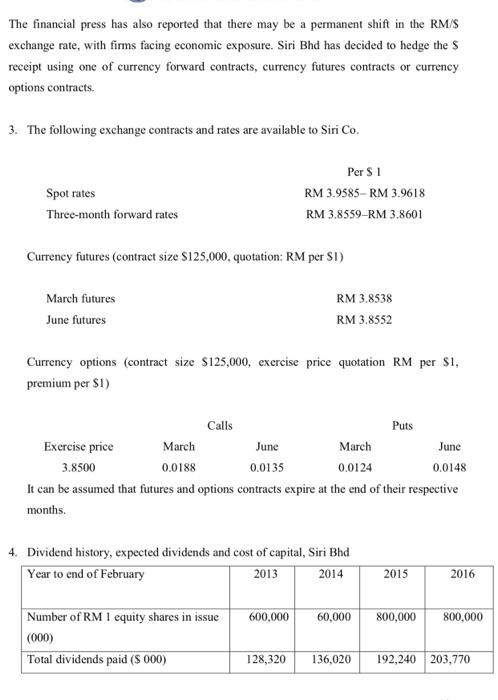

The financial press has also reported that there may be a permanent shift in the RM/$ exchange rate, with firms facing economic exposure. Siri Bhd has decided to hedge the $ receipt using one of currency forward contracts, currency futures contracts or currency options contracts.

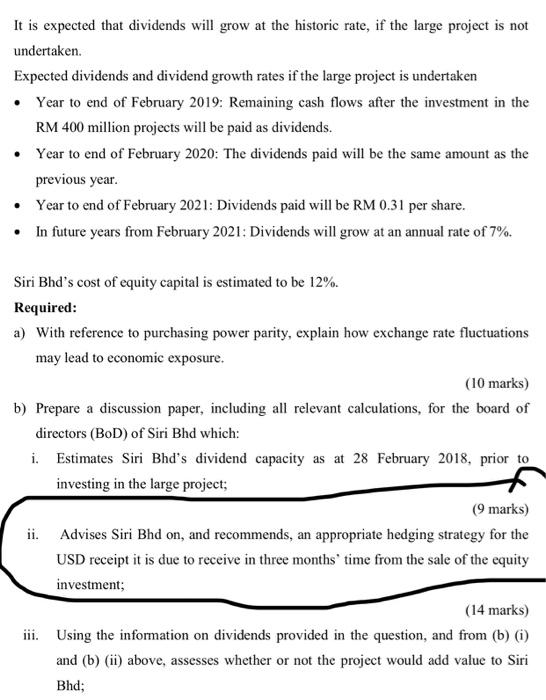

The financial press has also reported that there may be a permanent shift in the RM/S exchange rate, with firms facing economic exposure. Siri Bhd has decided to hedge the receipt using one of currency forward contracts, currency futures contracts or currency options contracts. 3. The following exchange contracts and rates are available to Siri Co. Spot rates Three-month forward rates Per $1 RM 3.9585- RM 3.9618 RM 3.8559-RM 3.8601 Currency futures (contract size S125,000. quotation: RM per S1) March futures June futures RM 3.8538 RM 3.8552 Currency options (contract size $125,000, exercise price quotation RM per si, premium per S1) Puts June Calls Exercise price March June March 3.8500 0.0188 0.0135 0.0124 It can be assumed that futures and options contracts expire at the end of their respective months. 0.0148 4. Dividend history, expected dividends and cost of capital, Siri Bhd Year to end of February 2013 2014 2015 2016 600,000 60,000 800,000 800,000 Number of RM 1 equity shares in issue (000) Total dividends paid (8 000) 128,320 136,020 192,240 203,770 It is expected that dividends will grow at the historic rate, if the large project is not undertaken. Expected dividends and dividend growth rates if the large project is undertaken Year to end of February 2019: Remaining cash flows after the investment in the RM 400 million projects will be paid as dividends. Year to end of February 2020: The dividends paid will be the same amount as the previous year. Year to end of February 2021: Dividends paid will be RM 0.31 per share. In future years from February 2021: Dividends will grow at an annual rate of 7%. Siri Bhd's cost of equity capital is estimated to be 12%. Required: a) With reference to purchasing power parity, explain how exchange rate fluctuations may lead to economic exposure. (10 marks) b) Prepare a discussion paper, including all relevant calculations, for the board of directors (BOD) of Siri Bhd which: i. Estimates Siri Bhd's dividend capacity as at 28 February 2018, prior to investing in the large project; (9 marks) ii. Advises Siri Bhd on, and recommends, an appropriate hedging strategy for the USD receipt it is due to receive in three months' time from the sale of the equity investment; (14 marks) iii. Using the information on dividends provided in the question, and from (b) (1) and (b)(ii) above, assesses whether or not the project would add value to Siri Bhd; The financial press has also reported that there may be a permanent shift in the RM/S exchange rate, with firms facing economic exposure. Siri Bhd has decided to hedge the receipt using one of currency forward contracts, currency futures contracts or currency options contracts. 3. The following exchange contracts and rates are available to Siri Co. Spot rates Three-month forward rates Per $1 RM 3.9585- RM 3.9618 RM 3.8559-RM 3.8601 Currency futures (contract size S125,000. quotation: RM per S1) March futures June futures RM 3.8538 RM 3.8552 Currency options (contract size $125,000, exercise price quotation RM per si, premium per S1) Puts June Calls Exercise price March June March 3.8500 0.0188 0.0135 0.0124 It can be assumed that futures and options contracts expire at the end of their respective months. 0.0148 4. Dividend history, expected dividends and cost of capital, Siri Bhd Year to end of February 2013 2014 2015 2016 600,000 60,000 800,000 800,000 Number of RM 1 equity shares in issue (000) Total dividends paid (8 000) 128,320 136,020 192,240 203,770 It is expected that dividends will grow at the historic rate, if the large project is not undertaken. Expected dividends and dividend growth rates if the large project is undertaken Year to end of February 2019: Remaining cash flows after the investment in the RM 400 million projects will be paid as dividends. Year to end of February 2020: The dividends paid will be the same amount as the previous year. Year to end of February 2021: Dividends paid will be RM 0.31 per share. In future years from February 2021: Dividends will grow at an annual rate of 7%. Siri Bhd's cost of equity capital is estimated to be 12%. Required: a) With reference to purchasing power parity, explain how exchange rate fluctuations may lead to economic exposure. (10 marks) b) Prepare a discussion paper, including all relevant calculations, for the board of directors (BOD) of Siri Bhd which: i. Estimates Siri Bhd's dividend capacity as at 28 February 2018, prior to investing in the large project; (9 marks) ii. Advises Siri Bhd on, and recommends, an appropriate hedging strategy for the USD receipt it is due to receive in three months' time from the sale of the equity investment; (14 marks) iii. Using the information on dividends provided in the question, and from (b) (1) and (b)(ii) above, assesses whether or not the project would add value to Siri Bhd