Question

The finance director of Park plc is preparing financial plans and different departments have submitted a number of capital investment applications. The managing director has

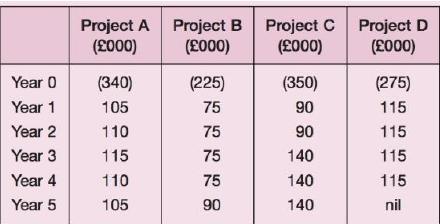

The finance director of Park plc is preparing financial plans and different departments have submitted a number of capital investment applications. The managing director has said that no more than £1m is available for new investment projects. Cash flow forecasts from the capital investment applications are as follows.

The cost of capital of Park plc is 15 per cent per year.

The cost of capital of Park plc is 15 per cent per year.

(a) Determine the optimum investment schedule and the net present value of the optimum investment schedule, if investment projects are divisible but not repeatable.

(b) Determine the optimum investment schedule and the net present value of the optimum investment schedule, if investment projects are not divisible and not repeatable.

(c) Discuss the reasons why the managing director of Park plc may have limited the funds available for new investment projects at the start of the next financial year, even if this results in the rejection of projects which may increase the value of the company

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Project A (2000) (340) 105 110 115 110 105 Project B (000) (225) 75 75 75 75 90 Project C (2000) (350) 90 90 140 140 140 Project D (000) (275) 115 115 115 115 nil

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Net present values of the different projects Proj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started