24.316 21201 18164 14.898 25.02.14 1918 1694 25 NOS 19.00 17.292 9.295 9.712 10.105 10477 TON 6402 6604 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 5668 5.72 3842 6000 6.142 6.265 3) 6467 650 4710 4.775 08470840 1566 1.547 2.174 2.140 2690 2.619 127 BOK 3498 3410 3812 3.706 4078 3.954 4.163 4.494 464 446 4.793 4611 4910 4.715 SOO 4802 3092 4X76 5162 493 $ 232 4.990 5.273 5011 5070 5.353 5.101 $314 5.127 410 5.149 5412 167 $451 SIZ 5467 105 5.206 $492 5.215 5.502 $ $10 $229 SSIT 5229 $14 5.405 5.475 5514 $.584 8311 R$84 26 K.950 9129 9292 9400 7379 7:50 7.702 789 7.91 8022 8201 R 365 NISS 7.004 7499 7.84) 355 745 9.108 9447 9.763 1009 1036 10594 TOM 1106 11272 114 116 11M 1197 12137 12214 12400 $ 214 $421 533 5.724 53 5954 6041 612 6198 629 0312 6. 190 6.44 6.464 6491 577 484) 096 S6 6.194 6424 66 6811 6.974 7.120 7.250 7366 7462 7.562 7645 7.711 7.784 700 796 7.943 7.984 22 6340 6938 7025 7102 7.170 PIEN CINT ( OUT 165 6265 395 5995 FLOT $971 0961 ISIS TI 176 10017 10 201 10 11 10 60 N772 RS X 95 H6 OSO 1109 662 6741 6.792 615 WEY OTEL 11.470 11.764 12040 12.103 12.50 12.90 11001 13.211 13.00 13.591 165 096 5.721 $705 $16 8.34 CILI 4900 4995 4934 49 4946 723 7310 54901 CNY 19 14175 8488 IN ONS 10.NO 10935 9.2017 0823 992 10.00 10.116 10.190 10 214 9.161 9239 9.307 6044 6093 6.097 6118 614 615 6 166 6.177 6906 695 6514 RA 1011 111 1969 7409 7441 7410 744 5.795 5810 $20 SN OLCE IPISI TUESI 60 2004 691 7003 6351 65 4970 4975 4919 11.25 9427 STES The finance director of ABC plc is concerned that interest rates could be more volatile due to global pandemic and regional conflicts. It is now 1 March 2022 and ABC plc is expected to need to borrow 8 million for a period of fifteen months commencing in three months' time on 1 June 2022. The spot interest rate on 1 March 2022 is 4% p.a. and the June three-month Sterling interest rate futures with a contract size of 500,000 are trading at 95. Information regarding traded interest options on futures on 1 March 2022 is as follows (premiums in annual %): Strike price 95.25 95.75 June 0.20 0.09 Call premiums Put premiums September December June September December 0.23 0.25 0.18 0.96 1.66 0.10 0.11 0.32 1.89 1.19 (1) Demonstrate how interest rate futures can be used by ABC plc to hedge against interest rate rises and show the effective annual interest rate achieved if, on 1 June 2022, the spot rate of interest is 5.5% p.a, and the March interest rate futures price has fallen to 94. Table 1: Present value of 1 unit received a periods in the future with an assumed appropriate constant discount rate of r per period 1% %! 2% 3% %E 4% 5% 7% 1060 LUXO 2980 0.990 0.950 0.971 1 2 3 4 5 0971 0943 0915 0.952 0.907 0.90 0961 0942 0.934 0.905 092 0.925 ON OTEN 0.943 090 0.340 0792 0935 0x13 0.16 064 0772 6090 0961 SSKO 6.30 6.50 0784 0949 9 SESO 0713 0666 0.633 OTO 0.746 0.911 SECO 0.705 0.665 ENSO 7 8 0.951 0.90 0.933 0.923 0.914 0.05 OR CSO 0.871 0.85 081 0.820 0.163 ORT OX13 0.7 0.766 0744 0.722 0.701 061 LLYD $190 6 we 1650 1610 10 EWO NO SITO 0544 oso 0.475 0.44 11 TOKO TO 0.614 OS 0559 0510 LETO 0.592 0.3 0529 0497 0400 0:42 LITO WO LINO ESCO SITO FOCO I 0.79 0.130 0.861 1998 SOSO 1 CHO 0x22 0.790 0.76 0.731 0.703 0.676 0.650 0635 0.001 0.577 0555 0534 0313 0.494 0.475 0456 0.419 0422 0.406 390 SICO NOI 0.642 0621 SO 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0917 0909 0893 085 0.870 0855 08470.840 0X13 0.859 0.42 0826 0812 0.797 073 0.769 0.756 0.743 0.731 0.706 0.004 0.794 0.751 0.731 0.712 0.001 0675 0,658 0641 0624 0.593 0.579 0935 0683 0.636 0.613 0.592 :52 0516 0.499 0480 0.651 0.650 0621 0593 0.567 050 0.519 0.491 0.476 0.456 0.437 0.419 0.40 0.630 0564 507 0.456 0:49 0.410 0.390 0370 0.152 0.542 0313 0.42 0452 0.425 0.400 0376 354 0331 0314 0.296 0.270 050 502 0467 044 0404 0196 0.151 305 0285 0.766 0.249 0.233 0.500 0.424 0.361 0.33 0303 0.24 0.363 0.243 0.325 0.300 0,463 0.432 0386 0.353 0.322 0.295 0270 0227 0.205 0.191 0.176 0.162 0350 0.287 0.261 195 0.17 0.162 0.148 0.135 0399 0.356 0319 0.26 0.231 0203 0157 016 0.152 0.137 0.134 0.112 01 0336 0.25 0229 0182 0163 0.145 0.13 0.116 0.104 0.003 140 0.29 0.261 0212 0.305 0.181 0.160 0.141 0125 0.111 0.09 0.071 0275 0.29 0.200 0.13) 0.160 0.140 0.125 0.084 0.074 0.055 0.292 0.252 0218 2.1 0.163 0.141 0123 0.107 0.093 DONI 0021 0.062 0.054 0.210 0.231 0.198 0.170 0.146 0.125 0.103 0.005 0.00 OVO 0.000 0.03 0.045 0.350 NO 0.153 10 0.111 0.051 0.051 0.044 0.038 0212 0.164 0.11 0.116 6083 2010 000 0.051 0.04) 0.037 0.001 0.215 0.178 0149 0.124 0.101 007 0073 0.061 0.051 0.00 0.017 0,031 0.036 0199 0.135 0.112 003 0077 00 0$ 0044 0037 0.031 0.06 0.003 0.154 0.150 0.123 0.101 0.06 0086 0.046 003 0.032 0.626 0.022 O.IN 0.170 0.135 0112 0.074 0049 000 0013 0.027 0.022 0,018 0,015 18 126 0102 0.053 0043 2015 0.021 0.015 001 0.146 116 0.092 0.014 0050 0.017 0.00 0.024 0020 0.016 0.013 0010 135 10 0.053 0042 0033 0021 0.017 0014 6011 . 0.076 0.000 0.007 0.023 0.018 0.014 0.011 0.007 0.00 0054 0.012 0.035 006 0.020 0.012 0.010 0.008 0.006 0.107 DOS2 0063 . 000 0.699 0.017 0014 0.011 0.00 0.00 0.005 0.099 0.075 0,097 0013 0036 0.030 2015 0.012 0.007 0.005 0.001 ISYO 0319 SOVO LICO 0.394 0.371 50 0331 ZITO ID SO 6500 57 STO 0554 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 ( 0.78% 0.773 0.75 0.74 0.72 0.714 0.700 0.686 0.675 00 0.647 0.614 0692 0.610 09 SS 0574 0.563 0.552 CICO 0:48 0:45 0.416 0416 0.396 0.377 0.150 0.343 326 0310 0.295 0.29 0277 0.25 0342 0.226 RESO 191 NEO CHOO 0X44 0.836 0.828 0.230 0.11 O.NO 0.795 0.78 0.780 0.772 0.764 0.759 0.749 0.143 0.322 0.507 0394 0275 0.262 0349 0233 TITO 1600 ERO 10 9900 store 6100 ( DO 1980 INCO OZO TO WATO 900 0.265 0340 0333 0.478 6.464 0.450 0:47 0.424 0.412 0301 0.196 0197 0.184 0.172 0.161 150 0.141 0131 0125 0.00 0.00 0629 9100 ICO 0.255 0.24 0231 SO 0.15 011 0.30 HOD 60 Table 2: Present value of an annuity of 1 unit received at the end of each of the next n periods with an assumed appropriate constant discount rate of r per period 3% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1% 2% 4% 5% 6% 7% 8% 9% 10% % 1060 CERO R 1 2 3 4 5 0.935 108 2634 1.713 2.444 0.009 1.756 2.487 3170 3.791 0885 1665 2361 0877 1641 2.322 2914 1525 2106 259 O 0.926 1.783 2577 1312 1991 4623 5.306 5.747 REY 0917 1.799 2531 1.200 1890 4436 5013 5555 0.893 1.690 2.402 30 360 4111 4564 160 2345 2.795 1274 ONS 094) 13 2.673 1465 4212 4911 SSKO 6210 62 7.300 787 1663 1517 3.995 0.870 1.626 221 2855 32 3.79 4.100 4.487 4.272 9 1095 4100 4.767 $389 5.971 SSC 1696 4231 4.712 5.145 0855 1.SXS 2210 2.70 3199 3.589 3922 4207 4.451 46.90 4846 49 4868 $335 1129 18 428 4639 4 5216 5453 4.799 409 344 4607 2012 SIS 5665 0545 LISS TOET 3 SAO 1326 16 337 4031 4192 327 4439 6710 6105 CERT MCP $426 SANT 9 6207 1165 5415 6805 7161 7.487 6.145 6495 6814 7.103 1566 (98 165 95 NOX ES SON 5.197 530 6.122 815 6.750 6962 TEST II DOC 7.06 7.596 7904 R344 8599 8851 0.122 372 7.191 $575 4675 0.99 0.9800971 0962 0.952 1.970 1.90 1.913 1886 1159 2941 2.884 2829 2.775 2.721 1903 . 3.717 3546 4851 4.713 4452 4.33 5.795 3.417 5243 5.076 6.725 6.472 6210 6002 5786 7652 7323 7030 6463 566 X2 7.76 1435 9491 9 RS 111 7.722 9353 M70 306 11.255 10.575 9.35 12.114 1134 10.635 9.96 9394 13004 12.106 11.29 10 SA 990 I1 11.118 10:30 14718 11578 12.561 1142 IONIS 15.562 14.292 13.166 12.166 11.214 16398 14.99 13.754 1265 11.69 1722 1568 14124 13.114 12. ONS IRO 16151 14877 1190 12.40 IKAS 17011 15 415 14000 12:21 1765 1523714451 20.454 1 292 1457 13.41 21.30 1914 16936 15347 13. 22023 19.521 15.632 14.094 22.795 2121 22.500 30707 127 16.30 14.6 24.316 21201 18164 14.898 25.02.14 1918 1694 25 NOS 19.00 17.292 9.295 9.712 10.105 10477 TON 6402 6604 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 5668 5.72 3842 6000 6.142 6.265 3) 6467 650 4710 4.775 08470840 1566 1.547 2.174 2.140 2690 2.619 127 BOK 3498 3410 3812 3.706 4078 3.954 4.163 4.494 464 446 4.793 4611 4910 4.715 SOO 4802 3092 4X76 5162 493 $ 232 4.990 5.273 5011 5070 5.353 5.101 $314 5.127 410 5.149 5412 167 $451 SIZ 5467 105 5.206 $492 5.215 5.502 $ $10 $229 SSIT 5229 $14 5.405 5.475 5514 $.584 8311 R$84 26 K.950 9129 9292 9400 7379 7:50 7.702 789 7.91 8022 8201 R 365 NISS 7.004 7499 7.84) 355 745 9.108 9447 9.763 1009 1036 10594 TOM 1106 11272 114 116 11M 1197 12137 12214 12400 $ 214 $421 533 5.724 53 5954 6041 612 6198 629 0312 6. 190 6.44 6.464 6491 577 484) 096 S6 6.194 6424 66 6811 6.974 7.120 7.250 7366 7462 7.562 7645 7.711 7.784 700 796 7.943 7.984 22 6340 6938 7025 7102 7.170 PIEN CINT ( OUT 165 6265 395 5995 FLOT $971 0961 ISIS TI 176 10017 10 201 10 11 10 60 N772 RS X 95 H6 OSO 1109 662 6741 6.792 615 WEY OTEL 11.470 11.764 12040 12.103 12.50 12.90 11001 13.211 13.00 13.591 165 096 5.721 $705 $16 8.34 CILI 4900 4995 4934 49 4946 723 7310 54901 CNY 19 14175 8488 IN ONS 10.NO 10935 9.2017 0823 992 10.00 10.116 10.190 10 214 9.161 9239 9.307 6044 6093 6.097 6118 614 615 6 166 6.177 6906 695 6514 RA 1011 111 1969 7409 7441 7410 744 5.795 5810 $20 SN OLCE IPISI TUESI 60 2004 691 7003 6351 65 4970 4975 4919 11.25 9427 STES