Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The financial ratio analysis for a minimum of 3 years - Discuss the cash flow in detail: Talk about investing: Operating and financing decisions: A

The financial ratio analysis for a minimum of 3 years -

Discuss the cash flow in detail:

Talk about investing:

Operating and financing decisions:

A final summary of the firm's financial condition:

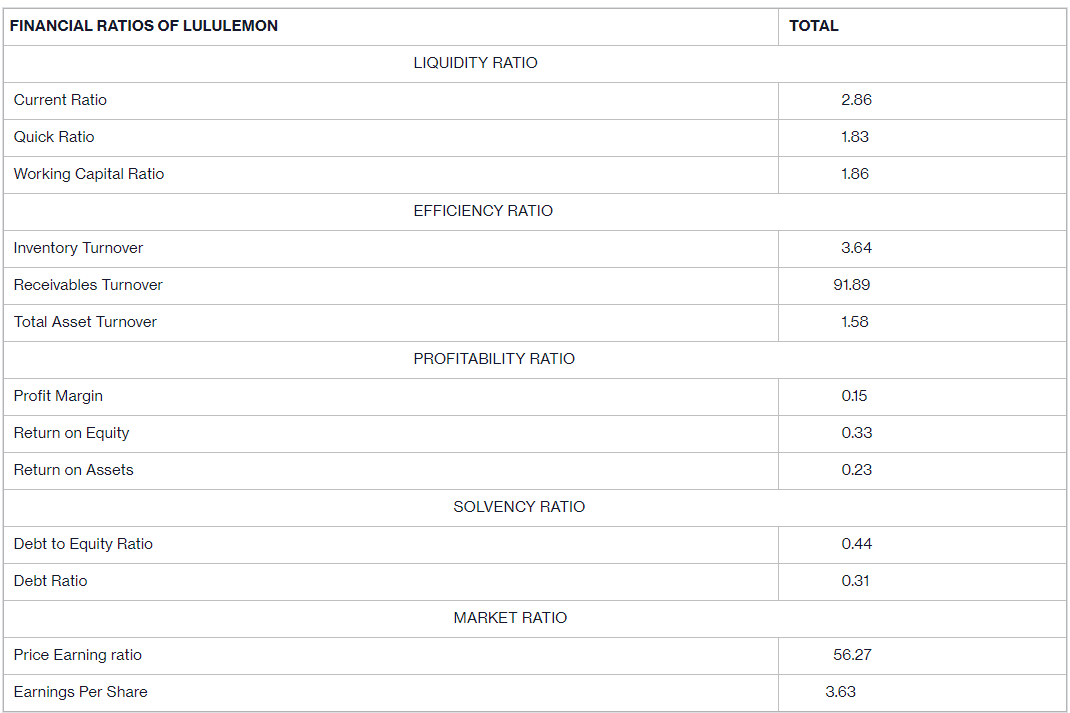

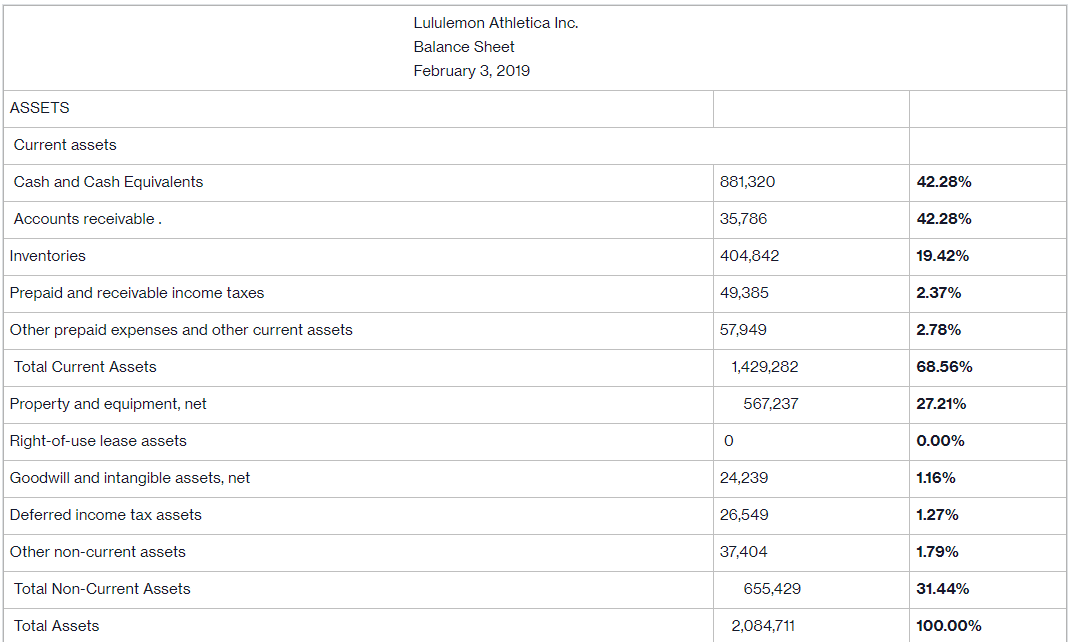

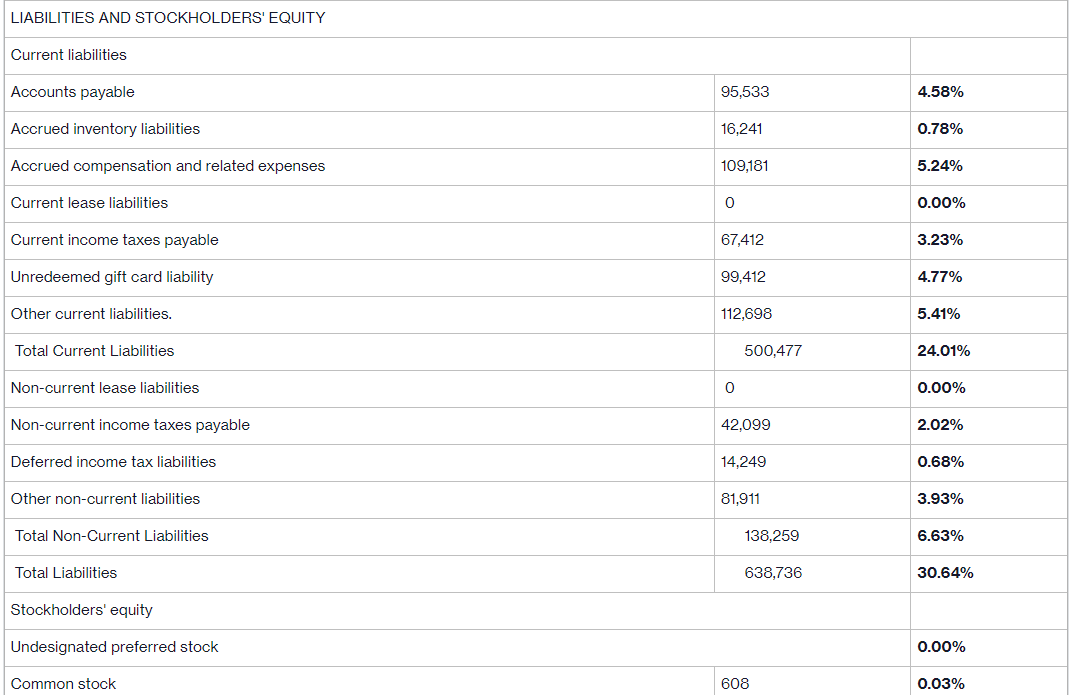

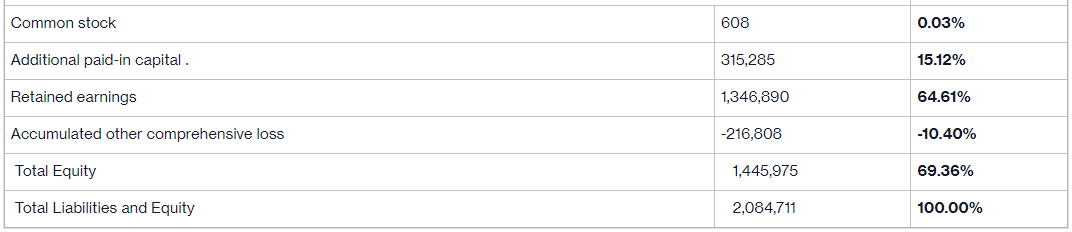

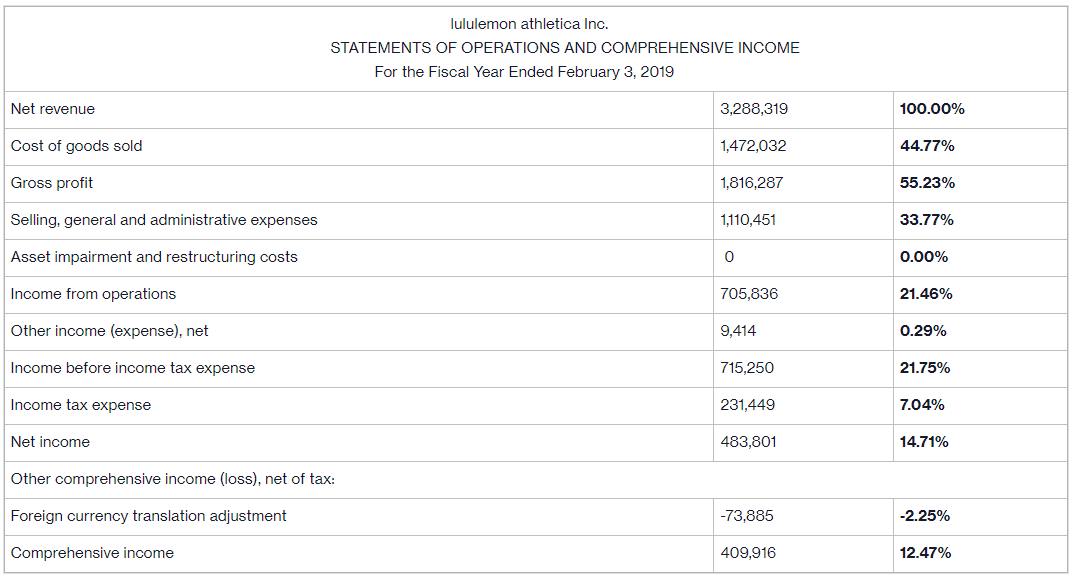

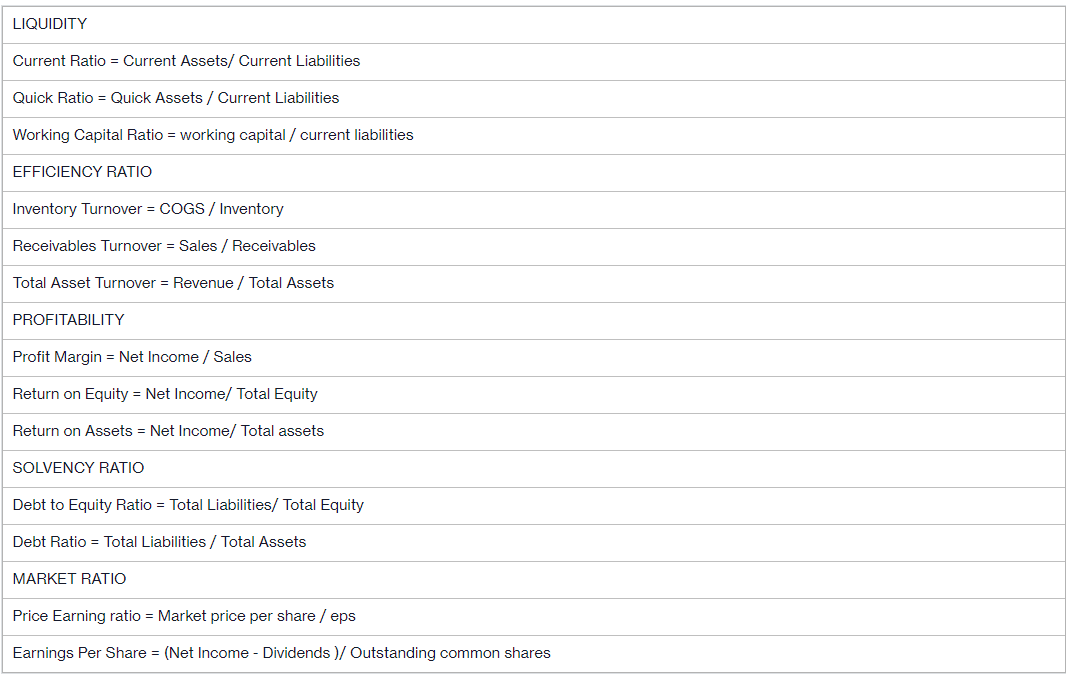

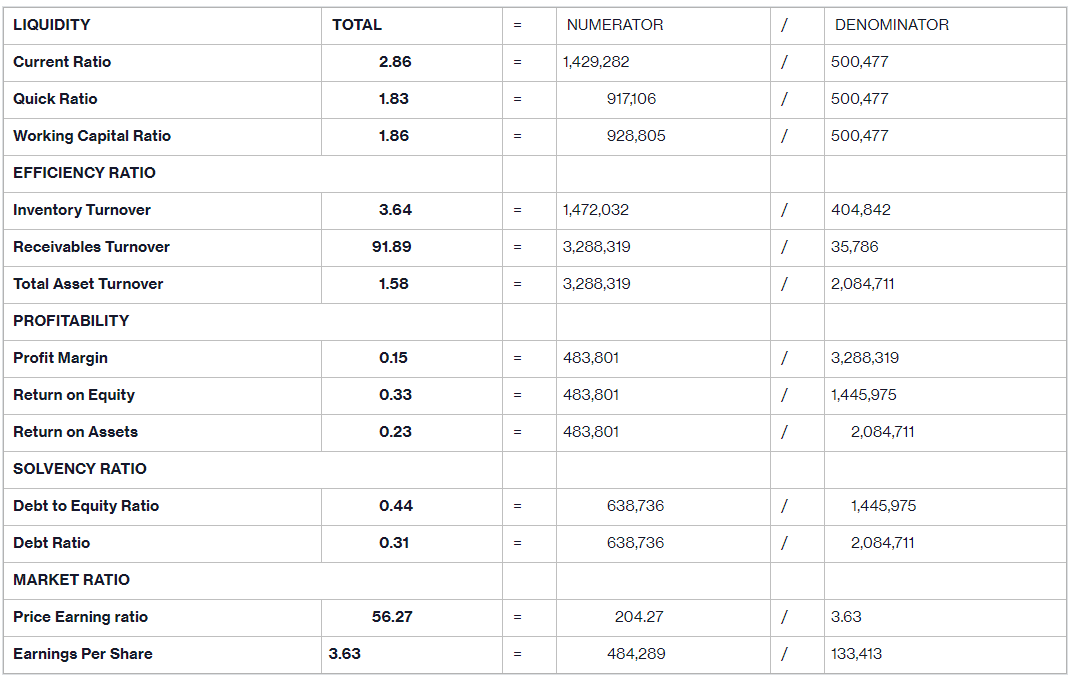

LIABILITIES AND STOCKHOLDERS' EQUITY Iululemon athletica Inc. STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME For the Fiscal Year Ended February 3, 2019 Other comprehensive income (loss), net of tax: \begin{tabular}{|l|l|l|} \hline Foreign currency translation adjustment & 2.25% & 73,885 \\ \hline Comprehensive income & 12.47% & 409,916 \\ \hline \end{tabular} LIQUIDITY Current Ratio = Current Assets/ Current Liabilities Quick Ratio = Quick Assets / Current Liabilities Working Capital Ratio = working capital / current liabilities EFFICIENCY RATIO Inventory Turnover = COGS / Inventory Receivables Turnover = Sales / Receivables Total Asset Turnover = Revenue / Total Assets PROFITABILITY Profit Margin = Net Income / Sales Return on Equity = Net Income/ Total Equity Return on Assets = Net Income/ Total assets SOLVENCY RATIO Debt to Equity Ratio = Total Liabilities / Total Equity Debt Ratio = Total Liabilities / Total Assets MARKET RATIO Price Earning ratio = Market price per share / eps Earnings Per Share =( Net Income Dividends )/ Outstanding common shares LIABILITIES AND STOCKHOLDERS' EQUITY Iululemon athletica Inc. STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME For the Fiscal Year Ended February 3, 2019 Other comprehensive income (loss), net of tax: \begin{tabular}{|l|l|l|} \hline Foreign currency translation adjustment & 2.25% & 73,885 \\ \hline Comprehensive income & 12.47% & 409,916 \\ \hline \end{tabular} LIQUIDITY Current Ratio = Current Assets/ Current Liabilities Quick Ratio = Quick Assets / Current Liabilities Working Capital Ratio = working capital / current liabilities EFFICIENCY RATIO Inventory Turnover = COGS / Inventory Receivables Turnover = Sales / Receivables Total Asset Turnover = Revenue / Total Assets PROFITABILITY Profit Margin = Net Income / Sales Return on Equity = Net Income/ Total Equity Return on Assets = Net Income/ Total assets SOLVENCY RATIO Debt to Equity Ratio = Total Liabilities / Total Equity Debt Ratio = Total Liabilities / Total Assets MARKET RATIO Price Earning ratio = Market price per share / eps Earnings Per Share =( Net Income Dividends )/ Outstanding common sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started