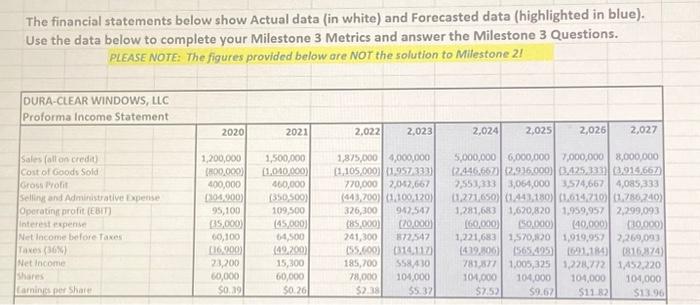

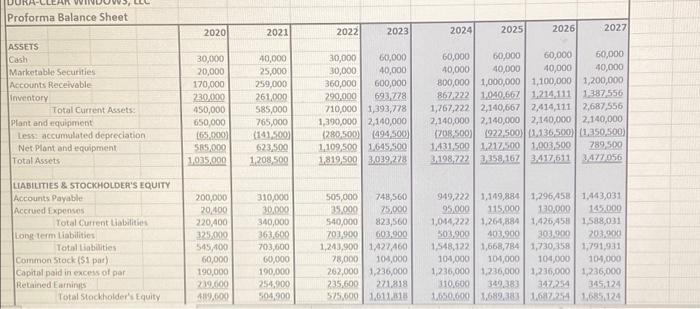

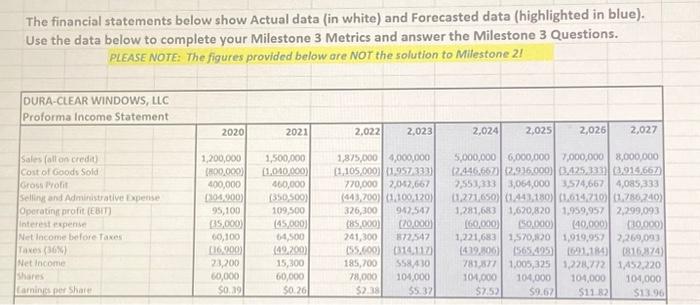

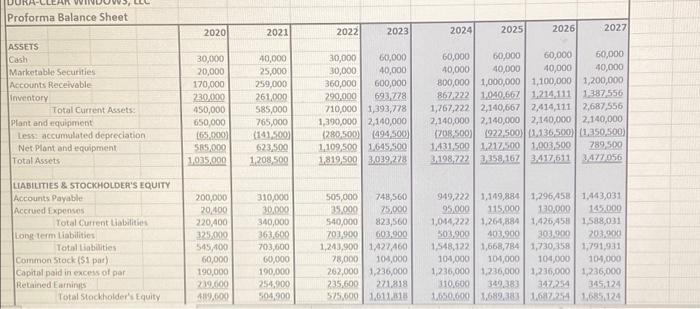

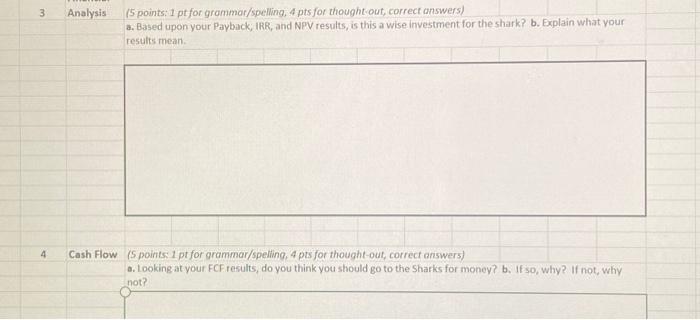

The financial statements below show Actual data (in white) and Forecasted data (highlighted in blue). Use the data below to complete your Milestone 3 Metrics and answer the Milestone 3 Questions. PLEASE NOTE: The figures provided below are NOT the solution to Milestone 2! DURA-CLEAR WINDOWS, LLC Proforma Income Statement Sales (all on credit) Cost of Goods Sold Gross Profit Selling and Administrative Expense Operating profit (EBIT) Interest expense Net Income before Taxes Taxes (36%) Net Income Shares Earnings per Share 2020 2021 1,200,000 1,500,000 (800,000) (1,040,000) 400,000 460,000 (304,900) (350,500) 109,500 (45,000) 64,500 (49,200) 15,300 60,000 $0.26 95,100 (35,000) 60,100 (36,900) 23,200 60,000 $0.39 2,022 2,023 1,875,000 4,000,000 (1,105,000) (1,957,333) 770,000 2,042,667 (443,700) (1,100,120) 326,300 942,547 (85,000) (70,000) 241,300 872,547 (55,600) (314,117) 185,700 558,430 78,000 104,000 $2.38 $5.37 2,024 2,025 2,026 2,027 5,000,000 6,000,000 7,000,000 8,000,000 (2.446,667) (2,936,000) (3,425,333) (3,914,667) 2,553,333 3,064,000 3,574,667 4,085,333 (1,271,650) (1,443,180) (1,614,710) (1,786,240) 1,281,683 1,620,820 1,959,957 2,299,093 (60,000) (50,000) (40,000) (30,000) 1,221,683 1,570,820 1,919,957 2,269,093 (439,806) (565,495) (691,184) (816,874) 781,877 1,005,325 1,228,772 1,452,220 104,000 104,000 104,000 104,000 $7.52 $9.67 $11.82 $13.96

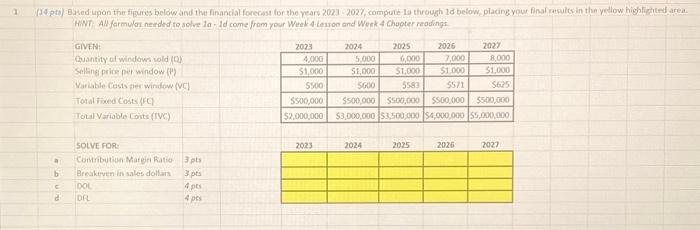

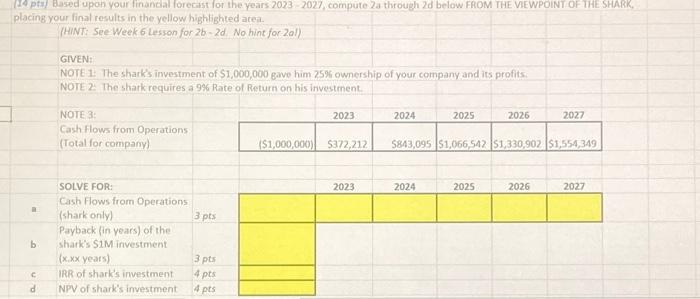

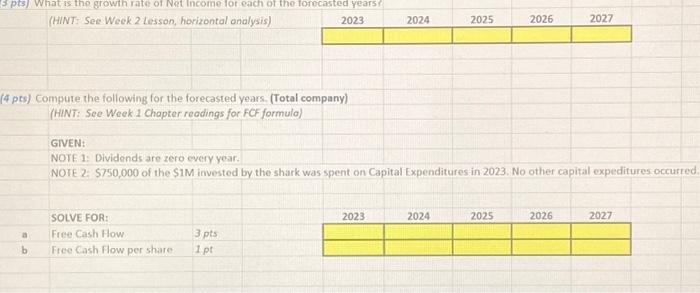

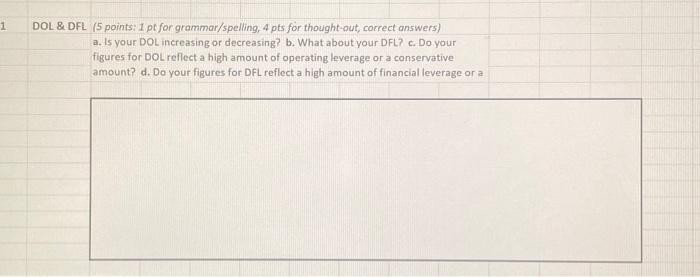

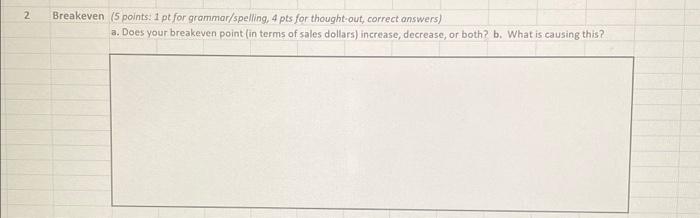

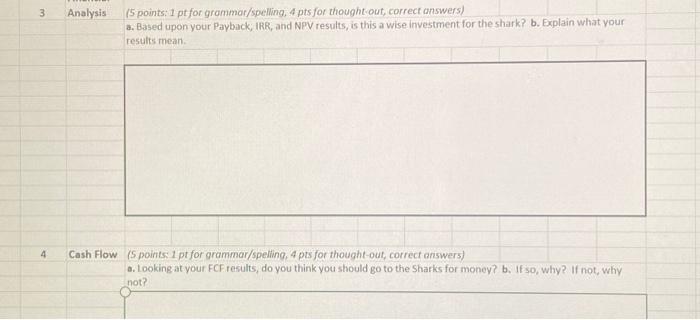

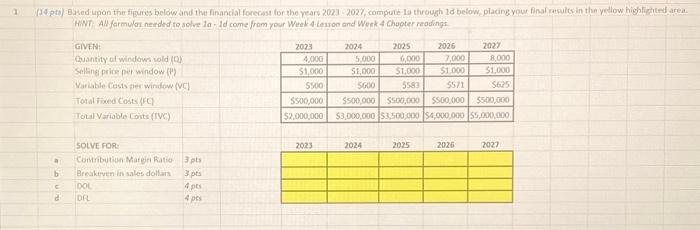

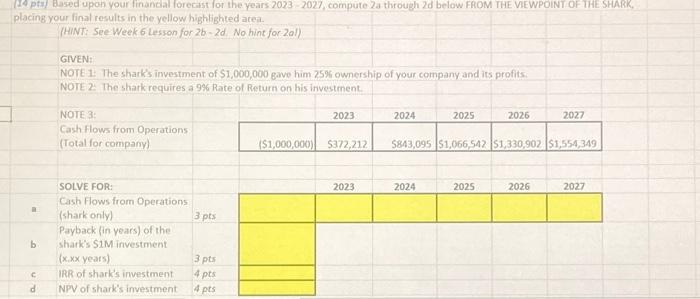

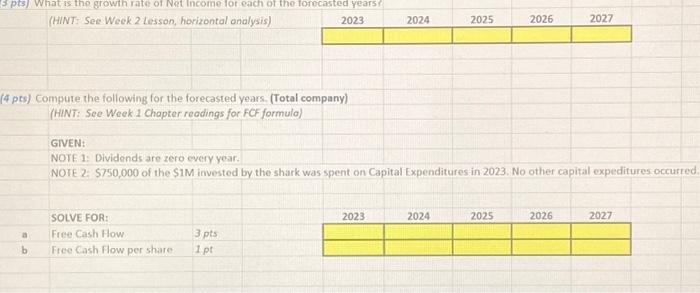

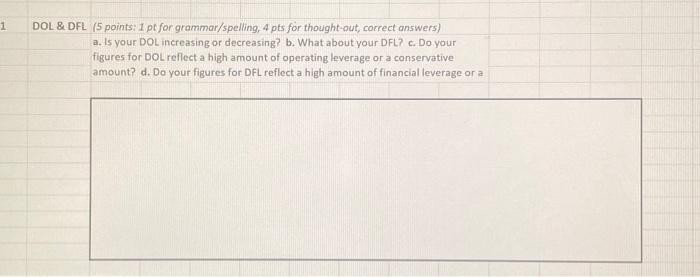

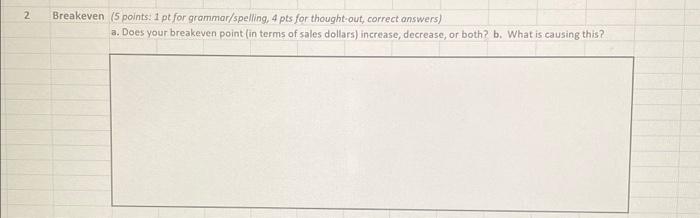

The financial statements below show Actual data (in white) and Forecasted data (highlighted in blue). Use the data below to complete your Milestone 3 Metrics and answer the Milestone 3 Questions. PLEASE NOTE: The figures provided below are NOT the solution to Milestone 21 1 DOL \& DFL (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Is your DOL increasing or decreasing? b. What about your DFL? c. Do your figures for DOL reflect a high amount of operating leverage or a conservative amount? d. Do your figures for DFL reflect a high amount of financial leverage or a (5 points: 1 pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Based upon your Payback, ithe, alid NPV results, is thits a wise investment for the shark? b. Explain what your results mean. Flow (S points: 1 pt for grammar/speling, 4 pts for thought-out, correct answers) a. Looking at your FCF results, do you think you should go to the Sharks for money? b. If so, why? If not, why not? (14 pty) Based upon your finandal forecist for the years 20232027, compute 2 a through 2d below FROM THE VEWPOINT OF THE SHARK, (HINT: See Week 6 Lesson for 2b2d. No hint for 2al ) GIVEN: NOrE 1: The shark's investment of $1,000,000 gave him 25% ownership of your company and its profits: NOTE 2 The shark requires a 9% Rate of Return on his investment. NOTE 3: Cash Flows from Operations (Total for company) SOLVE FOR: Cash Flows from Operations (shark only) 3 pts Payback (in vears) of the b. shark's $1M investment (x.xxyears) 3 pts c. IRR of shark's investment 4 pts d NPV of shark's investment 4 pts \begin{tabular}{|c|c|c|c|c|c|} \hline & & & & & \\ \hline & 2023 & 2024 & 2025 & 2026 & 2027 \\ \hline($1,000,000) & 5372,212 & 5843,095 & $1,066,$42 & $1,330,902 & $1,554,349 \\ \hline & & & & & \\ \hline & & 2024 & 2025 & 2026 & 2027 \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} GIVEN: Quantity ol windows sold you selline price per window (i) Variatile Costs per window (V)] Total fived Costs (FG) Total veriable conts (IVC) SOLVE FOR: * Comsibution Mirgen Ratio 3 pts b. Areskeven in sales dollars 3 pts c DOL d on \begin{tabular}{|r|r|r|r|r|} \hline \multicolumn{1}{c|}{2023} & \multicolumn{1}{c|}{2024} & \multicolumn{1}{c|}{2025} & \multicolumn{1}{c|}{2026} & \multicolumn{1}{c|}{2027} \\ \hline 4,000 & 5,000 & 6,000 & 7,000 & 8,000 \\ \hline 51,000 & $1,000 & $1,000 & $1,000 & $1,000 \\ \hline$500 & $600 & 5583 & $571 & $625 \\ \hline$500,000 & $500,000 & $500,000 & $500,000 & $500,000 \\ \hline$2,000,000 & $3,000,000 & $3,500,000 & $4,000,000 & $5,000,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline 2023 & 2024 & 2025 & 2026 & 2027 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} (HINT: See Week 2 Lesson, horizontal analysis) (4 pts) Compute the following for the forecasted years. (Total company) (HINT: See Week 1 Chapter reodings for FCF formula) GIVEN: NOTE 1: Dividends are zero every year. NOIE 2: 5750,000 of the $1M invested by the shark was spent on Capital Expenditures in 2023. No other capital expeditures occurred SOLVE FOR: a. Free Cash How b Free Cash Flow per share 1pt \begin{tabular}{|l|l|l|l|l|l|} \hline 2023 & 2024 & 2025 & 2026 & 2027 \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} 2 Breakeven (5 points: 1pt for grammar/spelling, 4 pts for thought-out, correct answers) a. Does your breakeven point (in terms of sales dollars) increase, decrease, or both? b. What is causing this