Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Financial Advisor's Investment Case A Speculator's Choices Cosima Wagner is an optimist who likes to specu- late. She enjoys watching prices change rapidly and

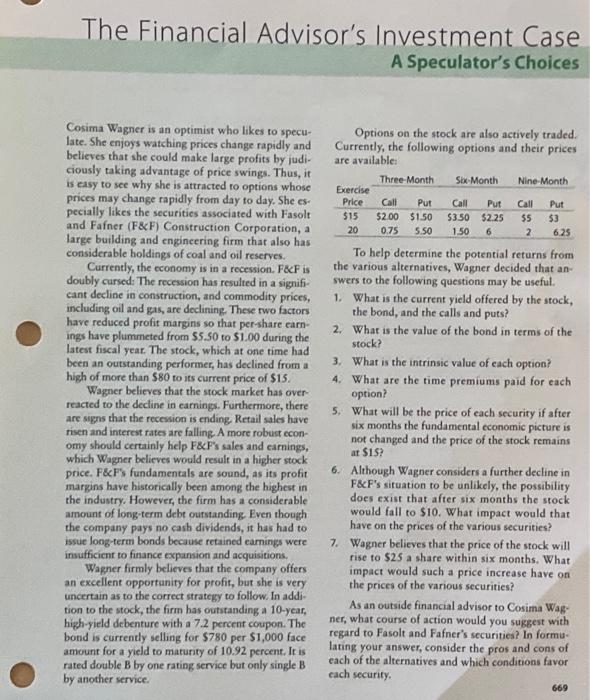

The Financial Advisor's Investment Case A Speculator's Choices Cosima Wagner is an optimist who likes to specu- late. She enjoys watching prices change rapidly and believes that she could make large profits by judi- ciously taking advantage of price swings. Thus, it is easy to see why she is attracted to options whose prices may change rapidly from day to day. She es- pecially likes the securities associated with Fasolt and Fafner (F&F) Construction Corporation, a large building and engineering firm that also has considerable holdings of coal and oil reserves. Currently, the economy is in a recession, F&F is doubly cursed: The recession has resulted in a signifi- cant decline in construction, and commodity prices, including oil and gas, are declining. These two factors have reduced profit margins so that per-share earn- ings have plummeted from $5.50 to $1.00 during the latest fiscal year. The stock, which at one time had been an outstanding performer, has declined from a high of more than $80 to its current price of $15. Wagner believes that the stock market has over- reacted to the decline in earnings. Furthermore, there are signs that the recession is ending. Retail sales have risen and interest rates are falling. A more robust econ- omy should certainly I F&F's sales and earnings, which Wagner believes would result in a higher stock price. F&F's fundamentals are sound, as its profit margins have historically been among the highest in the industry. However, the firm has a considerable amount of long-term debt outstanding. Even though the company pays no cash dividends, it has had to issue long-term bonds because retained earnings were insufficient to finance expansion and acquisitions. Wagner firmly believes that the company offers an excellent opportunity for profit, but she is very uncertain as to the correct strategy to follow. In addi- tion to the stock, the firm has outstanding a 10-year, high-yield debenture with a 7.2 percent coupon. The bond is currently selling for $780 per $1,000 face amount for a yield to maturity of 10.92 percent. It is rated double B by one rating service but only single B by another service. Options on the stock are also actively traded. Currently, the following options and their prices are available: Three-Month Exercise Price Call Put $15 $2.00 $1.50 20 Six-Month Nine-Month Call Put Call Put $3.50 $2.25 $5 $3 0.75 5,50 1.50 6 2 6.25 To help determine the potential returns from the various alternatives, Wagner decided that an- swers to the following questions may be useful. 1. What is the current yield offered by the stock, the bond, and the calls and puts? 2. What is the value of the bond in terms of the stock? 3. What is the intrinsic value of each option? 4. What are the time premiums paid for each option? 5. What will be the price of each security if after six months the fundamental economic picture is not changed and the price of the stock remains at $15? 6. Although Wagner considers a further decline in F&F's situation to be unlikely, the possibility does exist that after six months the stock would fall to $10. What impact would that have on the prices of the various securities? 7. Wagner believes that the price of the stock will rise to $25 a share within six months. What impact would such a price increase have on the prices of the various securities? As an outside financial advisor to Cosima Wag- ner, what course of action would you suggest with regard to Fasolt and Fafner's securities? In formu- lating your answer, consider the pros and cons of each of the alternatives and which conditions favor each security. 669

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started