Answered step by step

Verified Expert Solution

Question

1 Approved Answer

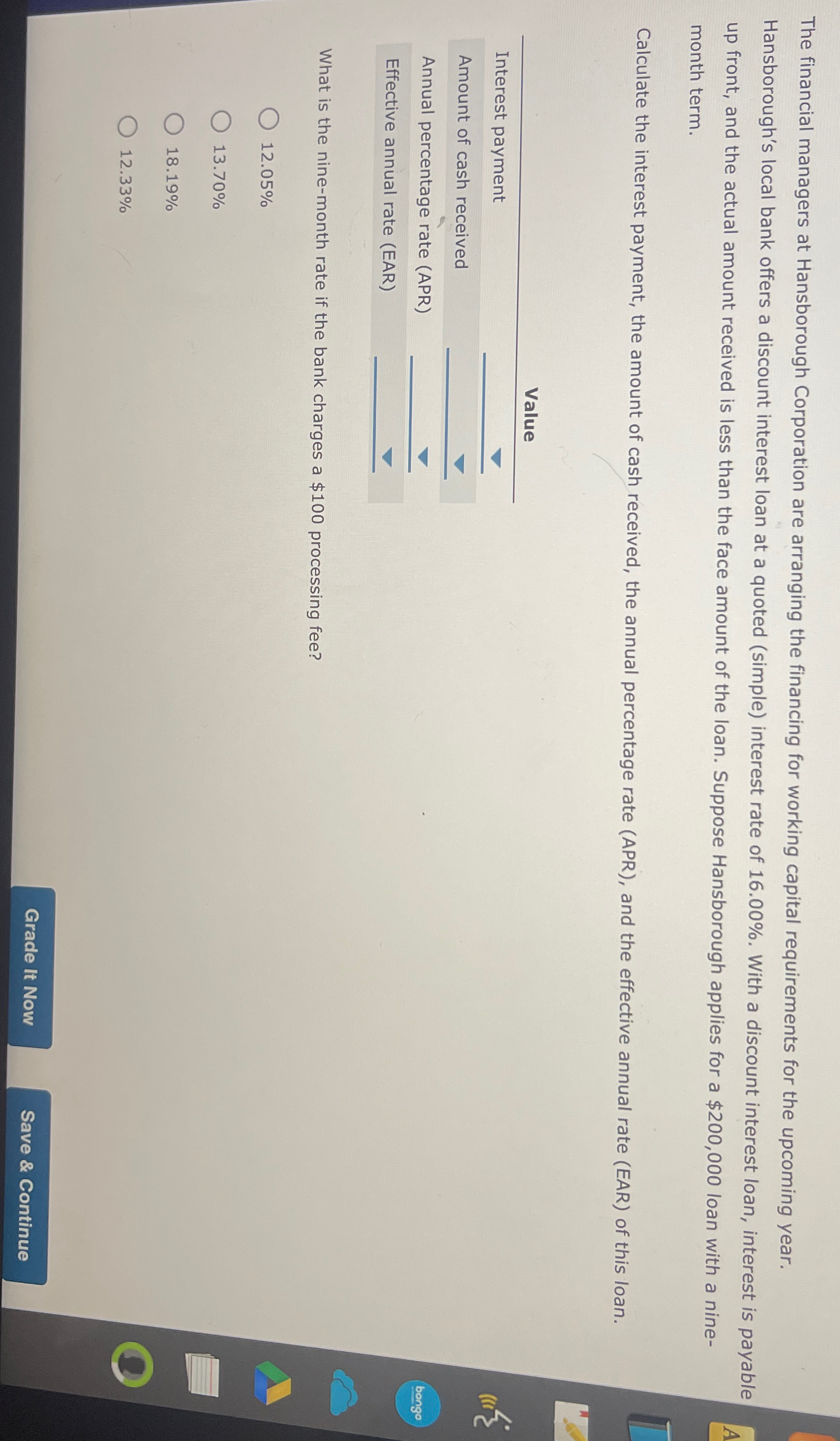

The financial managers at Hansborough Corporation are arranging the financing for working capital requirements for the upcoming year. Hansborough s local bank offers a discount

The financial managers at Hansborough Corporation are arranging

the financing for working capital requirements for the upcoming

year. Hansboroughs local bank offers a discount interest loan at a

quoted simple interest rate of With a discount interest

loan, interest is payable up front, and the actual amount received

is less than the face amount of the loan. Suppose Hansborough

applies for a $ loan with a ninemonth term.Calculate the interest payment, the amount of cash received, the

annual percentage rate APR and the effective annual rate EAR

of this loan.ValueWhat is the ninemonth rate if the bank charges a $

processing fee?abcd

The financial managers at Hansborough Corporation are arranging the financing for working capital requirements for the upcoming year.

Hansborough's local bank offers a discount interest loan at a quoted simple interest rate of With a discount interest loan, interest is payable up front, and the actual amount received is less than the face amount of the loan. Suppose Hansborough applies for a $ loan with a ninemonth term.

Calculate the interest payment, the amount of cash received, the annual percentage rate APR and the effective annual rate EAR of this loan.

Value

Interest payment

tableAmount of cash received,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started