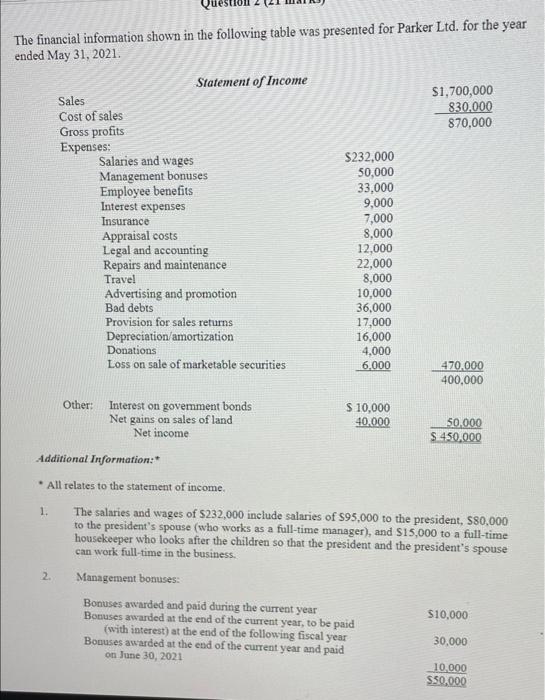

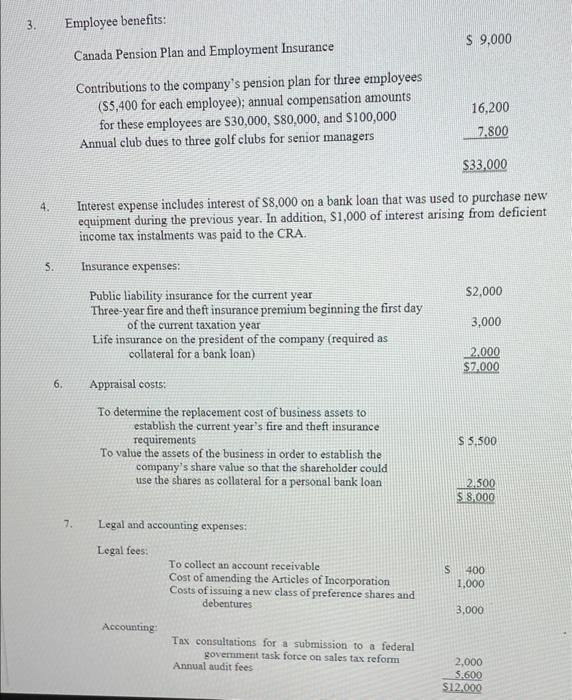

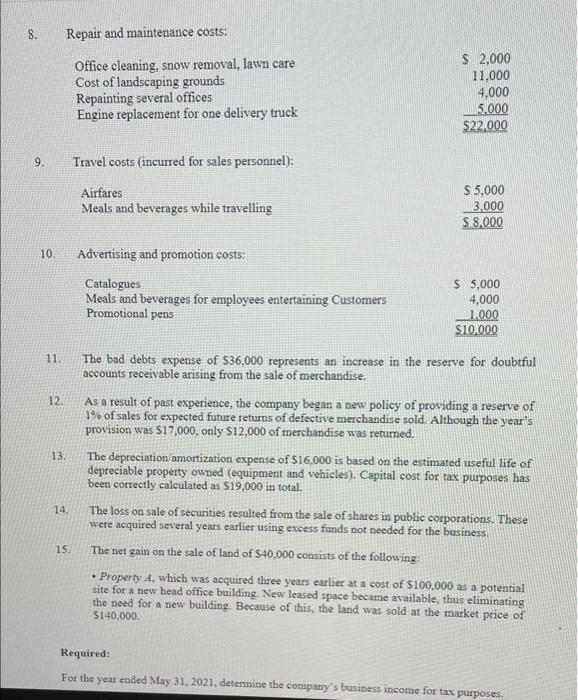

The financial information shown in the following table was presented for Parker Ltd. for the year ended May 31, 2021 $1,700,000 830.000 870,000 Statement of Income Sales Cost of sales Gross profits Expenses: Salaries and wages Management bonuses Employee benefits Interest expenses Insurance Appraisal costs Legal and accounting Repairs and maintenance Trave! Advertising and promotion Bad debts Provision for sales returns Depreciation/amortization Donations Loss on sale of marketable securities S232,000 50,000 33,000 9,000 7,000 8,000 12,000 22,000 8,000 10,000 36,000 17,000 16,000 4,000 6.000 470.000 400,000 Other: Interest on govemment bonds S 10,000 Net gains on sales of land 40.000 50.000 Net income S 450.000 Additional Information: All relates to the statement of income. 1. The salaries and wages of S232,000 include salaries of $95,000 to the president, $80,000 to the president's spouse (who works as a full-time manager), and $15,000 to a full-time housekeeper who looks after the children so that the president and the president's spouse can work full-time in the business. 2. Management bonuses: Bonuses awarded and paid during the current year $10,000 Bonuses awarded at the end of the current year, to be paid (with interest) at the end of the following fiscal year 30.000 Bonuses awarded at the end of the current year and paid on June 30, 2021 10.000 550.000 3 Employee benefits: $ 9,000 Canada Pension Plan and Employment Insurance Contributions to the company's pension plan for three employees (55,400 for each employee); annual compensation amounts for these employees are $30,000, S80,000, and $100,000 Annual club dues to three golf clubs for senior managers 16,200 7.800 $33,000 4. Interest expense includes interest of $8,000 on a bank loan that was used to purchase new equipment during the previous year. In addition, $1,000 of interest arising from deficient income tax instalments was paid to the CRA. S. Insurance expenses: $2,000 Public liability insurance for the current year Three-year fire and theft insurance premium beginning the first day of the current taxation year Life insurance on the president of the company (required as collateral for a bank loan) 3,000 2.000 $7.000 6. Appraisal costs: To determine the replacement cost of business assets to establish the current year's fire and theft insurance requirements To value the assets of the business in order to establish the company's share value so that the shareholder could use the shares as collateral for a personal bank loan S 5.500 2,500 5.8.000 7. Legal and accounting expenses: Legal fees: S To collect an account receivable Cost of amending the Articles of Incorporation Costs of issuing a new class of preference shares and debentures 400 1,000 3,000 Accounting Tax consultations for a submission to a federal government task force on sales tax reform Annual audit fees 2,000 5.600 S12.000 8. Repair and maintenance costs: Office cleaning, snow removal, lawn care Cost of landscaping grounds Repainting several offices Engine replacement for one delivery truck S2,000 11,000 4,000 5.000 $22.000 9 Travel costs (incurred for sales personnel): Airfares Meals and beverages while travelling $ 5.000 3.000 $ 8,000 10. Advertising and promotion costs: Catalogues Meals and beverages for employees entertaining Customers Promotional pens $ 5,000 4,000 1,000 $10,000 11. 12. 13. The bad debts expense of $36,000 represents an increase in the reserve for doubtful accounts receivable arising from the sale of merchandise. As a result of past experience, the company began a new policy of providing a reserve of 1% of sales for expected future returns of defective merchandise sold. Although the year's provision was $17,000, only $12,000 of merchandise was returned. The depreciation amortization expense of S16,000 is based on the estimated useful life of depreciable property owned (equipment and vehicles). Capital cost for tax purposes has been correctly calculated as $19,000 in total. The loss on sale of securities resulted from the sale of shares in public corporations. These were acquired several years earlier using excess funds not needed for the business The net gain on the sale of land of S40,000 consists of the following Property A, which was acquired three years earlier at a cost of $100,000 as a potential site for a new head office building. New leased space became available, thus eliminating the need for a new building. Because of this, the land was sold at the market price of $140,000 14. 15. Required: For the year ended May 31, 2021, determine the company's business income for tax purposes. The financial information shown in the following table was presented for Parker Ltd. for the year ended May 31, 2021 $1,700,000 830.000 870,000 Statement of Income Sales Cost of sales Gross profits Expenses: Salaries and wages Management bonuses Employee benefits Interest expenses Insurance Appraisal costs Legal and accounting Repairs and maintenance Trave! Advertising and promotion Bad debts Provision for sales returns Depreciation/amortization Donations Loss on sale of marketable securities S232,000 50,000 33,000 9,000 7,000 8,000 12,000 22,000 8,000 10,000 36,000 17,000 16,000 4,000 6.000 470.000 400,000 Other: Interest on govemment bonds S 10,000 Net gains on sales of land 40.000 50.000 Net income S 450.000 Additional Information: All relates to the statement of income. 1. The salaries and wages of S232,000 include salaries of $95,000 to the president, $80,000 to the president's spouse (who works as a full-time manager), and $15,000 to a full-time housekeeper who looks after the children so that the president and the president's spouse can work full-time in the business. 2. Management bonuses: Bonuses awarded and paid during the current year $10,000 Bonuses awarded at the end of the current year, to be paid (with interest) at the end of the following fiscal year 30.000 Bonuses awarded at the end of the current year and paid on June 30, 2021 10.000 550.000 3 Employee benefits: $ 9,000 Canada Pension Plan and Employment Insurance Contributions to the company's pension plan for three employees (55,400 for each employee); annual compensation amounts for these employees are $30,000, S80,000, and $100,000 Annual club dues to three golf clubs for senior managers 16,200 7.800 $33,000 4. Interest expense includes interest of $8,000 on a bank loan that was used to purchase new equipment during the previous year. In addition, $1,000 of interest arising from deficient income tax instalments was paid to the CRA. S. Insurance expenses: $2,000 Public liability insurance for the current year Three-year fire and theft insurance premium beginning the first day of the current taxation year Life insurance on the president of the company (required as collateral for a bank loan) 3,000 2.000 $7.000 6. Appraisal costs: To determine the replacement cost of business assets to establish the current year's fire and theft insurance requirements To value the assets of the business in order to establish the company's share value so that the shareholder could use the shares as collateral for a personal bank loan S 5.500 2,500 5.8.000 7. Legal and accounting expenses: Legal fees: S To collect an account receivable Cost of amending the Articles of Incorporation Costs of issuing a new class of preference shares and debentures 400 1,000 3,000 Accounting Tax consultations for a submission to a federal government task force on sales tax reform Annual audit fees 2,000 5.600 S12.000 8. Repair and maintenance costs: Office cleaning, snow removal, lawn care Cost of landscaping grounds Repainting several offices Engine replacement for one delivery truck S2,000 11,000 4,000 5.000 $22.000 9 Travel costs (incurred for sales personnel): Airfares Meals and beverages while travelling $ 5.000 3.000 $ 8,000 10. Advertising and promotion costs: Catalogues Meals and beverages for employees entertaining Customers Promotional pens $ 5,000 4,000 1,000 $10,000 11. 12. 13. The bad debts expense of $36,000 represents an increase in the reserve for doubtful accounts receivable arising from the sale of merchandise. As a result of past experience, the company began a new policy of providing a reserve of 1% of sales for expected future returns of defective merchandise sold. Although the year's provision was $17,000, only $12,000 of merchandise was returned. The depreciation amortization expense of S16,000 is based on the estimated useful life of depreciable property owned (equipment and vehicles). Capital cost for tax purposes has been correctly calculated as $19,000 in total. The loss on sale of securities resulted from the sale of shares in public corporations. These were acquired several years earlier using excess funds not needed for the business The net gain on the sale of land of S40,000 consists of the following Property A, which was acquired three years earlier at a cost of $100,000 as a potential site for a new head office building. New leased space became available, thus eliminating the need for a new building. Because of this, the land was sold at the market price of $140,000 14. 15. Required: For the year ended May 31, 2021, determine the company's business income for tax purposes